British Pound Forecast to Recover into BoE Meet, but Sell the Strength vs. Euro and US Dollar say SEB

- Written by: Gary Howes

- GBP to rise ahead of rate hike but gains won't last say SEB.

- Brexit, domestic politics will weigh on GBP again soon after.

- GBP rise is an opportunity to "sell the currency" say SEB.

Image © SEB

Pound Sterling will rise over coming days as the Bank of England gears up for its second interest rate hike since the financial crisis, according to analysts at Skandinaviska Enskilda Banken (SEB), but traders should use any short-term strength as an opportunity to sell the currency.

The call from the Scandanavian lender comes barely more than a week away from the Bank of England's August meeting and markets are betting heavily that the Monetary Policy Committee will vote for what will be only the second interest rate rise since the financial crisis.

Indeed, at the time of writing there are signs that this short-term rebound forecast by SEB could be underway: the Pound-to-Euro exchange rate is trading at 1.1255 on the inter-bank market having been as low as 1.1160 last week. The Pound-to-Dollar exchange rate is quoted at 1.3152, having been as low as 1.2957.

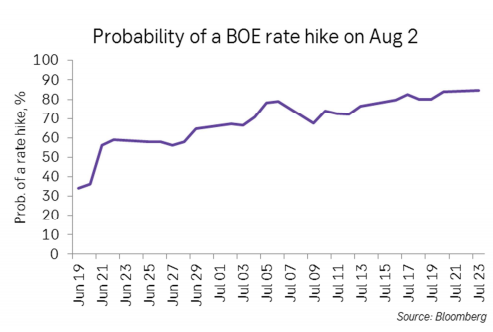

Pricing in interest rate derivatives markets, which enable investors to protect themselves against changes in interest rates while also providing insight into market expectations for monetary policy, implies an August 02 Bank Rate of 0.66%. This is up from 0.53% in early June and close to the 0.75% rate that would prevail if the BoE pulls the trigger next week.

However, Pound Sterling has fallen steadily against both the US Dollar and Euro throughout both June and July, in contrast to what one could normally expect from a currency as markets become more convinced an increase in rates is coming.

Above: SEB graph showing market-implied probability of an August rate hike.

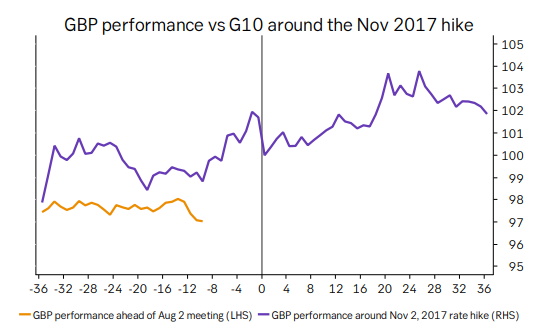

"The Fed and the Canadian central bank (BOC) have tightened policy several times. Just like the GBP reacted positively to last year’s rate hike by the BOE, these rate hikes were also combined with appreciating currencies," says Richard Falkenhall, a senior FX strategist at SEB in Stockholm. "The experience from the initial rate hikes by other central banks as well as the experience from the first BOE rate hike in November last year suggest the GBP should appreciate this week and next."

Changes in rates, or hints of them being in the cards, are only made in response to movements in inflation but impact currencies because of the push and pull influence they have on international capital flows and their allure for short-term speculators.

Falkenhall says that most currency appreciation that is related to interest rate rises takes place before the increase is announced by a central bank. In the case of the US and Canadian Dollars, the two currencies saw an average gain of 3.8% during the 50 days leading up to the event, but Pound Sterling has fallen close to that amount during the same preceding time period.

Above: SEB graph showing Pound Sterling ahead of and after November rate hike.

"Perhaps the political turbulence within the British government and the increased risk that Brexit negotiations with EU could fall apart have defied changes in monetary policy expectations. Although Brexit scares should continue to weigh on the GBP, previous rate hikes by central banks suggest there should be some room for, at least, a temporary recovery of the GBP in coming days," writes Falkenhall.

Ealier in July Prime Minister Theresa May set out her "Chequers plan" for Brexit which, having seen the PM abandon almost all of her "red lines" in the negotiations, prompted a wave of resignations from the cabinet, Department for Exiting the European Union and Conservative Party. Brexit-supporting MPs have claimed the PM's plan places the UK on track to leave the EU in name only and have threatened to vote it down when it comes to parliament.

Parliamentary and party protests over the PM's proposals have raised the spectre of a "Brexit deal" that too few within the UK parliament will support which, after its potential rejection in the House of Commons, could see the UK exit the EU on March 29, 2019 and default to trading with it on World Trade Organization (WTO) terms. This sets the stage for Pound Sterling's very own summer of discontent on the foreign exchange market, regardless of what the Bank of England does.

"Given the mess in British government and the weak support of PM May’s Brexit plan a positive pre-BOE reaction in the GBP until next week’s rate decision should be seen as an opportunity to sell the currency, as there is little to suggest a positive reaction will last beyond the day of the rate announcement," Falkenhall concludes.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here