Trump's Return Accelerates Rise in UK Borrowing Costs

- Written by: Sam Coventry

-

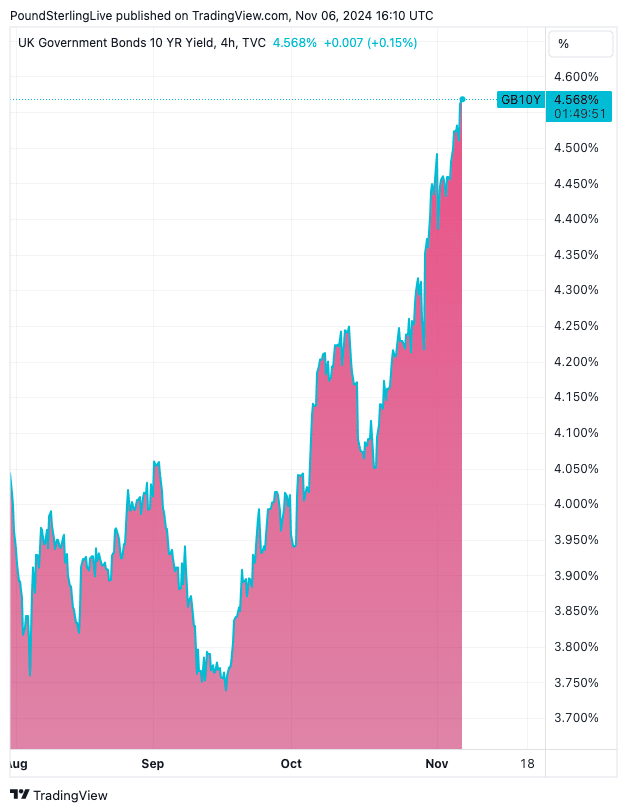

The cost of borrowing keeps climbing as a Trump victory adds to post-budget increases.

UK bond yields, or gilt yields, a key instrument in determining consumer borrowing rates such as mortgages, continue to rise with Donald Trump's election victory offering a fresh impetus.

"Fresh nervousness has been sweeping financial markets after Donald Trump’s triumphant win. His policies look set to increase inflationary pressures and swell the US deficit even further, with knock-on effects expected for the UK economy," says Susannah Streeter, head of money and markets at Hargreaves Lansdown.

The yield (the interest rate) offered by two-year UK government bonds rose to 4.51%, while the ten-year bond's yield rose to 4.57% (see the above chart).

"Gilts often move in tandem with treasuries and this special relationship is playing out today, pushing up UK borrowing costs sharply," says Streeter.

She points out that UK government bonds had already been skittish, with sentiment souring after concerns about the amount of borrowing the Labour administration was taking on.

"Now Trump’s win has piled on further pressure. Concerns about the inflationary knock-on effect of the fresh wave of tariffs promised by Trump are seeping through the markets. There is also concern that his trade policies could hold back Britain’s economic growth. The fear of a stagflation scenario emerging in some economies appears once again to be stalking markets," she explains.

The interest rates consumers are exposed to in the UK are determined by bond yields as these inform a host of products such as swaps, which in turn influence mortgage rates, credit card rates and corporate lending rates.

U.S. bond yields are on the rise as investors demand greater compensation for holding U.S. bonds, judging that their value will be devalued by inflation.

Rising yields, therefore, signal markets think Trump's second term will be more inflationary than the alternative.

Faced with the prospect of higher inflation, economists now anticipate fewer rate cuts from the Federal Reserve.

Economists at Nomura now expect just one Fed cut in 2025, with policy on hold until the realised inflation shock from tariffs has passed.

"We expect Trump to follow through on his campaign proposals to raise tariffs, leading to a significant near-term boost to inflation and modestly lower growth," says David Seif, an economist at Nomura. "We expect some additional easing in 2026, but have raised our terminal rate forecast to 3.625% from 3.125%."

Economists at Rabobank assume that Trump will increase some tariffs relatively quickly. Because of this, they think the Fed's easing cycle could end early next year as policymakers react to the inflationary implications of tariffs.

Wells Fargo economists say they are reassessing their forecasts for the Federal Reserve's base rate in the wake of the election.

"The FOMC's reaction function likely would be more hawkish in response to higher inflation from tax cuts than from tariffs. Tighter monetary policy is an effective method for slowing demand growth, but it cannot do much to combat inflationary pressure from a supply shock such as tariffs," says Wells Fargo economist Jay Bryson.

Wells Fargo, one of the country's biggest lenders, says its current forecast is for the FOMC to cut its target range for the federal funds rate, currently 4.75%- 5.00%, to 3.00%- 3.25% by the end of next year.