Copper Price Boom Won't Sustain

- Written by: Gary Howes

-

Image © Adobe Images

Exuberance in copper prices must fade as prices are likely to retreat from their highs, according to new research.

"The eye-popping market rally leaves prices looking even more overstretched. Although the fundamentals will support prices later this year, we expect copper to fall," says Joe Maher, Assistant Economist at Capital Economics.

The call comes after copper prices printed new record highs at $5.13 lb before retreating to $5.05. A number of analysts say the rally is simply a result of global recovery hopes that will boost demand.

Copper is up over 10% just this week, with some analysts citing a reported 'short squeeze' for delivery of the July futures contract.

However, the recent moves have an element of exuberance, with copper easily outperforming other industrial metals in the performance stakes.

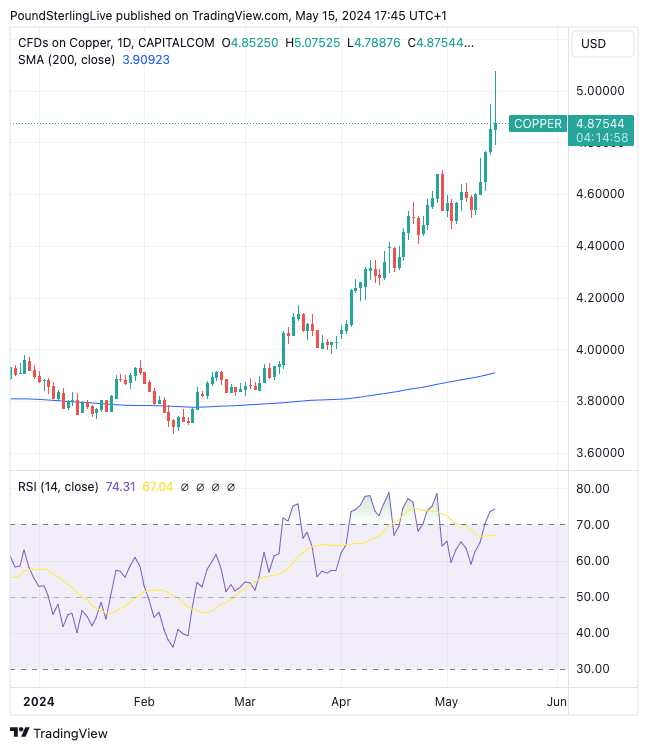

As the above daily chart shows, copper prices are technically stretched, with the Relative Strength Index (RSI) in the lower panel screaming overbought.

A short squeeze on the July contract points to a looming correction as excessive moves are not underpinned by fundamentals. A short squeeze is where traders who have an interest in selling copper are forced to buy back the metal as the market moves against them, which only fuels the rally.

"Traders appear to have been caught short on their trades and are being forced to buy back to cover their positions," says a note from ANZ Bank.

But the rally appears to have several drivers converging, pushing prices higher and triggering the need to short cover.

"Also, the latest proposal by China’s State Council to "buy millions" of unsold homes is another shot in the arm for copper," says Kenneth Broux, a strategist at Société Générale.

Supply is also an issue, with ANZ explaining ongoing supply-side issues continue to hover over the market. The market was provided another insight in the struggles in the mining industry, with Chile reporting its output fell 0.7% y/y in March.

"This follows the closure of mines late last year which is tightening up the availability of copper concentrate," says ANZ.

But on the all-important issue of demand, Capital Economics says it is not seeing anything out of the ordinary, which hints that markets are running ahead of fundamentals.

"For what it’s worth, our copper demand proxies suggest that demand for copper in China and the US has remained subdued so far this year," says Maher.

Capital Economics says prices are overstretched, and although the fundamentals will support prices later this year, "we expect copper to fall by about 10% by year-end".