Relief for New Zealand Dollar as Lockdown Restrictions Eased, but More Downside Potential ahead says Analyst

- Written by: James Skinner

- NZD welcomes risk-on market conditions.

- NZ lockdown restrictions set to be eased.

- But outlook for NZD remains challenging

- GBP/NZD onsensus available at Global Reach, find out more

© Naru Edom, Adobe Stock

- Spot GBP/NZD rate at time of writing: 2.0782

- Bank transfer rates (indicative): 2.0174-2.0319

- FX specialist rates (indicative): 2.0250-2.0616 >> More information

The New Zealand Dollar outperformed many rivals including Sterling ahead of the weekend as investors celebrated the prospective easing of virus related restrictions in major economies at the tailend of a week in which Reserve Bank of New Zealand (RBNZ) 'jawboning' has again weighed on the Kiwi.

Aiding investor confidence is Gilead Sciences' progress in developed a Covid-19 treatment that could substantially lower the mortality rate of the disease, while President Donald Trump set out guidance for U.S. states and their local governors on how they can 'reopen the economy' following what many say was a peak in the domestic coronavirus epidemic. Coronavirus has infected just more than 2% of the U.S. population although the spread of infection across the country is uneven and with the number of new cases confirmed each day having trended lower, the government is keen to get America back to work.

The Kiwi is sensitive to global risk sentiment as New Zealand is a small, open economy that can find itself exposed to global capital flows that favour it when markets are in an optimistic mood but eschew it when fear takes hold.

Improved sentiment has lifted the Kiwi in a move further aided by a decision to ease lockdown conditions in New Zealand, with the country announcing a plan to move to "alert level three" on Thursda,y from alert level four, previously, which will see some parts of the economy get back to normal.

Whilst we are definitely not out of the woods, we have compiled a quick summary table of what Alert Level 3 will look like based on the update provided today by Prime Minister Jacinda Ardern. pic.twitter.com/HN4wwxDaDQ

— Hāpai Te Hauora (@hapaitehauora) April 16, 2020

Kiwis will soon be able to go back to work if they're unable to continue from home but retailers and restaurants will only be able to reopen for web and phone sales as well as click and collect purchases or contactless delivery.

"The Alert Level 3 restrictions are more stringent than we expected. This may indicate downside risk to our forecast for a 14% decline in GDP growth in the June quarter. To brace the economy during this time, the Government has continued to roll out measures to support the economy. The most recently introduced measures include around $3.1bn of support for businesses, focused on tax relief. This brings the total amount of planned spending on Covid-19 support measures to $22bn (equivalent to around 7% of annual nominal GDP)," says Bill Evans, chief economist at Westpac.

This is after new confirmed coronavirus infections appeared to peak in the days leading up to April 05, from which they have declined sharply in New Zealand.

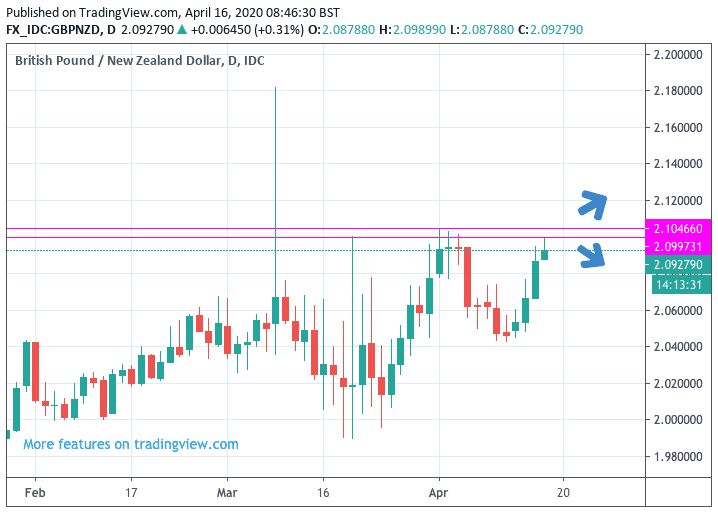

The Pound-New Zealand Dollar exchange rate fell to 2.06680 amidst Kiwi Dollar strength, having been as high as 2.10 earlier in the week, reinforcing the idea of 2.10 acting as a formidable technical resistance level for the pair.

Above: Our chart published on Thursday highlighting key resistance. GBP/NZD has since fallen back.

Many major economies are increasingly turning toward exiting 'lockdown,' although the process is expected to be slow and uneven, with countries returning to normal at different times in a manner that might been volatility for some exchange rates.

“Since developed markets reached a peak in the number of new COVID-19 cases, the news flow has improved significantly, with risk assets following along. The focus is now turning to the approach to re-opening economies, particularly in Europe and the US. Key to this remains the infrastructure to test-and-trace populations and the health care capacity to manage any new outbreaks,” Tom Kenny, an economist at ANZ. “While resuming activity after this health crisis is one thing, the globalised nature of supply chains raises the risk of bottlenecks and dislocations to activity. Collapsing discretionary spending and low business investment are also expected to continue in the medium term.”

Concerning the prospect of a treatment for Covid-19, a science and medical publisher said Gilead's antiviral drug, remdesivir, has proven highly effective at combatting the coronavirus in clinical trials being carried out by The University of Chicago Medicine. The drug is not a vaccine of any kind but rather a treatment for patients suffering from the pneumonia-inducing disease.

"Markets will be sensitive to any news that seeks to downplay the effectiveness of the new anti‑viral drug," says Joseph Capurso, a strategist at Commonwealth Bank of Australia. "China GDP contracted for the first time since 1992... In our view, sluggish consumption and faltering external demand mean downside risks to the Chinese economy remain."

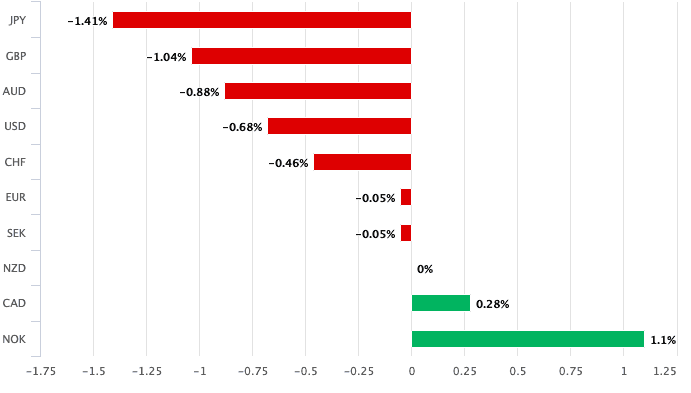

"Improved risk sentiment has benefited riskier currencies like the AUD, NZD, NOK and ZAR. Sterling is actually lower against all of these but also against safe havens too, likely weighed down by extra domestic pressures such as Brexit and lockdown extensions," says George Vessey, a currency strategist at Western Union. "The US Dollar remains the currency of choice as the world’s reserve and most liquid currency. Therefore, even when data from the US disappoints, the dollar seems to strengthen."

Above: The NZ Dollar has lost ground against the majority of the world's major currencies this week

The New Zealand Dollar's strong end to the week comes in the wake of a bout of weakness on Thursday after the Reserve Bank of New Zealand's Governor Adrian Orr said interest rates in the country could slip into negative territory if need be.

In an online appearance before members of the Epidemic Response Committee on Thursday, Orr said negative interest rates at the RBNZ are still on the table, while more direct financing to help support monetary conditions are possible.

The RBNZ has already slashed the OCR interest rate to a record 0.25%, a significant development considering that just a year ago New Zealand commanded the highest interest rates in the G10 currency sphere.

This interest rate advantage proved to be a key source of support for the New Zealand Dollar which was bid higher by inflows of capital from foreign investors looking to earn profitable returns on higher interest rates.

News that the rate could actually slip into negative territory not only decisively ends the country's advantage, but also creates a situation where capital leaves New Zealand to seek returns elsewhere.

"NZD paid a higher price for the fragile risk environment in recent days than its pro-cyclical peers and NZD/USD has edged back below 0.60. The key reason for this is the ultra-dovish stance of the RBNZ, as Governor Orr surprisingly hinted that negative rates are not off the table while the Bank is already set to increase its asset purchases. When adding the downturn in dairy prices, there’s likely some room for more NZD weakness in the near-term," says Petr Krpata, Chief EMEA FX and IR Strategist at ING Bank.

Concerning Sterling's outlook, markets eye the June deadline for the UK to request an extension of the Brexit transition period that ends with 2020, which is a potentially toxic mix given the government said Thursday it will not ask for an extension and that it would say "no" if the EU happens to ask the UK for one. The EU has lobbied for an extension since January.

Pound Sterling's lesser sensitivity to commodity prices and risk appetite is normally enough to see it underperform the Kiwi on days when the mood music in the market brightens but outperform as and when it deteriorates. However, there's uncertainty around whether that relationship will hold in the coming weeks given the above set of unique, or idiosyncratic headwinds.

"We believe the UK is well on the way to a reversal in the current lockdown from the second week of May potentially. However, as we move forward from here and hopefully the COVID-19 data continue to improve, it is very likely that investors will start to give greater focus to another important factor that has been understandably forgotten – the Brexit negotiations," says Derek Halpenny, head of research, global markets EMEA and international securities at MUFG. "We see this as a reason for GBP recovery to remain more muted and remains a negative risk for the pound as COVID-19 risks hopefully start to recede."