Bets Against Pound Sterling Stabilise, Traders Boost Bets for Further Euro Gains

Traders have increased their exposure to the Euro, betting further gains are likely.

The latest data from the US Commodity Futures Trading Commission's Commitments of Traders Report (CFTC) also confirms the speculative community are negatively positioned on the British Pound in anticipation of further weakness.

The data offers the most comprehensive insight into sentiment amongst global currency traders and can often give hints as to future direction in various currencies.

Dollar & Pound Neutral, Bullishness on Euro Increasing

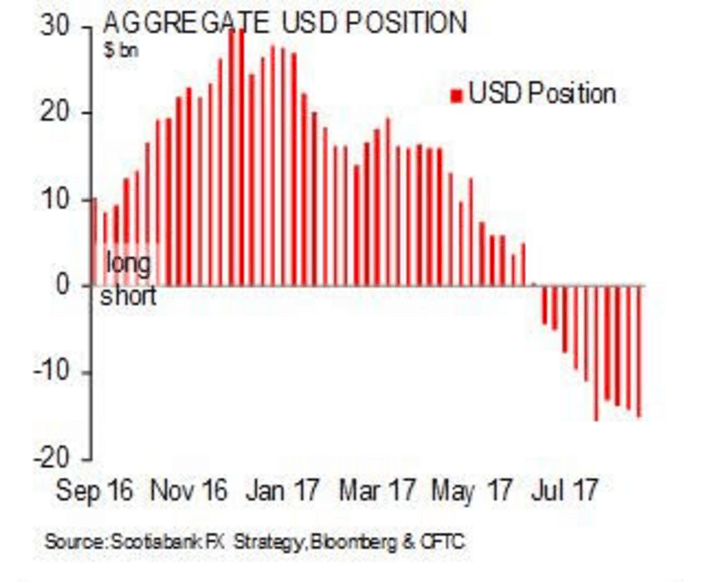

Speculative positioning in the major currencies reflects a small increase in the overall bearish bet on the US Dollar with an aggregate net short of $15.1BN, up $764MN on the week and edging closer to the recent peak bear bet of $15.6BN.

The bullish bet on the Euro stands at $14.343BN, up $1.4BN.

“This week, EUR bullish sentiment has strengthened much more obviously,” says Shaun Osborne, an analyst with Bank of Nova Scotia adding that this represents a rise in “speculative bets on the EUR appreciating.”

Net EUR longs had been relatively stable since early July but this week’s rise takes the overall EUR bull bet to the highest since 2011.

The desire for exposure to a rising Euro comes amidst a broad-based rally in the Euro exchange rate complex with traders betting the European Central Bank will soon start withdrawing stimulus. At their September policy meeting conducted on Thursday, September 7, the ECB said an announcement on such measures would be made at the October meeting.

Bets for further depreciation in the British Pound stand at $4.3BN, a change of -$149MN, which Osborne describes as being an effectively neutral shift.

The neutrality in the bet would more or less par with price action in key Sterling pairs witnessed since late-August, early-September in which the Pound-to-Euro and Pound-to-Dollar exchange rates have edged higher.

The Dollar is meanwhile seen enduring ongoing selling pressures as traders bet the US Federal Reserve will slacken the pace at which they intend to raise interest rates over the remainder of 2017 and through 2018.

Analysts also point to a great rotation amongst US investors into global investment assets; something that is putting pressure on the Dollar.

Potential for Euro Reversal?

What does the data tell us about future direction?

Positioning data is useful at anticipating future moves when positioning on a currency is at extended levels. What can happen is that when a bet is crowded the move is liable to fade and even reverse, often quite sharply.

For instance, the massive pro-Euro positioning could mean the drive higher in EUR/USD and EUR/GBP starts to fade as it becomes increasingly harder to find new market entrants to push the move onwards.

And when traders start booking profit on the move, or an adverse piece of data is released, the exchange rate can reverse quite rapidly.

While positioning on Sterling and the Dollar are not extreme, it could be argued that positioning on the Euro is extreme.

So we could see some rapid reversals in the Euro over coming weeks.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.