Pound Favoured Over Indian Rupee Near-Term

The Pound has risen versus the Rupee and a breaks Above a major trendline in GBP/INR is seen as a bullish catalyst that hints at the potential for further gains.

The Pound to Rupee exchange rate has been in a strong short-term uptrend since the establishment of the August 23 low.

The spot-market rate is currently seen at 84.38.

The move up to this point was afforded added impetus by the break above the downsloping trendline drawn from the December 2016 high.

The break above the trendline is a key bullish sign and is likely to lead to an extension higher (labeled 'b') of the same length as the move prior to the break (labeled 'a').

This will probably lead to a move up to roughly 84.90, at the level of the July 31 highs.

The July 31 highs are likely to cap further gains as they represent historical resistance at that level.

A break above the 84.504 highs would lead to a probable continuation up to the next target at 84.900.

The MACD has moved above the zero-line, further enhancing the bullish outlook.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

News for the Rupee this Week

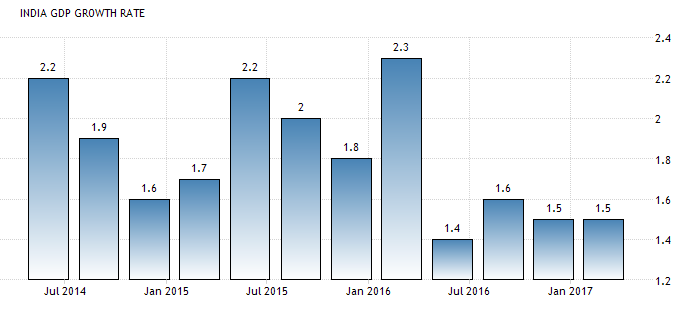

Slowing economic growth, rising commodity prices and peaking foreign investment combine to present a picture of economic growth momentum shifting from maturity to decline.

"Q2 GDP disappointed and the move higher in commodity prices is likely to reinforce the view that the best of the current account balance improvement is now well and truly behind us," comments J.P. Morgan's Jonathan Cavanagh.

However, he goes on to say that longer-term the Indian Rupee continues to present a positive profile.

"Of course, structurally, INR remains a positive story. Deterioration in the current account balance will remain modest compared to history and the RBI's FX reserves remain very ample. Longer-term investors will also remain attracted to the government’s reform-orientated agenda," said the analyst.

Driving the INR story this week are inflation data due for release on Tuesday, September 14, at 7.30 BST. The data are expected to show a rise in the headline rate of 3.2% in August, from 2.7% previously.

Bank loan growth in September will be a key indicator for the Rupee when it is released on Friday at 12.30.

In the previous month, it showed 6.3% growth, and a continuation of loan growth could be positive for the Indian currency.

Data, Events to Watch for the Pound this Week

It looks set to be a busy week for the Pound with the Bank of England announcing their rate decision on Thursday, as well as data showing inflation, unemployment and wage growth.

The Bank of England is not widely expected to announce a change in policy on Thursday at 12.00 BST, and according to Canadian investment bank TD Securities, the voting is expected to show a 6-2 split in favour of keeping interest rates unchanged.

BK Asset Managment's Kathy Lien, highlights the continued weakness in "consumer spending and inflation," as a reason to expect the BOE not to, "veer away from its cautious tone."

Forecasters are expecting a rise in inflation when data is released at 09.30 on Tuesday, September 12.

The headline rate is expected to rise to 2.8% year-on-year from 2.6% in August 2016, and core inflation to 2.5% from 2.4% respectively.

Without a corresponding rise in wages, higher inflation is likely to weigh on the Pound rather than support it, as it simply results in everyone being poorer.

Which is why data out on Wednesday, September 10, is likely to be so important, as it will show the state of the UK labour market and wages. Expectations are for earnings to rise by 2.3% in August.

A beat on expectations in this number could prove to be supportive of Sterling.

Remember to keep an eye on politics at the start of the week as parliament intend to vote on the government's great repeal Brexit bill.

The Labour party are currently against the bill, which they say gives too much autonomous power to ministers to make changes to EU law once it is transposed into the UK legal system.

A small number of conservative MPs are also against the bill which means, the vote could be close given the government's slim majority.

A failure of the bill to pass, would cause volatility for the Pound with the most likely direction of travel being lower.

The time within which to negotiate Brexit is fast running out and any domestic legislative failures will only frustrate the process further.

However, damage would be limited as we would expect the domestic squables to have limited impact on negotiations themselves.

The increased uncertainty caused by the Bill's failure would argue for Sterling to devalue owing to the increased uncertainty such an outcome would bring.

However, we see little chance of Conservative lawmakers rebelling against the Government; the party's slim majority means there is little appetite for an election which they could well lose considering Labour and the Conservatives are near even in the polls.