"Buying Thrust" Could Propel Pound Sterling Higher Against Euro and Dollar Into Year-end

- Written by: Gary Howes

Image © Adobe Images

According to an analyst we follow, a "buying thrust" in global equity markets could be underway, and market correlations mean it could just propel the British Pound higher into year-end.

Pound Sterling recovered through the course of the midweek session, helped by a recovery in global equity markets.

The price action confirms the Pound remains sensitive to global investor sentiment, particularly as the focus on central banks fades and economic data releases dry up.

"After a slow start to the week, things have picked up for stocks. European markets have made solid gains while on Wall Street things are more muted. But overall the outlook in the short-term continues to look good for stock markets," says Chris Beauchamp, Chief Market Analyst at IG.

The Pound has a strong correlation to risk-sensitive, meaning any rise in global equity markets can often be reflected in its performance against the 'safe-haven' currencies of the Dollar, Yen, Franc, and to a lesser extent, the Euro:

Above: GBP/USD (top) has positively correlated with the S&P 500, a solid proxy for global investor sentiment, since 2022. Set up a daily rate alert email to track your exchange rate OR set an alert for when your ideal exchange rate is triggered ➡ find out more.

The Pound to Dollar exchange rate had been as low as 1.2242 but has ultimately recovered to 1.23. Progress is more limited in the Pound to Euro exchange rate (as GBPEUR is less correlated to broader risk), with the pair remaining stuck in the 1.1470 area at the time of writing.

"Being a risk-sensitive currency, sterling also benefited by the rise in global stocks," says George Vessey, Senior FX Strategist at Convera.

But other currencies, such as the Australian and New Zealand Dollars and the Krone and Krona, are more geared toward risk, meaning they tend to outperform Sterling when market sentiment improves.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

For Pound exchange rates, the outlook remains dependent on how market expectations for future Bank of England interest rates progress and whether the market 'prices in' further rate cuts over the coming weeks. With this in mind, Friday's GDP release will offer some idiosyncratic action.

But as discussed above, the evolution of equity markets into year-end could be more important.

A bullish scenario for the British Pound would involve a rally in equity markets through to the end of the year, in what is traditionally known as the 'Santa Rally'.

Mensur Pocinci, a technical analyst at Julius Baer, says he has turned bullish on the outlook for risk, noting that a "buying thrust paves the way for year-end rally".

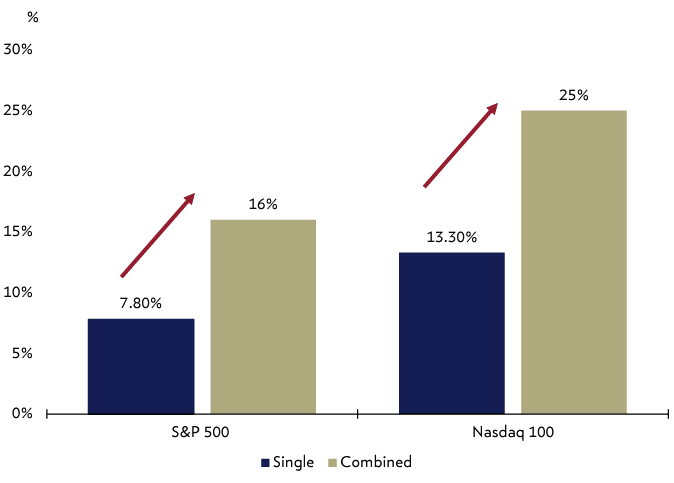

Above: "Equity market 52-week performance after buying thrust" - Julius Baer.

Global markets surged on November 03 after the U.S. reported softer-than-expected labour market figures, which hinted that the Federal Reserve has completed its rate hiking cycle.

In fact, markets proceeded to bring forward expectations for rate cuts, implying more constructive conditions lie ahead for investors.

This boosted stocks and the Pound.

Pocinci notes a broad demand for equities from depressed levels and that on November 03 "the S&P 500 managed to confirm short-term buying thrust, as more than 90% of its members have moved to a short-term uptrend."

"Not only the S&P 500 but also the Nasdaq 100 saw short-term buying thrust. Historically, a combined signal, where both indices experience a short-term buying thrust, produced almost double the return of a single-market buying thrust," he adds.

If this buying thrust can extend over the coming weeks, the Pound could also see a thrust in demand, with gains most likely to be witnessed against the Dollar.

Julius Baer technical strategists upgrade their S&P 500 view to bullish as a new medium-term momentum bottom is confirmed by a short-term buying thrust.

As the first chart in this article suggests, a rise in the S&P 500 will coincide with a rally in Pound-Dollar, but puts it at risk against the likes of the Australian and New Zealand Dollars.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes