GBP/JPY: Already Best in Class, But Has Further to Rally

- Written by: James Skinner

The Pound has gained 7% over the Yen in one week but policy divergence might see it go further

The Pound could extend its gains over the Japanese Yen during the coming months if the Bank of England remains on a hawkish footing, tensions remain high on the Korean peninsula and inflation remains south of the Bank of Japan’s already-downgraded forecasts.

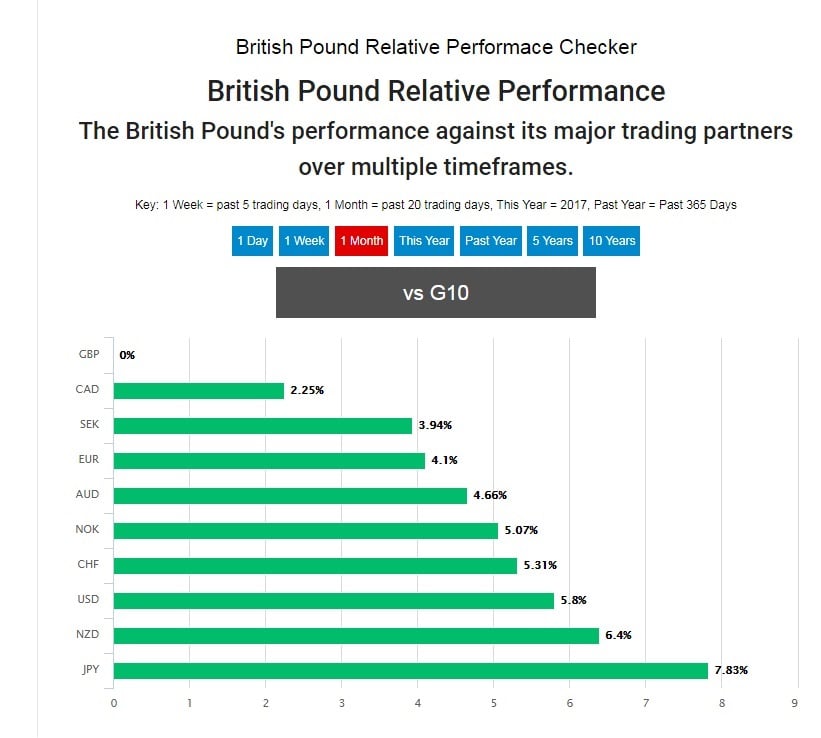

Sterling is currently top of the class in the G10 basket after an aggressive pivot onto a hawkish footing by the BoE Thursday and Friday. Nowhere has the change of fortunes for the Pound been more apparent than in the Pound-to-Yen exchange rate.

The Pound has rose by close to 3% during the morning session Friday, driven mostly by BoE talk and overnight by fallout from the latest North Korean missile test, bringing the currency pair’s gain in the last week alone to more than 7%.

Pound Sterling Performance Against G10 Currencies.

With October’s flash crash set aside, the swing is the largest one week movement seen in GBP/JPY since late 2016 and puts the exchange rate at its highest level since the outcome of the Brexit referendum became known in June 2016.

Friday’s price action comes after Monetary Policy Committee member Gertjan Vlieghe, who has been among the strongest advocates of a lower-for-longer policy at the BoE, told a conference audience that an interest rate hike could be imminent.

"We are approaching the moment when bank rate may need to rise...the appropriate time for a rise in bank rate might be as early as in the coming months, Vlieghe said in a set of prepared remarks.

Moving Onto The Front Foot

Thursday saw the Bank of England harden its language around monetary policy, telling markets interest rates could need to rise earlier and faster than they have been expecting, possibly before the year is out.

Governor Mark Carney supplemented this hawkish rhetoric when he told the press the possibility of an interest rate hike has “definitely increased”, at an event marking the launch of the new ten Pound note.

"The majority of members of the (Monetary Policy) Committee, myself included, see that that balancing act is beginning to shift....there may need to be some adjustment of interest rates in the coming months," Carney said.

Traders are now betting on a rate hike from the BoE in November 2017 while strategists have said the odds of action from the Monetary Policy Committee have increased notably.

Japan: Rock And A Hard Place

With inflation across some parts of the consumer price basket turning negative in July for the first time since the BoJ launched its world-record-breaking quantitative easing program in 2013, the other side of the Sterling-Yen trade sees Japan’s currency caught between a rock and a hard place.

“As a result, expectations for policy tightening have receded: The share of analysts who expect the Bank of Japan to tighten monetary policy by the end of next-year has halved since February,” says Mark Williams, chief Asia economist at Capital Economics. “We share this assessment.”

Consumer prices have averaged an annualised pace of just 0.4% in first four months of the fiscal year, beginning in April, far below the Bank of Japan’s forecast for CPI of 1.1%. This is while the BoJ has already cut its inflation forecast, from 1.4%, back in July.

“We expect inflation to average just 0.7% in 2019, and we think that policy tightening remains unlikely before end-2019,” says Williams.