British Pound hits Fresh Highs on Renewed Global Risk Aversion

- Quotes:

- Pound to Euro exchange rate: 1.1848, up 0.55% on the day's open

- Euro to Pound Sterling exchange rate: 0.8445

- Pound to Dollar exchange rate: 1.2888, up 0.3% on the day's open

Pound Sterling is in demand on Thursday, April 27 having hit a fresh 2017 high against the US Dollar at 1.2918.

The currency meanwhile sought to recover ground lost to the Euro following the French election and the tone delivered by the ECB at their April policy decision announcement and accompanying press conference went some way in helping the Pound achieve this aim.

Sterling outperformed other rivals amidst a broad-based aversion to taking on risk amongst global investors.

Risk-aversion refers to the investor's decision to stay away from more volatile assets such as stocks, commodities and commodity-linked currencies and typically occurs when markets are nervous about the trajectory of the global economy.

Investor sentiment was soft as tensions on the Korean peninsula continue to rise and the US administration fails to whet investor appetite after announcing tax cuts that were lacking in detail.

We have seen through the course of April that the Pound tends to benefit when market nerves are running high as investors hunt out the safety of UK gilts.

"European markets, much like their Asian counterparts appear to have followed the negative precedent set by the US, with many disappointed that yesterday’s tax announcement shed very little additional light apart from the information already leaked ahead of the announcement. There is certainly a degree of hesitancy given the difficulty Trump has had with the travel ban and healthcare reforms," says Joshua Mahony, Market Analyst at IG, the online trading provider.

A snapshot of global market conditions suggest investors are showing nerves which allows us to draw the conclusion that this new-found relationship between risk and Sterling remains with us:

- The FTSE 100 is down three-quarters of a percent

- The DAX is down 0.33%

- Oil prices are down over half a percent

- The safe-haven Yen is up against the Dollar by 0.2%

Trump Disappoints

President Trump's tax plans barely filled a page which confirms the kind of details markets wanted were not forthcoming.

There is also the sense that Republicans in Congress will not simply let the plans sail through unopposed as most economists suggest that the plans are no budget neutral and they will in fact further expand the United States’ burgeoning debt pile.

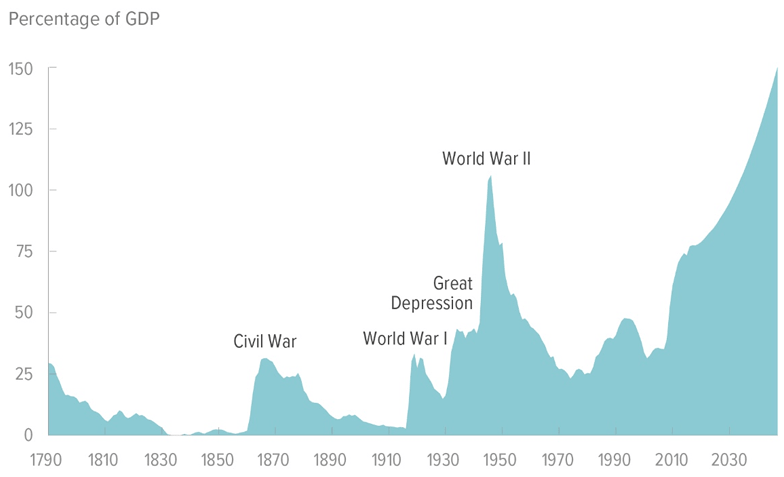

Above: Are we in World War 3? The US debt pile suggests we are.

As it stands, the US budget deficit would reach 150% of GDP in 2047, and this is before Trump enacts his massive tax cuts.

“So, while plans to cut corporation tax rates, simplify the tax code and encourage repatriation of money from overseas look very positive for the economy on the surface, market participants are holding back their enthusiasm until they see detail of how they will be funded,” says Kit Juckes, an analyst with Societe Generale in London.

What was Announced

- The proposals filled little more than a page. Nevertheless, highlights of today’s announcement:

- Personal tax brackets go from 7 to 3: 10%, 25%, 35%. Income brackets not yet determined.

- Capital gains taxed at 20%.

- No taxes on couples earning under $24K.

- Corporate taxes slashed to 15%, with small business included.

- One-time tax on foreign earnings, rate not yet determined (Mnuchin: rate will be “very competitive”).

- Shift to territorial corporate tax regime.

"When Wednesday’s tax announcement was first scheduled, it was hardly a surprise that a press conference heavy on bluster and light on detail failed to impress investors, especially since, like healthcare, any proposed bill would face an uphill battle to get passed," says Connor Campbell at Spreadex.

Markets have moved into the red since the announcement confirming a shift in sentiment.

Korea Sees Geopolitical Risks Running Hot

Korea is another reason markets are showing nerves.

Recent developments have seen the administration say it will tighten sanctions against North Korea as it aims to quell rising fears that Pyongyang will launch a nuclear attack.

All 100 members of the Senate met at the White House for a briefing by Secretary of Defence Jim Mattis, Secretary of State Rex Tillerson, and Director of National Intelligence Dan Coats.

The message delivered was Washington will "remain open to negotiations" but also prepared to defend the US and its allies.

The mass invitation is an unusual move on the part of the Trump administration, and Senator Chris Coons called the briefing "sobering".

The US has recently upped its engagement in the area having sent warships to waters around the Korean Peninsula and engaged in aerial exercises that seek to, “ameliorate Kim Jong-un's worst impulses".

The US is also conducting other exercises with the Japanese and South Korean militaries in an effort to discourage North Korean action, but also prepare for it.

Near-Term Outlook for the Pound

It is far too early to say with certainty the Pound is now a safe-haven. The thing is, the relationship between a currency and risk is a fluid one. There is no rule set in stone and and different risk scenarios present different reactions.

So for now the Pound appears to do well when markets in the red, how long this lasts remains to be seen.

Concerning the GBP/USD outlook, “prices are trying to push up out of the recent "flag" consolidation phase. Momentum is positive, so we can see a push towards the 1.3000 key resistance region, but we still believe that the upside is limited to these levels as part of a medium term range,” says Robin Wilkin, an analyst with Lloyds Bank.

A clear break of 1.30/1.31 would force Lloyds to review the outlook as it would risk a broadening of the range expectations to the 1.35 area on the topside.

Meanwhile the GBP/EUR exchange rate continues to hold above 1.1723 pivot support.

Intra-day momentum remains positive suggesting there is the chance of a move back to close this week’s opening gap in the 1.1883-1.2121 region.

Broadly though Lloyds expect the exchange rate to remain in a medium-term range between 1.2048-1.2121 to the top and 1.1363-1.1236 to the bottom. Their short-term bias is for a shift back towards these lower levels.

Some Good News on the Data Front

On the domestic front, there was some good news for Sterling in the form of retail sales data from the CBI.

One of the thorns in the side of the UK economic growth story, and hence confidence towards the Pound, has been the notable slowdown in UK retail sales growth since December 2017.

Recent data confirms the UK has witnessed a lull in sales activity which economists points to a the likelihood of slower economic growth in the wider economy for 2017.

There was a recent pick-up in the official data in the March release, and it looks like upcoming releases could extend signs of a recovery in the sector.

According to the CBI Distributive Trades Survey - released on April 27, retail sales growth accelerated in the year to April, with volumes rising faster than expected.

The survey of 112 firms, of which 57 were retailers, showed that the volume of sales grew at the fastest pace since September 2015 in the year to April, with orders placed on suppliers rising at the strongest rate for a year-and-a-half.

Overall, sales for the time of year were considered to be slightly above seasonal norms.