New Zealand Dollar Lags Peers on Orr's Negative Rates Comments

- Orr says RBNZ could cut rates further

- Comments aid NZD weakness

- GBP/NZD at key resistance line

- Covid-19 GBP/NZD bank forecasts now available for download at Global Reach

Above: File image of RBNZ Governor Adrian Orr. File Image © Pound Sterling, Still Courtesy of Financial Services Council NZ

- GBP/NZD market rate at time of publication: 2.0904

- Bank transfer rates (indicative): 2.0174-2.0319

- FX specialist rates (indicative): 2.0250-2.0716 >> more information

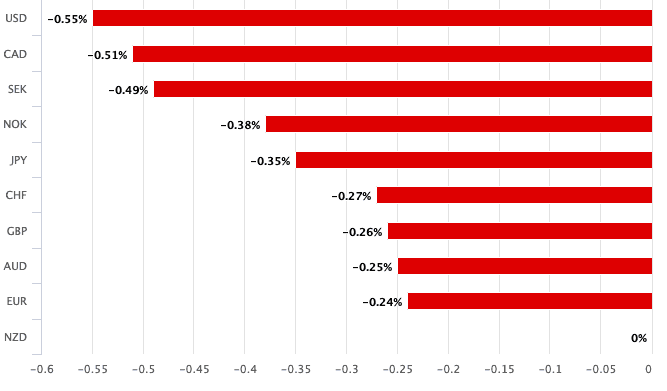

The New Zealand Dollar is the foreign exchange market's laggard on Thursday amidst fresh anxieties over the global economic outlook and comments from Reserve Bank of New Zealand Governor Adrian Orr that negative interest rates were a possibility.

In an online appearance before members of the Epidemic Response Committee on Thursday, Orr said negative interest rates at the RBNZ are still on the table, while more direct financing to help support monetary conditions are possible.

The RBNZ has already slashed the OCR interest rate to a record 0.25%, a significant development considering that just a year ago New Zealand commanded the highest interest rates in the G10 currency sphere.

This interest rate advantage proved to be a key source of support for the New Zealand Dollar which was bid higher by inflows of capital from foreign investors looking to earn profitable returns on higher interest rates.

News that the rate could actually slip into negative territory not only decisively ends the country's advantage, but also creates a situation where capital leaves New Zealand to seek returns elsewhere.

"A recession in New Zealand appears inevitable, and we see room for further near-term FX pressure, with NZDUSD forecast at 0.58 at end-June and end–September. The rhetoric from the

RBNZ matches that of many of its peers, with rates set to stay lower for longer," says Mark Haefele, Chief Investment Officer Global Wealth Management at UBS AG.

Orr said the RBNZ was at the end of the beginning for monetary stimulus, suggesting more efforts to support the economy were likely, as he believed domestic demand would remain sluggish even if NZ comes out of lockdown fully.

"The higher beta major currencies (the Aussie and Kiwi) are under pressure today, not helped by the dovish comments from RBNZ Governor Orr noting that negative rates are not being ruled out at this stage," says Richard Perry, an analyst at Hantec Markets.

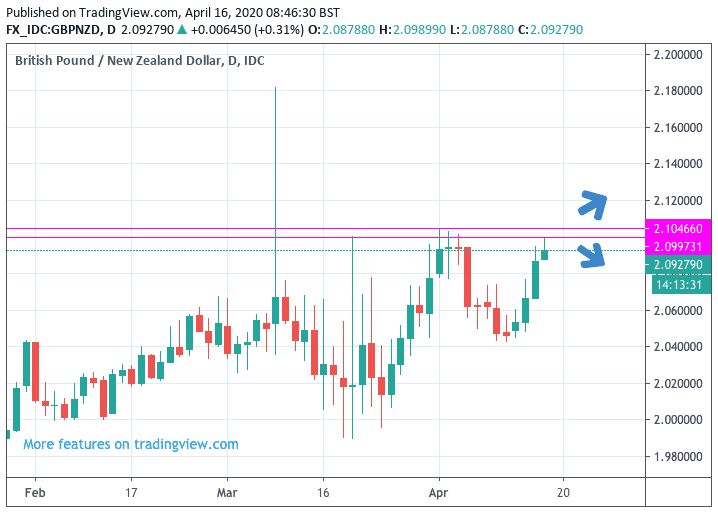

The Pound-to-New Zealand Dollar exchange rate has risen to a high at 2.0984 on the back of the NZD's recent bout of softness, which is a significant development from a technical perspective as it suggests the pair is at something of a crossroads.

If we look at the below chart we can observe that there appears to be some resistance in the 2.09-2.10 area which has meant that recent attempts by Sterling to decisively break into fresh air have ultimately failed:

We would therefore expect that GBP/NZD upside will continue to struggle in this vicinity and would look for another capitulation lower, based on recent trends.

Note that GBP/NZD has failed to close above 2.0984 in over three years, with leaps above this level proving fleeting.

However, any fresh impetus would likely propel Sterling to fresh multi-year highs, the likes of which have not been seen since the 2016 EU referendum. A sustained break higher - which would at least require a daily close above this area - would open the door to a potential run higher.

Therefore GBP/NZD is one exchange rate worth keeping an eye on, but we stress it would take some decisive fundamental developments to get the ball moving on this.

We would expect that Sterling would find fresh upside impetus on any deterioration in global sentiment, such as that witnessed over the course of the past 48 hours.

"The ebb and flow of the tide of risk appetite seems to be in the process of another turn as the risk aversions is coming back to the fore in recent days. This comes as we begin to gather more data on how the economic impact is hitting across the major economies for March. US retail sales and industrial production paint a grim picture for the US economy, whilst the IMF forecasts for a slump in global growth is also painting a very dark picture," says Perry.

The New Zealand Dollar suffered a sharp decline in mid-week trade amidst a broad swing in global risk appetite into negative territory following two weeks of building optimism that the worst of the coronacrisis had now come to pass.

The New Zealand Dollar had been enduring a two-week spell of appreciation, before sentiment flipped sending commodity prices and world stock markets into negative territory once more as a steady flow of negative data asks questions of the building optimism.

The downshift in sentiment is particularly important for the New Zealand and Australian Dollars which tend to show a clear correlation to trends in sentiment, rising when markets are on the up and falling when they point lower.

"In forex, there is a risk aversion resulting in JPY outperformance, whilst USD is regaining some of its recent lost ground against major forex. AUD and NZD are the key underperformers," says Richard Perry, analyst at Hantec Markets. "In commodities, there is a mixed look to oil after another rout of selling yesterday, whilst the precious metals are beginning to slip back from recent strong gains, with gold a-$15 and silver -2.3%."

The stock market rally of the past two weeks has therefore understandably coincided with a rise in the value of the New Zealand Dollar, but there were questions to be asked as to why major U.S. stock indices were once again priced at the same level as they were in 2019.

We will therefore keep an eye on U.S. data over coming days as this tends to be the locus of global investor sentiment.

It is also worth keeping an eye on financial conditions in the U.S., as there are concerns that there are growing stresses underneath the surface as businesses are are pushed to the brink owing to the shutdown.

An example would be news that JCPenney - the large U.S. retailer - will miss a payment to bond holders by the due date, leading to speculation of a possible default.

Right now the market is nervous about the outlook, but is still relatively stable. We are wary of any surprises that might tip the balance and send stocks and other 'risk on' financial assets lower.

A victim in such a scenario would invariably be the Kiwi Dollar we fear.