Soc Gen: Pound Sterling Not Ready to Fully Recover, Parity vs Euro Still Possible

- Written by: James Skinner

Sterling needs more than a standalone rate hike to sustain a recovery. A new narrative is needed say Societe Generale who warn a fall to parity against the Euro is still likely.

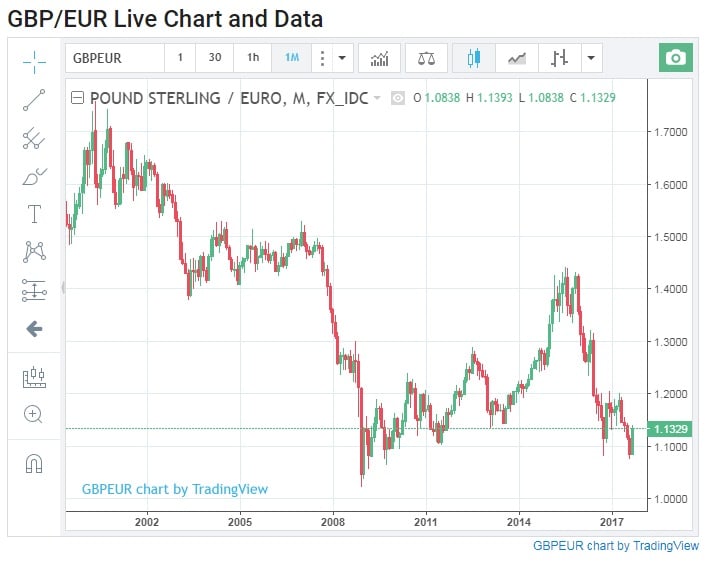

We report today that HSBC Bank plc have upgraded their forecasts for Sterling and in doing so advise they no longer see the Pound falling to parity with the Euro.

But just as HSBC row back from their forecast for parity, another analyst briefs that a fall to such levels is still possible.

Kit Juckes at Societe Generale in London believes Sterling is not yet ready to fully recover against the Euro and should 'bounce along the bottom' for a little longer.

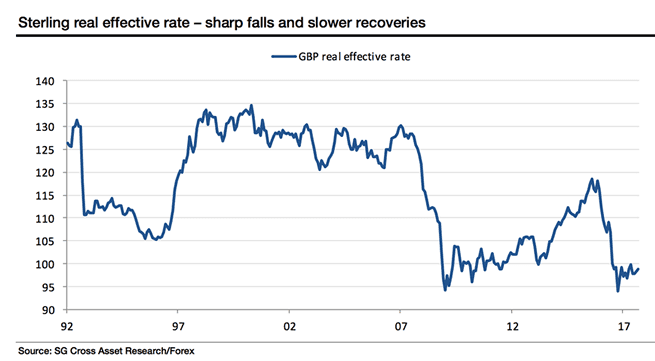

Juckes notes that the Pound does tend to suffer suppressed levels for extended periods following substantial declines, and it would be too early for the currency to recover:

Juckes notes the recovery after 2008 was choppy and helped by the Euro’s weakness in 2010. GBP/USD reached a low in January 1993, but it wasn’t until mid-1996 that the Pound really made gains, and the low in GBP/DEM didn’t come until the end of 1995.

"A protracted period of ‘bumping along the bottom’ during which sterling does make a new low in trade-weighted terms, seems more likely than a turnaround," says Juckes.

Juckes says we should not be surprised by the recent bounce in Sterling as such episodes are always likely.

But, "with an economy slowing into the decision to leave the EU and rates too low to fall, the only sources of optimism about the outlook for Sterling are negative sentiment and depressed levels. Can you build a meaningful rebound on those alone?" asks Juckes.

Why the Pound Should Stay Supressed Against the Euro

Sterling has leapt to a fresh 15-year high against the US Dollar and multi-week highs against the Euro.

But, beyond an initial hubbub of excitement over a Bank of England rate rise, widening yield differentials could still see the Euro-to-Pound rate forging ahead to set new highs say Societe Generale.

Driving the exchange rate will be yield differentials - the difference between UK gilts and German Bunds.

"Low levels of gilt yields remain an anchor on Sterling. EUR/GBP’s recent correction looks very warranted and the GBP/USD bounce looks very sensible,” Juckes says.

Looking ahead, Juckes believes the European recovery story should push the yield on Bunds higher, in turn pulling the Euro up against the Pound.

“As the European economy recovers, and the ECB edges towards tapering, can the MPC help Sterling unless the economy gains momentum enough to warrant not just a one-off reversal of last year’s rate cut, but expectations of a series of moves?,” notes Juckes.

Sterling does not look excessively cheap against the Euro at current levels however it does look fairly well-balanced against the Dollar.

As such Societe Generale see a fall in GBP/EUR as being more likely than a fall in GBP/USD.

From here, Societe Generale see far more chance of making a new high in EUR/GBP and a test of parity at some point, than a break below the lows in GBP/USD.

"1.25-1.40 probably captures the GBP/USD range for the next year (or longer). And EUR/GBP 0.85-1.0 may well capture the vast bulk of trading in that cross through to the end of 2018, too. Bumping along the bottom still about sums it up, even if weeks like the last one show what a bump can look like," says Juckes.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

The Counter Argument. HSBC, ING Say Parity Shelved.

Not everybody got Juckes' memo Monday as the beginning of the new week saw HSBC join the ranks of financial institutions saying the Pound-to-Euro parity call is off the table now.

HSBC had forecast the UK's chronic trade deficit, which is the difference between imports and exports of goods and services, would drag sterling lower to parity before the year is out. Given ongoing speculation and an absence of sufficient countervailing flows.

But foreign exchange strategists at the world's seventh largest bank noted Monday that markets have focused much less on structural issues like the trade deficit and more on the cyclical trends that drive the economy and policy maker responses.

“We were wrong. Contrary to our expectations, GBP has been exclusively driven by cyclical forces in 2017,” says David Bloom, Strategist with HSBC Bank plc based in London. “Combined with a more hawkish BoE, we revise our year-end 2017 forecast.”

Strategists at ING said two weeks ago that a sustained move in the Pound-to-Euro rate past 1.1100 would effectively shelve fears over parity with the Euro. The Pound-to-Euro rate has traded above 1.1100 for more than a week now.

"Both near-term political uncertainty and louder BoE forward guidance over a shallow hiking cycle means that we are content with our forecasts for EUR/GBP at 0.90 and GBP/USD at 1.33 by end-2017," says Petr Krpata, a strategist at ING Group, in recent note.

Sterling is Best-in-Class

In a rare post-referendum performance, Sterling was the best performing currency in the G10 basket last week, thanks to a decisively hawkish turn by the Monetary Policy Committee at the Bank of England.

Policy-makers voted 9-2 to hold the bank rate at a record low of 0.25% and to leave the BoE’s QE program unchanged. However, the committee warned in its statement that markets are underestimating how soon and fast interest rates might need to go.

The BoE could hike rates, reversing its August 2016 cut, as soon as November according to the latest policy statement. A sentiment that was echoed in speeches by governor Mark Carney and “uber-dove” Gertjan Vlieghe over the course of Thursday and Friday.