New Zealand Dollar Lifted by RBNZ's Hawkish Tilt

Image © Pound Sterling Live, Still Courtesy of RBNZ

The Reserve Bank of New Zealand (RBNZ) left rates unchanged and upgraded its assessment of economic activity at their February monetary policy event, but a light-touch approach to the issue of the strengthening Kiwi Dollar appears to have opened the door to further appreciationin the currency.

The RBNZ's cash rate was let at 0.25% while the quantitative easing programme was maintained at a total of NZD100BN, but the RBNZ said the possibility of negative interest rates being delivered remained possible.

However, RBNZ Governor Adrian Orr maintained it remains "an option that should be available to us, not an immediate expectation to have to use".

Despite's Orr's guidance, the takeway from the market was that the decision and the RBNZ's stance was more 'hawkish' than anticipated.

"With the pandemic all but over domestically, and government spending helping to offset the impact from closed borders, there was only upside risk to the New Zealand economy," says Geoff Yu, Senior EMEA Market Strategist at BNY Mellon.

Crucially on the matter of the New Zealand Dollar exchange rate, the RBNZ was sanguine.

"The RBNZ just mentioned that international prices for New Zealand’s exports also supported export incomes, although the New Zealand dollar exchange rate has offset some of this support. No strong warning to the recent currency appreciation was sent in the statement," says Kurran Tailor, an analyst with Citibank.

- GBP/NZD spot rate at publication: 1.9219

- Bank transfer rates (indicative guide): 1.8545-1.8680

- Independent money transfer provider rates (indicative): 1.8624-1.9083

- More information on securing independent provider rates, here

Citibank detect a "slight hawkish tilt" to the RBNZ, and in the world of foreign exchange a hawkish central bank is one that tends to prompt a rise in the value of the currency it issues.

The RBNZ's stance on the New Zealand Dollar was always going to be important given the currency's rapid rise over recent months, which economists have warned makes the job of the RBNZ to support the economy all the more harder.

We noted some analysts were weary that the RBNZ would push back hard against the appreciating currency and that a downside reaction might materialise.

Therefore, a lack of talk on the value of the currency will have come as a relief and opened the door to further NZD upside in sympathy with the recent trend.

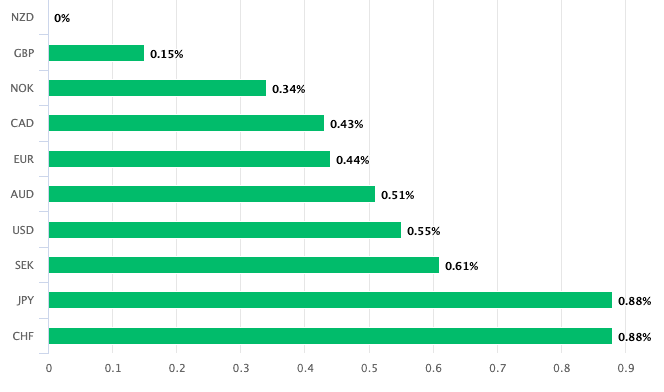

The New Zealand Dollar strength is being felt most acutely by the Euro and U.S. Dollar: The New Zealand-to-U.S. Dollar exchange rate is half percent higher at 0.7373. This is a new 34-month high for the New Zealand Dollar.

The Euro-to-New Zealand Dollar is 0.40% lower at 1.6492, this is a new 22-month high for the New Zealand Dollar.

But gains are harder to come by against Pound Sterling, which is 2021's top performer and a new bid for the UK currency, that actually came alongside the NZ Dollar bid, means the Pound-to-New Zealand Dollar exchange rate is virtually flat on the day at 1.9248.

GBP/NZD is up by a percent in 2021.

"At face value, the dovish tone of the comments suggest that short-end yields have scope to go lower, but the lack of firm dovish signal through forward guidance or OCR track, plus an upward sloping unconstrained OCR in 2022 has given conviction to market pricing and fuelled the NZD," says Sharon Zollner, Chief Economist at ANZ.

Above: GBP/NZD leads the pack in the wake of the RBNZ event.

"GBP and NZD are slight outperformers in otherwise fairly flat markets," Chief Currency Strategist at RBC Capital Markets. "GBP/USD rose 100pts+ in the middle of the Asian day, without any clear driver. More than half of the move has reversed, but GBP is still slightly higher on most crosses. The RBNZ policy announcement was much as expected".

The RBNZ said it will retain all stimulus options and was aware of the rise in global bond yields which have been impacting negatively on global equity markets of late.

But improving global growth and rising inflation expectations were believed by the RBNZ to be the driving factors behind the yield spike, as opposed to anything sinister.

Nevertheless, the RBNZ would rather be a downward influence on New Zealand's yield curve and there is a need to see domestic inflation and employment outcomes materially improve before considering raising policy rates.

Indeed, Governor Orr said settings are consistent with achieving these objectives.

He said the RBNZ will nevertheless watch the data and maintain a patient tilt.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}

On the matter of the housing market the RBNZ noted that demand for houses might now have passed its peak, "the fading impact of interest rate declines, low net migration over most of 2020 and 2021, elevated unemployment compared to before the pandemic, and the reintroduction of LVR restrictions," said the RBNZ in a statement.

But if monetary conditions tighten too much they can alter settings and the OCR (the basic cash rate at the RBNZ) can still go lower, said the RBNZ.

"Members noted that the banking system is operationally ready for negative interest rates. The Committee assessed a negative OCR and the LSAP programme against its Principles for Alternative Monetary Policy. The Committee agreed that it was prepared to lower the OCR to provide additional stimulus if required," said the statement.

Economists at the RBNZ now see GDP growth contracting 0.3% in the first quarter of 2021, growth in the second quarter is now forecast at +0.3%.

Inflation is forecast well above target at 2.5% in the second quarter of 2021, but this peak is deemed to be temporary as inflation is seen slowing to 1.4% in the second quarter of 2022.

"Data since November has been far more positive than the RBNZ anticipated in November – the housing market, the labour market, commodity prices, and inflation," says Sharon Zollner. "It was therefore widely anticipated that the RBNZ would upgrade its forecasts, and they duly did."

Economists at Westpac say they think the RBNZ is being too optimistic in forecasting a 0.30% decline in GDP in the first quarter and they expect the reading to come in at -0.7%.

"We also expect that the exchange rate will rise above the RBNZ’s forecast, and that fiscal stimulus will be reduced. . If we are right about that, the RBNZ will be comfortable with maintaining stimulatory monetary policy even if house price inflation does exceed their expectation," says Dominick Stephens, Chief Economist at Westpac.

As a result, Westpac remain comfortable forecasting no change in the OCR until 2024.