Fed Decision: Traders Could be in for a Shock says XM.com

Image © Adobe Images

Traders seem to have jumped the gun ahead of this Fed decision, prematurely betting that rate cuts are around the corner.

If Fed officials push back against this notion and maintain their rate projections for this year near 5%, that might come as a 'shock' for investors considering where market pricing stands today.

Such a message would likely propel US yields back higher, helping to boost the dollar in the process.

In contrast, the main casualty in the FX arena might be the Japanese yen, so dollar/yen could experience a particularly sharp reaction.

Any resurgence in rate expectations would likely spell bad news for riskier assets such as tech stocks and cryptocurrencies, which enjoyed tremendous gains lately as yields crumbled.

Gold could also suffer collateral damage, as the precious metal loses its appeal in an environment of rising yields and an appreciating US dollar.

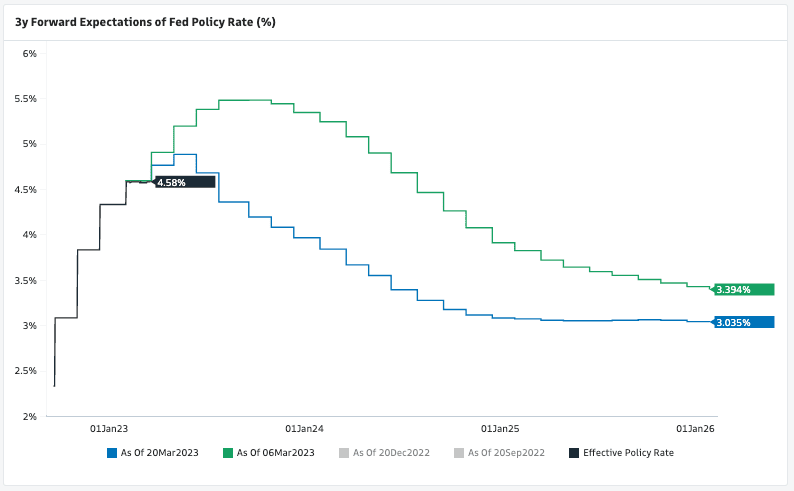

Above: Markets now expect a succession of rate cuts at the Fed starting by mid-2023.

A Big Day

One of the most important Fed decisions in recent history lies ahead.

With the banking turmoil receding for now, traders have priced in an 85% probability for a quarter-point rate increase and a 15% chance for no action at all.

If the Fed does raise rates, markets think it will probably be the last increase of this cycle and anticipate rate cuts in the fall.

Beyond the rate increase itself, investors will focus on the updated interest rate projections.

When the Fed issued its latest projections back in December, officials expected rates to end this year above 5% but market pricing currently sees rates at only 4.3% by year-end.

That’s a huge gap between Fed and market expectations, which will likely narrow today.

In a nutshell, the strength in the economic data pulse warrants a rate increase and argues for the Fed to keep its year-end rate projections elevated near 5%, as the banking sector has already been reinforced with a shower of liquidity.

The Fed can emulate what the ECB did last week - raise rates to tame inflation and stress it has different tools to deal with any further troubles in the banking system.

This could be the first split decision in years.

Some Fed officials will likely anticipate the banks to rein in lending activities after this episode, which would make their inflation-fighting job easier and would call for a pause in rates.

Others might place more emphasis on the strength of the real economy and argue they need to forge ahead.

Sterling Gains on Inflation

Finally, the British pound has taken the lead in early trading Wednesday, following a batch of hotter than expected inflation numbers.

The persistence of UK inflation in the double digits has convinced traders that the Bank of England will raise rates by 25 basis points tomorrow and might signal more to come.

Equities Up

Equity traders do not seem particularly concerned about the risk of a hawkish Fed, judging by the 1.3% rally in the S&P 500 yesterday. Bond markets told a different story though, as yields spiked higher.

At first glance these moves suggest bond and stock traders expect the Fed decision to play out differently, but hedging activities ahead of the event might be muddying the picture.

Another element that could fuel volatility in stock markets today is a gigantic expiration of VIX options.

Such expirations have the capacity to amplify market moves, so equities could be even more sensitive than usual to what the Fed says.

Marios Hadjikyriacos is Senior Investment Analyst at XM.com. An original version of this article can be found here.