Carney Must Push Back Against the Bank's Latest Hint at Higher Interest Rates

- Written by: Gary Howes

UK interest rate yields and the value of Pound Sterling have risen sharply on news that Bank of England's Monetary Policy Committee voted 5-3 to keep rates unchanged at their June meeting.

That three members of the MPC voted to raise rates came as a surprise to markets which have rapidly had to reassess their assumptions on future policy rates.

When Governor Carney next speaks, his comments could be crucial for market direction.

"If he is seen to endorse the more hawkish tone set by three of the external members of the Committee, it will fully validate the market reaction to the split vote which has seen 5yr Gilt yields rise as much as c.10bps on the day," says Sam Hill at RBC Capital Markets.

This rise in gilt yields has fostered a stronger Pound.

Carney had been due to speak this evening at the Mansion House banquet, although this has just been cancelled in light of the Grenfell Tower fire.

RBC Capital Markets believe the Bank has sent the wrong signal at a time when it is especially important to take a cautious approach on the consumer slowdown.

This is particularly important given that the very low household savings ratio skews the bias of risks to the downside.

It has fallen to 3.3% (end-2016) from over 6% a year ago and 11% in 2010.

Aside from contributions to occupational pensions, Hill is concerned that discretionary saving has been very thin indeed. The consumer could find it difficult to smooth its spending profile in the face of income or confidence shocks at this stage.

"Our view is that Carney should downplay the signal sent by the hawkish external members in light of the precarious position of the consumer and the uncertain post-election aftermath. Indeed, despite the vote split from the June meeting, we retain a forecast for more stimulus in Q1 2018, in the form of a Bank Rate cut to 0.1% and an additional £50bn of QE Gilt buying," says Hill.

So we now wait for Carney's next set-piece for that all-important guidance.

The Mansion Hall event really was set to be of importance to Sterling and the wider markets.

The Financial Times reported that Chancellor Hammond will air his concerns about the economic risk of crashing out of the EU, warnings he has made before.

Markets will now have to wait a little longer for this message as it will be a key topic for Sterling going forward. As we note here, the syle of Brexit could be as important as the final outcome.

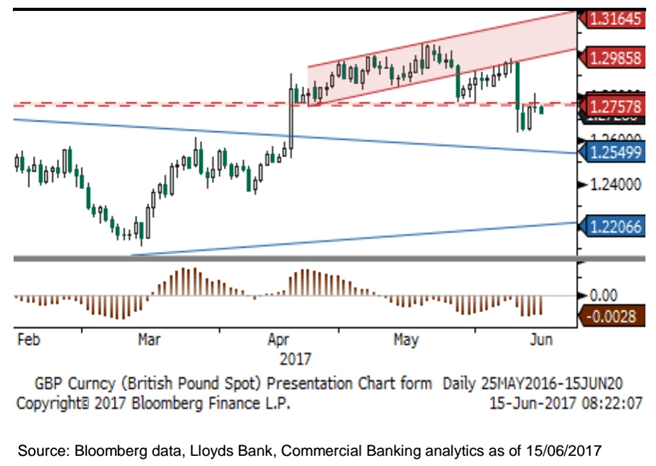

Pound to Dollar Rate Technical Targets

GBP/USD is quoted at 1.2704 at the time of writing having and Wilkin says he is still biased for a move lower.

“Next support below the 1.2636 election night reaction low is 1.2550, which is close to the mid-point of our expected 1.20-1.30 range,” says Wilkin.

For those hoping for a stronger Pound, a rally back through 1.2840 would negate the immediate bearish bias and risk a re-test of the range highs.

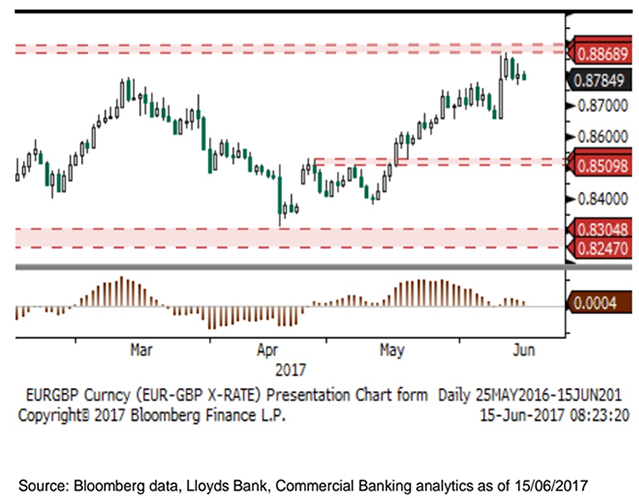

Euro to Pound Rate Technical Targets

Euro to Pound Rate Technical Targets

It looks like Sterling could be in with a shot at recovering some lost ground to the Euro.

“The EUR/GBP exchange rate continues to hold under the medium-term range highs in the 0.8800-0.8900 region,” notes Wilkin.

Intra-day and daily momentum studies are bearish and Lloyds are watching to see if support today at 0.8735 and then 0.8655 break to confirm a return towards the 0.8400-0.8250 range lows.

“A move up through 0.8850-0.89000 is needed to negate and keep the trend from 18-April lows intact with 0.9000 next resistance,” says Wilkin.

Long term it is still unclear to the analyst whether the decline from the “flash-crash” highs at 0.9710 are just corrective, for an eventual re-test of the 2008 highs at 0.9802, or a major lower high for a move back towards 0.7500-0.7000 range lows.