British Pound Risk is "Skewed" to Downside vs. Euro and Dollar with Market's Gaze Turning to Outcome of Brexit Negotiations

- Pound-to-Euro rate under pressure on Brexit jitters and poor data.

- "Risks remain skewed" to the downside for Sterling - Danske Bank.

- Barnier and Raab comments following EU-UK talks the next key hurdle.

Image © European Union, 2018 / Source: EC - Audiovisual Service / Photo: Lukasz Kobus

Theresa May's government survives a testing two days of parliamentary intrigue in which it largely protected its legislative agenda that will underpin Brexit. Overnight, the passage of the Trade Bill through parliament, largely unchanged, ensures the government remains in control of Brexit negotiations.

We warned that a failure of the government to pass this key piece of legislation could well stimulate further GBP losses as it would likely open Prime Minister Theresa May to a leadership challenge, which would in turn open the door to significant domestic political uncertainty that must ultimately be reflected in the value of Sterling.

"There was some minor relief into end of day as the PM narrowly succeeded in avoiding efforts to tie her hands, though there needs to be a lot more achieved on the PM’s side right now to reduce all of the stress that has arisen in recent weeks. Looking ahead, all things Brexit will continue to dictate the flow," says Joel Kruger, a foreign exchange analyst with LMAX Exchange.

Midweek, the Pound-Euro exchange rate is quoted at 1.1256 on the inter-bank market but retail rates available to readers of this article are as low as 1.0860 on some bank accounts, while independent specialists are offering better exchange rates towards 1.1140.

The Pound-Dollar exchange rate is meanwhile quoted at 1.3103 on the inter-bank markets with retail rates ranging between 1.2644 and 1.2985.

"The negative impact of heightened UK political uncertainty on the performance of the pound is becoming more evident. The government has only narrowly avoided defeats on key Brexit legislation in recent days, which has further undermined confidence in the government’s ability to pass the required legislation to ensure a smooth and orderly Brexit. Indeed, the government had to rely on the votes of four Eurosceptic Labour MPs to defeat the latest amendment," says Derek Halpenny, European Head of Global Markets Research at MUFG in London.

The deep sell-off in the Pound came despite the release of a solid UK job report, which came in as expected and supports market expectations for an interest rate hike from the Bank of England in August. Weakness was exacerbated Wednesday by a lower-than-expected inflation numbers.

"However, the market is already pricing in more than an 80% probability that the Bank of England will raise the Bank Rate on 2 August, and thus relative interest rates should provide only little support to GBP ahead of the BoE meeting," says Vladimir Miklashevsky with Danske Bank.

In a midweek briefing to clients, Danske warn "risks remain skewed" to the downside for Sterling against the Euro-near term "amid political uncertainty related to Brexit."

The sense that Theresa May's grip on power has weakened and that Brexit has 'hardened' following a busy two days in UK politics ensures Sterling will likely trade with an offered tone over coming days with any strength being taken as a signal to sell by canny traders looking to profit on expected further losses.

This week's votes "showed that the hard Brexit Conservatives have the numbers to sway the government's Brexit strategy, in contrast to the Rebel Remainers who have lost or withdrawan some of their key amendments. Overall, it shows that Parliament has the numbers to pass a harder - not softer - form of Brexit," says a morning strategy note from TD Securities.

Nevertheless, the prospect for some relief for the British Pound grows as domestic politics are likely to take a back-seat now that parliamentary business is largely over; but all eyes turn to ongoing negotiations in Brussels with the response to the UK's new stance being the next hurdle for Sterling.

"We will now analyse the Brexit White Paper with Member States & the European Parliament, in light of European Commission guidelines. EU offers an ambitious Free Trade Agreement and effective cooperation on wide range of issues, including a strong security partnership. Looking forward to negotiations with the UK," said EU negotiator Michel Barnier in response to the release of the government's white paper.

Of course the white paper was released prior to the amendments to UK Brexit legislation that will dictate its approach to trade and customs negotiations, therefore the white paper that Barnier struck a relatively constructive tone on has changed, and most likely changed for the worse in Barnier's view.

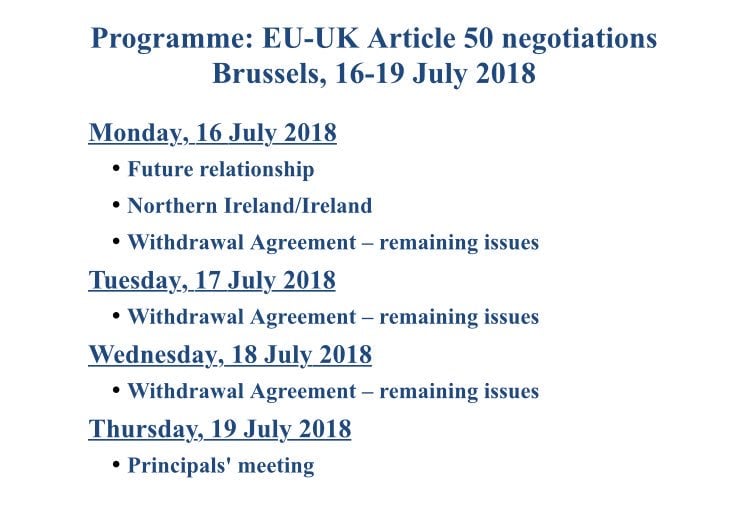

Barnier and the new UK Secretary of State for Exiting the European Union, Dominic Raab, will meet on Thursday. We believe the communications offered by both parties following this meeting could influence movements in Sterling.

"An established pattern may be observed, at least up to the 2 Aug Bank of England meeting. Bullish comments by Bank of England speakers will drive the GBP higher, only to be depressed once Brexit headlines hit," says Terence Wu, a treasury analyst with OCBC in Singapore reflecting the sense markets that until Brexit headlines improve, Sterling will ultimately struggle.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here