British Pound Outlook v Euro and Dollar Improves, London FX Turnover Down

There are growing signs that the downside pressure on pound sterling is easing - here are the factors what to watch over coming days. Meanwhile, the Bank of England has released their latest FX market data concerning turnover in the London market.

Pound Sterling has endured a poor start to 2016 having registered notable declines.

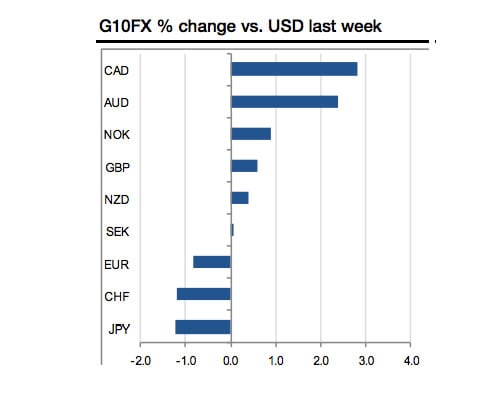

To be sure, the lion’s share of the losses came against the euro and US dollar, and there were some marginal advances against the risk-off currencies such as NZD and AUD.

But the truth is USD and EUR are by far the pound’s most heavily traded counter-parties; and gains against the minnows of the FX universe: the AUD's, CAD's, NZD's and ZAR's should have been more aggressive had sterling been genuinely in demand.

Here is the issue - sterling is simply failing to find demand as the Bank of England continues to punt the timing of the first interest rate in years further into the distance.

Global stock market selling has also weighed; conditions that favour the funding currencies such as the JPY, EUR and USD. So, should global markets settle down over coming weeks sterling should find support in our opinion.

Where is the Pound Ahead Today?

- The pound to euro exchange rate has recovered from sub-1.30 earlier in the week towards 1.3127 on the spot markets. Bank rates are offered towards 1.2760, independents are doing payments just below 1.30 again.

- The pound to US dollar exchange rate is seen at 1.4245 on the spot markets. Independents are seen offering around 1.4070 and banks in 1.3850-1.39.

- The pound to Australian dollar rate is going in the opposite direction, highs towards 2.07 at the start of the week have given way to 2.0482 at the weekend.

- The pound to New Zealand dollar rate has slipped below 2.20 once again as interest in the NZ dollar picks up.

Could the Pound Enjoy Strength Over Coming Days?

It appears that a corner may have been turned against the shared currency - in the near-term at least - owing to this week’s European Central Bank warning on further quantitative easing being a possible path of action in the future.

Any further mention of further interest rate cuts and quantitative easing will continue to weigh on the euro over coming weeks and months.

This talk on the ECB has combined with the solid 1.30 support area which was layered with buy orders for sterling by strategists who felt anything below here was oversold.

Then, if we look at the US dollar we note that the world’s currency has actually failed to find any major upside traction against the board.

Even the pound managed to put in an advance over the past week:

"We've been fairly skeptical of the US Dollar Index's recent attempt at a breakout, and recent price action may vindicate that view shortly. A bearish daily key reversal was posted yesterday, nonetheless at yearly highs, as a sharp reversal in AUD/USD and GBP/USD removed the two main catalysts for the greenback's kick higher in recent days," says Christopher Vecchio, Currency Analyst, at DailyFX.

Remember I said global risk conditions matter for the pound? To back the argument we have been noting the correlation between GBPEUR and the FTSE 100 over recent times.

Now, risky assets appear to have found a near-term floor this week as the ECB signalled further easing may come at its March meeting.

“It was Draghi, however, who nailed the bottom—so far—in risky assets. By signalling they would ‘reconsider’ their monetary policy stance at their next meeting in March, the ECB has helped put a floor under sentiment,” says Ned Rumpeltin, European Head of Currency Strategy at TD Securities in London.

This could well support the pound agains the euro and dollar in coming days.

But beware, the AUD, NZD and CAD - when risk is on they will be bought, so upside by sterling against these currencies could become increasingly hard to come by.

Ultimately Though, Further Downside in GBP to USD is Likely

While we see scope for some upside in the pound to dollar exchange rate, be aware that momentum indicators continue to advocate for further downside.

"We believe that sterling remains a sell on rallies because of the deterioration in spending, slowdown in wage growth and less hawkish BoE comments," says Kathy Lien, Director at BK Asset Management.

According to Society Generale’s Head of Technical Analysis, Stéphanie Aymes, “GBP/USD has formed a daily hammer near 1993 lows of 1.4080/30 which also happens to be a projection for ongoing down move.”

The pair has breached below a multiyear upward channel (1.46) and the downtrend is expected to persist towards 1.36/1.35 eventually forecasts Aymes.

Soc Gen do however recon that in the short term, in light of oversold indicators a recovery can’t be ruled out.

“A move above immediate resistance at 1.4250 will mean possibility of rebound towards 1.4350, the 23.6% retracement since last month highs with next resistance at 1.4560/1.46,” says Aymes.

EUR to GBP: Short-Term Pause to the Move Higher

The rally by the euro could extend argue Soc Gen.

After achieving crucial support at 0.70/0.68, EUR/GBP has embarked on a recovery over December/January. The pair confirmed a double bottom and breached above a descending channel.

“It has achieved our target of 0.7750. Larger rebound is likely however, short term, a pause is not ruled out. 0.75/0.7450 should be an important support,” says Aymes.

Meanwhile Viraj Patel, FX Strategist with ING in London asks a question many in the market are pondering - is it time to sell EUR/GBP after the recent rally?

"Not yet, in our view, as risk sentiment is likely to remain choppy this week. While the pair is trading above its fair value based on our short-term financial model (0.7500), better entry levels may arise after the coming Fed and BoE meetings," says Patel.

A dovish Fed may keep the EUR bid, while the BoE Inflation Report (4 Feb) is likely to be GBP negative (though the bar is high for the MPC to sound even more dovish).

Bank of England Reveals FX Turnover is Lower

The BoE, together with a number of other central banks, released their semi-annual turnover surveys for FX markets.

These are useful in lieu of the broader BIS survey which is only conducted every three years (we believe the next release will be towards the end of the year).

For the UK, average daily reported FX turnover was USD2,148bn in October 2015, 13% lower than April 2015, and 21% lower than April 2014.

This is the lowest daily turnover since October 2012.