Pound Sterling to Head Higher v Dollar, Euro into Year-End Forecast Crédit Agricole CIB

“We believe that a lot of negatives seem to be in the price of the currency and thus expect a less pronounced sell-off from current levels.”

- Market Quotations for Reference:

- Pound to Dollar exchange rate: 1.2960

- Pound to Euro exchange rate: 1.0759

A significant “further deterioration in GBP’s fundamentals” is required to push the Pound down to 1.25 against the Dollar and 1.05 against the Euro argues the foreign exchange rate strategy team at Crédit Agricole CIB.

Analysts have said that while they share the market’s concern regarding the softening of the UK economy and challenging Brexit talks that lie ahead, the Pound will likely find support in that it is already heavily undervalued at current levels.

The British Pound has come under renewed pressure in late summer amidst deteriorating sentiment linked to weaker economic data which has in turn reduced the chance of an interest rate rise at Bank of England.

Currencies tend to rise when their central bank is entering and move through a rate-raising cycle. The Pound rallied mid-year as markets increased bets that rising inflation offered enough reason to allow the Bank to raise rates 0.25%.

These expectations have since been dashed by weaker data elsewhere.

But the Euro is a prime example of a currency that is enjoying strength as investors gear up for a period of monetary tightening at the European Central Bank.

The sentiment has pushed the Pound to Euro exchange rate down to 8-month / 8-year lows (depending on whether or not you wish to count the price action of the flash-crash of early October 2016 as valid).

Fall to Parity vs Euro Unlikely

While the Euro is one of the best-performing global currencies at present, the Pound remains subdued by a slowing economy amidst a climate of uncertainty owing to the Brexit process.

For many investors, the latest weakness in Sterling represents “only the start of a protracted period of economic underperformance linked to Brexit,” note Crédit Agricole CIB.

The debate regarding whether or not the Pound will fall to 1.00 against the Euro was ignited by a research report issued by Morgan Stanley in which they argued ‘real money’ investors may increase their exposure to Eurozone assets and stimulate the Euro yet higher.

An exchange rate of 1.00 is forecast by Morgan Stanley for early 2018.

While we have seen a swathe of analysts cut forecast for GBP/EUR, consensus amongst the analyst community remains that a fall to 1.00 is unlikely.

Nordea Markets, for instance, argue that the Pound will not par the Euro on the basis that “a complete meltdown of UK key figures is already priced into EUR/GBP.”

British Pound Undervalued

Crédit Agricole CIB say they share the market’s worries about the economic impact from Brexit and maintain a cautious outlook for GBP in the near-term.

“That said, we believe that a lot of negatives seem to be in the price of the currency and thus expect a less pronounced sell-off from current levels,” say Crédit Agricole CIB.

Last week we reported that a number of investment banks were wary of the Pound’s valuation having cited the currency as being substantially undervalued against the Euro with various models placing that undervaluation in the region of 4-20%.

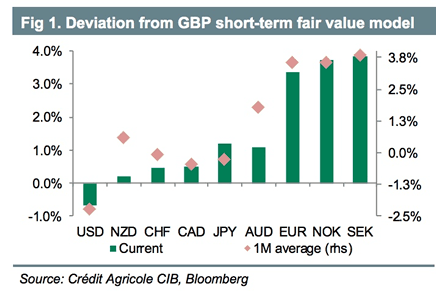

Crédit Agricole CIB’s FX valuation analysis suggests that GBP is undervalued against both USD and EUR at present.

According to their long-term fair value model (G10 VALFeX), GBP/USD should be closer to 1.40 and EUR/GBP 0.88 given the current levels of relative productivity, commodity terms of trade, real rates and yields, as well as external imbalances.

EUR/GBP at 0.88 gives us a GBP/EUR at 1.1360.

Furthermore, other analysts have raised concerns have grown that the Euro’s stellar rally is looking stretched and is due to fade.

"Expect the strong EUR-sentiment to ease. EUR has rallied more than fundamentals and see risk of verbal intervention from ECB to limit further upside short term,” says D.N.B FX strategist, Magne Østnor

Our own technical studies meanwhile note that the Relative Strength Index on the GBP/EUR exchange rate is heavily oversold commensurate with conditions that should prompt a rebound.

We join those who believe that while Sterling should remain under pressure against the Euro, some near-term relief is due.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Fundamentals Don’t Justify a Fall to Parity

Crédit Agricole CIB believe that the UK economy should provide enough positive indicators into year end to justify a stabilisation in Sterling’s activity.

“Stable and even subsiding inflation going forward would help boost the real purchasing power of UK consumers while weak GBP could continue to boost UK trade. We further think that the prospects for a ‘very hard’ and ‘cliff-edge’ Brexit have now subsided,” say Crédit Agricole CIB.

As such, “to justify a rally in EUR/GBP towards 0.95 or higher, or a selloff in GBP/USD towards 1.25 or lower, we have to assume a significant further deterioration in GBP’s fundamentals, consistent with a severe post-Brexit supply shock to the UK economy and even a balance-of payments crisis.”

These are non-negligible risks that Crédit Agricole CIB believe will be largely avoided.

Analysts at the French investment bank subsequently expect GBP/USD to trade close to 1.30 and EUR/GBP close to 0.90 in the fourth quarter of 2017, and 1.38 and 0.88 respectively in the fourth quarter 2018.

EUR/GBP at 0.90 gives a GBP/EUR exchange rate of 1.11 and 0.88 gives 1.1360.

... But the Euro's Trend Higher is Hard to Resist

While the fundamental's behind further Euro strength against Sterling are questioned by Crédit Agricole CIB, who is going to stand in front of the ever-stronger Euro?

The Euro rose while the Dollar fell amidst fresh geopolitical concerns following the firing of a missile by North Korea over Japan.

As a result, the EUR/USD currency pair has broken above 1.20 on Tuesday, August 29 and this is inevitably heaping further pressure on the Pound.

Indeed, Sterling-Euro is at all-out eight-year lows at the time of writing having reached 1.0760.

More gains are likely before this trend runs out of steam.

Analyst Kathy Lien at BK Asset Management thinks EUR/USD could hit 1.22 and possibly even 1.25:

“The longer target is a stretch but realistically, above 1.20, there is no technical resistance for EUR/USD until 1.25.

“Historically, 1.25 still puts the pair less than halfway between its 2008 1.6038 high and last year's 1.0352 low. Also the 5-year average value of EUR/USD is around 1.21, so 1.25 would not be a significant overvaluation.”

So expect the Euro's uptrend to maintain strenght on Sterling going forward, even if fundamentals are crying out for the market to stabilise.

Underlying the Euro's recent run higher is an apparent failure by EU leaders to stand in the way. In the past ECB policy makers have welcomed the Euro's apparent undervaluation as it provides a stimulant for the area's exporters.

The rapid rise makes Eurozone goods and services more expensive will also placing downward pressure on inflation.

But, markets have noted that the ECB's President Draghi has on numerous occassions failed to show concern for the move. His address to the Economic Symposium in Wyoming ahead of the weekend was a prime example that only emboldened Euro-bulls further.

And on August 29, German Chancellor Angela Merkel told reporters that she doesn't "have a political influence over the exchange rate, we’re happy about our competitiveness and we avoid unfair trade practices."

Further, on the point of a potential loss of competitiveness owing to the Euro's rise Merkel reflects, "if the trade surplus should now shrink, then that would be one of those developments that’s really out of our hands.”