The Pound-to-New Zealand Dollar Rate Could Face Extreme Volatility Ahead

- Written by: James Skinner

- GBP/NZD faces extreme volatility amid coronavirus outbreak.

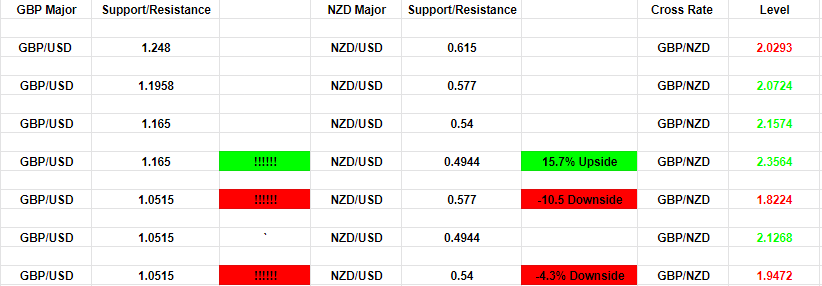

- GBP/NZD trading range of up to 25% possible in weeks ahead.

- GBP/NZD may see 15.7% upside in the most extreme scenario.

- GBP/NZD may see 10.5% downside in most extreme scenario.

- Relative pace of GBP/USD and NZD/USD rate declines is key.

- GBP/NZD suffered after last crisis, may do so again this time.

Image © Adobe Stock

- GBP/NZD Spot Rate: 2.0378, up +0.36% today

- Indicative bank rates for transfers: 1.9660-1.9803

- Indicative broker rates for transfers: 2.0067-2.0190 >> find out more about this rate.

The Pound-to-New Zealand Dollar rate faces extreme volatility in the weeks ahead with a trading range of up to 25% between peak and trough possible, although the exact path trodden by the exchange rate will be determined by the relative pace of decline in GBP/USD and NZD/USD.

Sterling received a last minute lift from Chancellor Rishi Sunak on Tuesday, which reduced its loss against the U.S. Dollar and helped it to swing back into the intraday black against a range of currencies including the New Zealand Dollar when before punishing losses had seen it languishing near the bottom of the major currency table. Sunak has fired another fiscal bazooka that will see, among other things, coronavirus impacted firms in the hospitality industry doled out "grants" of cash as they navigate the crisis.

But Britain's currency has been pummelled in recent weeks amid ongoing strong demand for the U.S. Dollar and as concerns about the current account deficit encourage a possible buyers' strike on UK assets. And if not for heavier losses in Kiwi exchange rates, owing to New Zealand's larg commodity trade with the rest of the world that gives the Kiwi a 'high beta' to other risk assets, the Pound-to-New Zealand Dollar rate would have fallen.

"The NZD is finally getting on with the job of helping the country out, even if it has been a USD story," says David Croy, a strategist at ANZ. "Global markets rallied overnight following the massive fall the previous day, with volatility still very high. Liquidity was boosted by approval for a USD10bn programme for the Fed to buy short-term corporate debt. The UK has also announced it will provide £330bn support to companies, which is equivalent to 15% of GDP."

Above: Pound-to-New Zealand Dollar rate shown at 4-hour intervals. Click for larger image.

The Pound-to-New Zealand Dollar rate was up 0.21% on Tuesday as well as 3% for 2020, and it should really retain an upside bias in the weeks and months ahead if the traditional major currency pecking order remains intact. But an upside bias for it is far from guaranteed during times of turmoil, as was demonstrated in the aftermath of the global financial crisis, and he exchange rate has already fallen -1.2% in the last week.

Furthermore, the very the same kinds of conditions that saw the Pound-to-New Zealand Dollar rate fall sharply in March 2009 could now be in place again.

"NZD/USD fell further below 0.6000," says Elias Haddad, a strategist at Commonwealth Bank of Australia. "As long as the spread of the virus is not contained financial market turbulence will persist. As such, we anticipate more downside for AUD, NZD, CAD and GBP versus USD."

Above: Pound-to-New Zealand Dollar rate between May 2008 and July 2009. Shown at daily intervals. Click for larger image.

Sterling, as a larger major currency with only limited exposure to commodities, should in theory outperform the Kiwi when the going gets tough for the global economy but the British unit doesn't appear to do so in times of crisis that might have implications for London's financial centre. The above chart shows the Pound-to-Kiwi rate rising in July 2007 when two U.S. hedge funds collapsed, marking the very beginning of the financial crisis, but falling sharply the next month when a French bank told investors in some of its funds they couldn't have their money back and the crisis moved closer to home.

The Pound-to-New Zealand Dollar rate was extremely volatile during the ensuing months, suffering steep falls when the government stepped in with bailouts for RBS and Lloyds Bank, two of the world's largest lenders at the time. But the real blow came when the Bank of England cut its interest rate to 0.50% and first launched its quantitative easing program, which crushed British bond yields and boosted the relative high-yield appeal of the Kiwi. That hurt Sterling at the time and the rub for the currency now is that exactly this kind of scenario could be in the pipeline again as a result of the coronavirus.

Above: GBP/USD rate shown at monthly intervals alongside NZD/USD rate (blue line). Click for larger image.

The Pound has found little if any support on both the good days and the bad days of late, with neither improved risk appetite nor increased risk aversion enough to generate a sustained bid for the currency that's inceasingly being pushed to levels consistent with a 'no deal Brexit'. Meanwhile some British government yields have risen sharply, the domestic stock markets have underperformed international counterparts and analysts are concerned about the current account deficit again.

The UK's current account deficit is often described as its achilles heel and means Sterling's relies for part of its value on continuous inflows of foreign capital. Those flows now risk being interrupted amid the unprecedented threat to the economy and smooth operation of the City of London posed by coronavirus. London is home to assets worth more than three times GDP and is fast shaping up to be the virus hotspot in the UK, where cases rose to 1,950 on Tuesday despite testing of only hospitalised patients.

Recent underperformance of UK financial assets could be symptomatic of what's to come for Sterling, and if that turns out to be the case then losses in the GBP/USD rate might begin to outpace those of the NZD/USD rate, which would then produce a falling Pound-to-New Zealand Dollar rate. Much more so if China's economy continues to recover and if New Zealand is able to avoid a major coronavirus outbreak like those seen in some parts of Europe, which might be positive for the NZD/USD rate.

"Yesterday, G7 leaders committed “to do whatever it takes to achieve strong growth in the G7 economies”. Meanwhile, governments are ramping up or expected to boost fiscal stimulus," says CBA's Haddad. "The New Zealand Government unveiled a $NZ12.1bn (4% of annual GDP) fiscal stimulus package to offset the impact of the coronavirus. Roughly two thirds of the stimulus package (about 10% of quarterly GDP) will be deployed in coming months. The total amount of stimulus will depend in part on business’ uptake of some elements of the package such as applying for wage subsidies."

Above: Pound-to-Dollar rate shown at monthly intervals, with Fibonnaci retracement levels marked out. Click for larger image.

The Pound-to-Kiwi rate can be calculated at a basic level by dividing the GBP/USD rate over NZD/USD. That GBP/USD rate has crashed through a series of support levels on the charts this last week and is now on course for the 1.1958 level, some analysts say. However, if Sterling breaks below that level then the GBP/USD rate faces a possible decline to the 1.15-1.18 region and beyond there, possibly even as far as 1.0515 with both having potentially serious implications for the Pound-to-Kiwi rate.

New Zealand had only 11 coronavirus infections on Tuesday while the government has wasted no time in taking advantage of a healthy national balance sheet to unveil a stimulus program, worth 4% of GDP, to support the economy as it grapples with travel restrictions, border closures and reduced internal as well as external demand. The Reserve Bank of New Zealand has cut its interest rate to 0.25% and warned it could launch a QE program of its own, which has hurt the Kiwi but could yet turn into a blessing if containment efforts prevent a major coronavirus outbreak and China's economy continues to recover from the sudden stoppage seen in late January and February.

A low coronavirus case count, recovering Chinese economy and a domestic economy that's been loaded with fiscal stimulus could easily turn into a source of support for the NZD/USD rate and if that happens at a time when the Pound is still reeling from current account and coronavirus concerns, then losses for the GBP/USD rate could easily begin to outstrip those of the Kiwi. And that could then see the Pound-to-Kiwi rate under pressure.

NZD/USD has fallen 13.8% in 2020 but it will soon meet with the 60.8% Fibonacci retracement of the 2001 uptrend, which could offer support to the exchange rate ahead of the next level down at 0.4944, which coincides with the 78.6% retracement of the 2001 uptrend on the charts.

Above: NZD/USD rate shown at monthly intervals, with Fibonnaci retracement levels marked out. Click for larger image.

"We are now at a new low for the cycle, and with large-scale QE inevitable in coming weeks and the US gearing up for more fiscal stimulus, we expect the Kiwi to be under gravitational pull," says ANZ's Croy. "NZD/GBP: Sterling is still on the skids, but the NZD has done worse. We see this cross ultimately going lower but may need to wait till we actually see QE in NZ."

GBP/USD has declined -9.09% this year and might fall much further if a coronavirus disruption to the City of London leads to capital flight, or if the outbreak neccesitates further intervention from the government and BoE that stretches the national balance sheet or tests confidence in the currency.

The BoE is already now increasingly expected to cut its interest rate again as well as increase the size of its quantitative easing program by £100bn, with economists looking for Bank Rate to fall from 0.25% to 0.10% within days. That would reduce UK interest rates to below the level prevailing in New Zealand while crushing government yields even more than they have been so far, which lends the present day strong parrallels with the post-crisis period that brought sharp falls in the Pound-to-Kiwi rate.

Below is a table that details the Pound-to-New Zealand Dollar exchange rates that would prevail with the GBP/USD and NZD/USD rates trading near various combinations of support. It shows potential upside of some 15.7% and prospective downside of -10.5% in the most severe scenarios. The table and recent price action demonstrate how the Pound-to-Kiwi exchange rate could be extremely volatile in the weeks ahead.