British Pound Pares Advance after UK Manufacturing and Industrial Data Disappointment

- Written by: James Skinner

- Weak industrial activity driven by adverse weather in February.

- Poor performance means UK growth likely slowed to 0.2% in first quarter.

- Sterling outlook remains robust, May interest rate rise still expected.

© freepeoplea, Adobe Stock

The Pound pared earlier advances on the Euro and US Dollar during the morning session Wednesday after the latest round of industrial and manufacturing production data from the Office for National Statistics showed output from Britain’s manufacturing and construction sectors surprising on the downside for the month of February.

Manufacturing production fell by -0.2% during February when markets had been looking for growth of 0.2%, while the construction sector sank deeper into recession when output fell by -1.6%. Economists had been looking for construction to recover and record growth of 0.7%.

This meant the broader measure of industrial production, which covers manufacturing, construction, energy production and mining, also came in lower than was expected. Accordingly, overall industrial production grew by just 0.1% during the recent period when markets had been looking for a 0.4% expansion.

At the time of writing the GBP/EUR exchange rate is quoted at 1.1473, down after having gone as high as 1.1492 ahead of the data release, while the GBP/USD exchange rate is quoted at 1.4195 having been as high as 1.4221.

“A soft reading in both industrial and manufacturing production has done little to move the pound, with the narrowing trade deficit bolstering positive sentiment around Sterling and painting a positive GDP picture of the domestic economy," says Nish Parekh, a senior trader with Silicon Valley Bank.

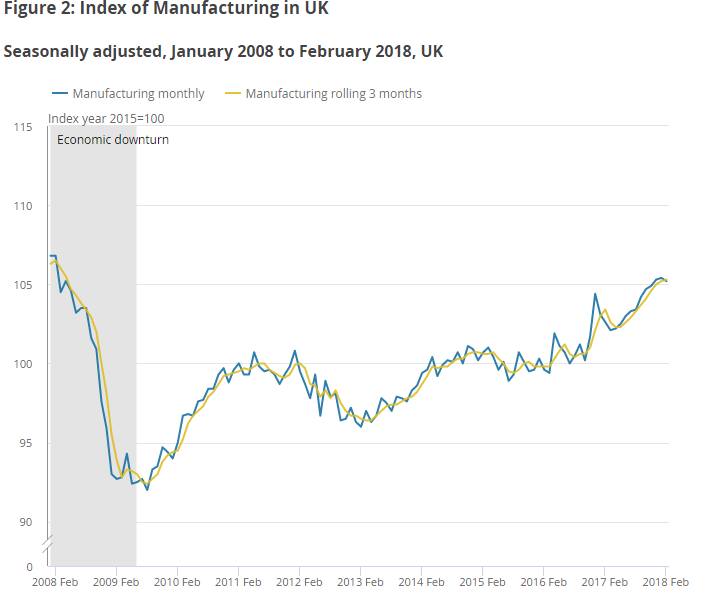

Wednesday’s data marks the first time UK manufacturing output has fallen since March 2017 although, over the three months to the end of February, sector output grew by 0.6%. On a quarterly basis, the manufacturing industry still expanded but overall industrial production fell by 0.1% thanks to the temporary closure of a key oil pipeline in the North Sea during December.

"February’s activity data have added to the evidence that the economy lost a little pace in Q1. Like the retail sector, the construction sector appears to have been blown off course by the bad weather at the end of the month," remarks Ruth Gregory, an economist with Capital Economics.

However, the ONS noted that there was no anecdotal evidence to suggest the snowfall in February had a negative impact on the manufacturing sector.

"As such, the February decline raises questions as to whether it could be part of the industrial slowdown in the Eurozone, where the cause(s) of the persistent weakness across January and February has been hard to pin down. Reasons cited for the softness have included adverse weather, capacity constraints and even a bad flu season. Could the two slowdowns be related? Possibly, though we cannot draw any firm conclusions at this stage," says George Brown, an economist with Investec in London.

Following below-consensus industrial production and construction output data for Feb., it now looks like GDP growth slowed to 0.2% in Q1, below the MPC's recently-downgraded 0.3% forecast. The case for holding back from hiking rates in May is strengthening with every data release

— Samuel Tombs (@samueltombs) April 11, 2018

Economists and markets care about the data because manufacturing is Britain's third largest economic sector and so production numbers here can have an impact on overall expectations for GDP growth.

"Total industrial production likely increased by about 0.8% quarter-on-quarter in Q1, causing its contribution to GDP growth to step up to 0.11 percentage points, from 0.07pp in Q4," says Samuel Tombs, chief UK economist at Pantheon Macroeconomics. "But this won’t be enough to offset weakness in retail sales, consumer services spending and construction activity, all partly induced by the bad weather."

Tombs says Wednesday's data is consistent with UK GDP growth slowing to around 0.2% during the first quarter of the year. If correct, then this would cut UK growth in half when compared with the 0.4% expansion seen at the end of 2017 and would also put it beneath the Bank of England forecast for an expansion of 0.3%.

Capital Economics' Gregory says industrial and construction sectors are unlikely to make much contribution to GDP growth in Q1. "And with the bad weather also hitting the retail sector, we anticipate a quarterly rise in GDP in Q1 of around 0.3%, a bit weaker than Q4’s 0.4% increase".

This apparent slowdown may place a question mark over the idea of an interest rate rise in May, which markets have begun to take for granted, although it remains to be seen whether a short term blip will be enough to deter the Bank of England.

The Details

Manufacturing has been a relative bright spot in the UK economy ever since the Brexit vote of June 2016 when the double digit fall in the Pound made British goods cheaper for overseas customers to buy. A robust domestic economy has also fuelled demand.

Above: ONS graphs showing changes in UK manufacturing production.

However, the above also shows growth among manufacterers could now be beginning to wane, or at least consolidate, while the construction industry remains a concern.

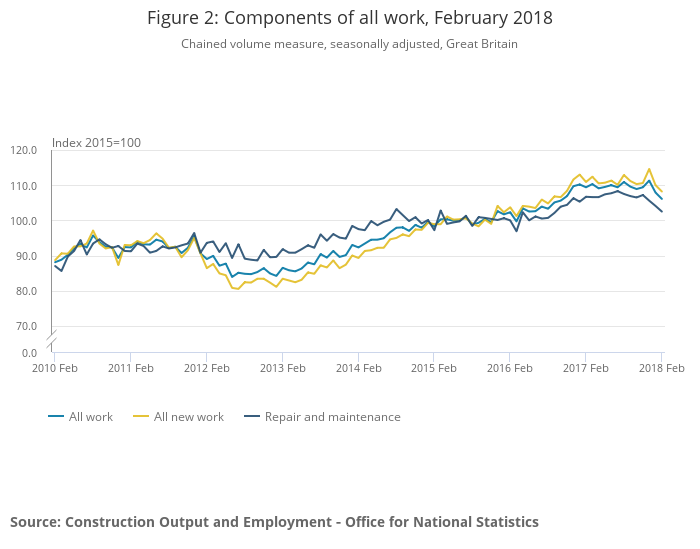

The January construction result marked the steepest fall in industry activitysince March 2013, before the UK’s economic upturn really took hold, and left the sector in recession at the start of the year. This fall was the result of a continued decline in commercial construction activity, which has been hindered by Brexit uncertainty and oversupply of new office space in key business hubs like London.

This recession now looks to have deepened in February as industry activity was stalled by adverse weather conditions at the end of the month. Furthermore, Wednesday's data comes hard on the heels of PMI surveys of the services, construction and manufacturing sectors, all of which painted a mixed picture of economic activity in the first quarter.

Above: ONS graphs showing changes in UK construction output.

Activity in the all-important services sector fell sharply during March, according IHS Markit data, while manufacturers enjoyed another good month, albeit with a slower pace of growth. The beleaguered construction industry slumped deeper into the red after snowfall hindered production.

The recent period of snow and colder temperatures is expected to dent UK economic growth for the first quarter. Already, retail sales tracked by the Confederation of British Industry fell sharply last month and economists forecast the official numbers will do the same when released later in April.

This weather-induced disruption adds to an already muddy picture of the UK economy after the fourth-quarter GDP report was also impacted by one-off events, such as the closure of a key oil pipeline in the North Sea during November, which dented industrial production and lowered GDP growth for the period. However, other economic barometers such as the unemployment rate and wage growth numbers remained firm in amongst all of this.

Pound Sterling Outlook

While Sterling turned softer in the wake of the morning's data, analysts remain upbeat in their outlook for the currency.

“The long term trend for GBP/USD still points upwards and the weaker-than-expected reading appears to be a small blip in the road to policy tightening, with the market looking towards a potential rate hike from the BOE on May 10th," says Sillicon Valley's Parekh.

The outlook for the Pound-to-Euro rate is also turning more positive, according to some, with the exchange rate potentially moving as high as 1.1727 over coming weeks.

"EUR/GBP continues to sit at the base of its range. Near term it is struggling to overcome resistance at 0.8800/0.8810 and while capped here, a negative bias remains. A close below 0.8697 is needed to confirm the market is ready to head lower towards the 78.6% retracement at 0.8527," says Karen Jones, head of technical strategy at Commerzbank. "The intraday Elliott wave counts remain negative and we have a confirmed sell signal on the Directional Movement Indicator."

A EUR/GBP rate of 0.88 is equal to a Pound-to-Euro rate of 1.1363 while a 0.8697 EUR/GBP rate translates into 1.15 for Pound-to-Euro. The 0.8527 level is equal to 1.1727.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.

Bank of England Still Likely to Raise Rates in May

For Sterling, what matters is whether or not the recent data reduce the chances of the Bank of England raising interest rates in May. For now, the bet is that the BoE won't be swayed as the broader picture remains constructive.

UK unemployment falling back to a 42 year low of 4.3% in the three months to January despite a continued rise in the participation rate, as the economy created 168,000 new jobs during that period. This was twice the number of new jobs expected by even the most bullish forecasters.

Meanwhile Bank of England data has shown wages picking up thanks to a tightening labour market and improved profitability in the manufacturing sector. Wage pressures are important for the economy and Pound Sterling because of their influence over demand growth and inflation.

This is part of the reason why economists forecast the BoE will continue to raise interest rates this year even though the consumer price index is already in retreat from the 3.1% high seen in November last year. Inflation is what the BoE seeks to contain when it raises interest rates, which are themselves the predominant driver of exchange rates.

The Bank of England already raised the base rate by 25 basis points to 0.50% back in November 2017 and said in February that it will raise rates faster and further than the market expects if the inflation outlook evolves in line with its latest forecasts. It predicted the consumer price index would be above the 2% target until at least the first quarter of 2021 although consumer price inflation fell from 3% to 2.7% that same month.

Pricing in interest rate derivatives markets, which enable investors to protect themselves against changes in interest rates while providing insights into expectations for monetary policy, suggests a greater than 50% probability of another rate hike in May with the market-implied bank rate on May 10 sat at 0.66%. Any change in this implied probability between over the next six weeks will have a significant impact on Sterling.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.