Pound Sterling Bulls Need Market Sentiment to Improve

- Written by: Gary Howes

- GBP underperforms amidst soft risk sentiment

- But downside looks limited at this juncture

- USD looks undermined by 'late cycle' sentiment

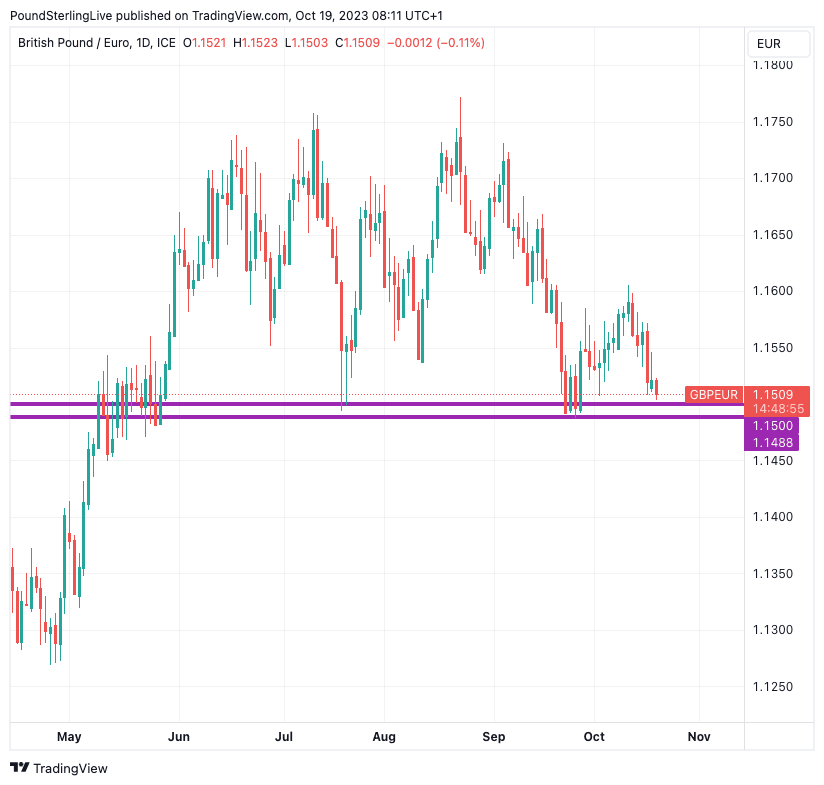

- GBPEUR near key 1.15 support

- But a downturn in global risk could yet herald new lows

Image © Adobe Images

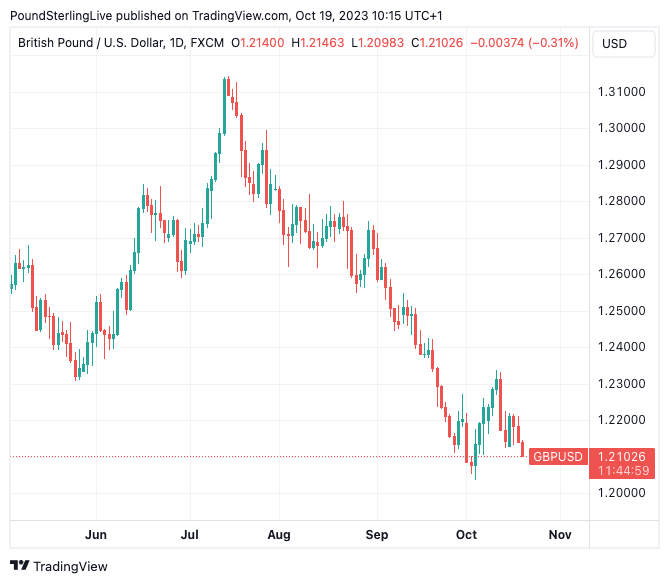

The British Pound has come under renewed selling pressure amidst a deterioration in market sentiment, confirming that global matters are taking a firmer hold of the currency's prospects.

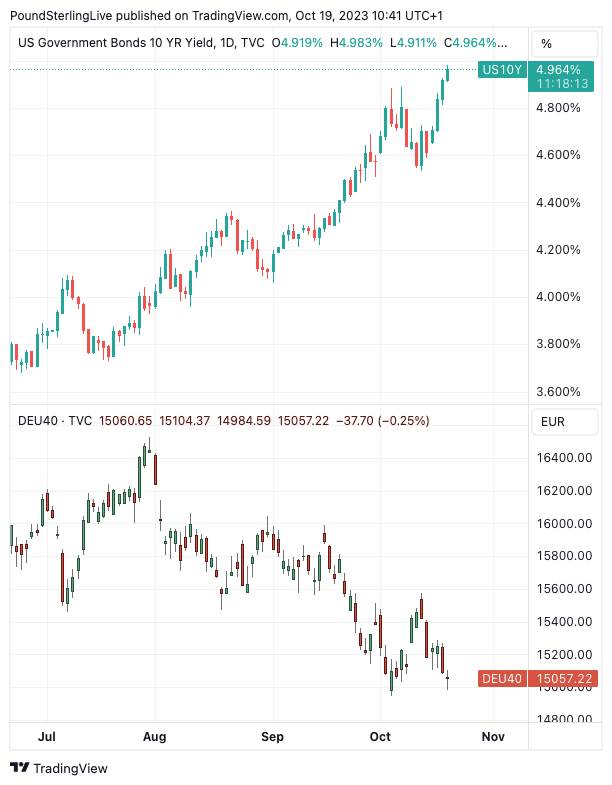

European stock markets recorded losses in the Thursday session amidst a broad deterioration in sentiment linked to a fresh push higher in global bond yields, which in turn filtered through to currency markets.

The Dollar, Yen and Franc are winners owing to their 'safe-haven' credentials, while the Australian Dollar and New Zealand Dollars were amongst the most significant losers. "Risk off, dollar bid as 10y U.S. treasury yield climbs to cycle high of 4.96%," says a note from Société Générale.

The Pound sits in the middle of the 'risk pack', meaning it tends to lose against the safe havens but advance against those at the bottom of the risk pack.

The Pound has now broken below the 1.15 level against the Euro, taking the Pound to Euro into a crucial level of support that must hold or risk the exchange rate falling back to lows seen earlier in the year. The Pound to Dollar exchange rate is higher by a third of a per cent at 1.2105.

"Bear-steepening curves and rising term premia tell the story of a market that is rushing to price in a transition to a higher interest-rate environment. The longer simultaneous strength in bond yields, USD and oil persists, the greater the chances that “something breaks”, precipitating a deeper economic slowdown," says Andrea Cicione, an economist at TS Lombard.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Rising U.S. treasury yields, imply the global cost of money is increasing and will provide headwinds to businesses and consumers alike.

"Equity markets are looking increasingly vulnerable as the risk-free rate rises and as businesses are finding their margins under pressure. A turn lower in core equity markets would like to keep the activity currencies under pressure and the dollar bid," says Chris Turner, Global Head of Markets at ING Bank.

With October's two primary UK data releases - inflation and wages - out of the way, the Pound looks set to be increasingly left to the whims of global drivers.

Above: GBPUSD at daily intervals. Set up a daily rate alert email to track your exchange rate OR set an alert for when your ideal exchange rate is triggered ➡ find out more.

Sterling looks to be reestablishing a linkage to broader risk sentiment again, tending to fall against the Euro and Dollar when markets are in the red.

The deterioration in investor sentiment also has links to news that Chinese house prices fell by the largest amount in almost a year in September added to doubts over whether Beijing’s steps to prop up the property market are enough to revive the sector.

Should sentiment improve through the day, then the Pound can rally, and it could fall on U.S. Federal Reserve Chair Jerome Powell to boost sentiment in a much-anticipated speech at 17:00 BST.

If Powell doubles down on a message that U.S. interest rates will stay higher for longer, the Dollar can benefit further, and the Pound will likely remain under pressure.

"We expect Powell to reiterate the FOMC view that another hike in the Funds rate this year is more likely than not. A reiteration of the 'higher for longer' message on interest rates may allow US yields to stay at or above their current levels and keep the USD supported," says Kristina Clifton, a currency strategist at Commonwealth Bank.

Above: U.S. ten-year yields are powering higher and undermining equities (German DAX 40 in lower panel).

But the rise in yields could prompt Powell into a more circumspect mood that might disappoint some USD bulls. Indeed, rising yields imply tightening financial conditions that aid the Fed's already-delivered interest rate hikes in cooling economic activity and inflation.

Should Powell reference these developments, the market might pare back expectations for a November rate hike, potentially offering the likes of GBPUSD some relief.

"Powell may be asked in the Q&A about the implications of the recent surge in Treasury yields for FOMC policy. It would be a blow to US interest rates and the USD if Powell sided with some of his FOMC colleagues to argue that the increase in yields is a substitute for an increase in the Funds rate," says Clifton.

The Dollar has been benefiting of late from U.S. economic outperformance relative to the Eurozone and UK economies over recent weeks, but the 'peak outperformance' narrative is one to watch out for: how much more of this outperformance can be priced into the Dollar?

"The USD's failures to advance on the back of stronger than expected data and higher yields yesterday supports the impression that choppy—but essentially flat—trading in the DXY since late September reflects 'late cycle' activity as investors consider the peak of the Fed tightening cycle and the peak in the US economy," says Shaun Osborne, Chief FX Strategist at Scotiabank.

Instead, it appears the broader risk channel remains the single greatest threat to the Pound and opportunity to the Dollar. In particular, concerns over the Isreal-Gaza conflict risk heightening tensions in the Middle East.

Investors will remain cautious that a more active Iran could threaten a spike in global oil prices, which would raise inflation expectations across the developed world, in turn resulting in higher interest rates, for longer.

This provides a Dollar-supportive environment and risks further downside for GBP/USD and EUR/USD.

Above: GBPEUR looks heavy, but there is some solid support that can counter the recent move. Set up a daily rate alert email to track your exchange rate OR set an alert for when your ideal exchange rate is triggered ➡ find out more.

Elsewhere, downside potential against the Euro looks to remain relatively limited given the vital support area for the GBP/EUR exchange rate near the 1.15 region.

The Euro is also hardly a standout alternative to the Pound given the slowdown in the Eurozone that leaves the economic and interest rate policy outlook broadly similar to that of the UK and weakness might prove limited in this regard.

The only caveat is that a major deterioration in risk sentiment would likely result in significant GBP weakness that breaks the above support level.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes