Pound Sterling Could Sling-shot 1.20 against Euro Says One Analyst

- Written by: Gary Howes

File image of Emmanuel Macron. Copyright: European Union.

According to a new analysis, the British Pound could rise to its highest level against the Euro since 2016, but one major investment bank disagrees.

Robert Howard, a Reuters market analyst, says a rise to post-Brexit highs would be due to a combination of outcomes involving the French and UK elections.

"EUR/GBP could slide to 0.80 for the first time in eight years if Emmanuel Macron's centrist alliance does worse than expected in a French parliamentary election and the UK's pro-business Labour Party wins a 'goldilocks' majority next week," says Howard.

A fall in Euro-Pound to 0.80 would give a Pound to Euro exchange rate conversion of 1.25. The last time Pound Sterling commanded such a purchasing power was in 2016 when the UK voted to leave the European Union.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"A worse-than-predicted showing from Macron's centrist alliance would raise the prospect of either the far-right National Rally or left-wing New Popular Front unexpectedly winning a National Assembly majority – a shock which could hit the euro hard," says Howard.

Current polling suggests such an outcome is unlikely, with no party on track to score a majority. This would deliver a 'hung parliament', whereby no major changes would be enacted.

Howard says political paralysis after the French election might also be negative for the euro, "especially if accompanied by civil unrest or violence".

Above: EUR/GBP could fall to 0.80 (GBP/EUR to 1.25) says a market analyst. Track GBP/EUR with your own alerts, find out more here.

To be sure, losing control of the legislature is not ideal for the reformist agenda of Emmanual Macron, but it is by no means a worst-case scenario for the Euro.

In fact, we have seen the Euro recover over recent days as markets prepare for such an outcome and the tail-risk of a majority for either the far left or far right fades.

"The pound, meanwhile, may benefit if Labour's expected majority is perceived to be neither too big nor too small," says Howard. He explains this would mean a majority of "perhaps around 160 seats".

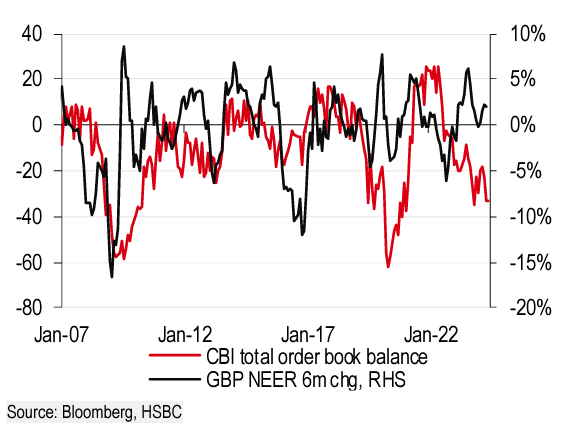

Above: "GBP looks too strong relative to some cyclical indicators" - HSBC.

However, an analysis from HSBC says the UK election will be a non-event for the Pound.

"We are not convinced that the upcoming elections would necessarily be positive for GBP. Instead, we believe GBP remains beholden to rates and will likely be on a path of gradual weakness in the coming months," says Paul Mackel, head of FX research at HSBC.

Mackel says that with poll results largely in Labour's favour, the market is likely already positioned for such a result. Some analysts argue a Labour government would be more pro-EU, but HSBC questions what that would mean.

For example, closer alignment on defence and veterinary issues are hardly game changers. Instead, the UK would need to head towards joining the EU customs union, which Labour has ruled out.

HSBC thinks interest rates and the Bank of England ultimately matter. "GBP's strength is stretched," says Mackel, "the start of the BoE’s easing cycle should be a catalyst for a reassessment of the currency."

HSBC forecasts Pound-Dollar to end the year at 1.25, and Euro-Pound at 0.84 (Pound-Euro at 1.19).