Pound Sterling Hedging Opportunity or Imperative Rarely Greater

- Written by: James Skinner

"We are sceptical that UK GDP will stage any rebound next year" - Oxford Economics.

Image © Adobe Images

Pound Sterling has remained an outperformer among major currencies for the year in recent trading but with market interest rate assumptions implying close to unprecedented monetary tightening still to come for the economy, the opportunity or imperative for protecting against future currency losses is rarely greater.

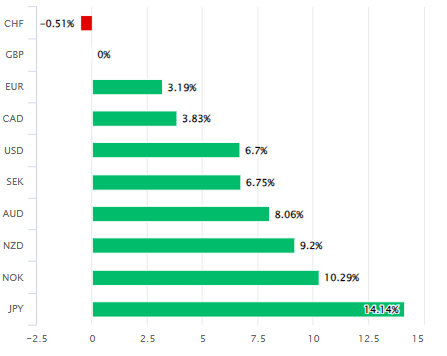

Sterling was higher for the year in relation to all of the G10 currencies except for the Swiss Franc on Wednesday while also having risen in relation to most within the broader G20 basket following an outperformance that has helped to reverse around two-thirds of the losses sustained against the Dollar and Euro since early in 2021.

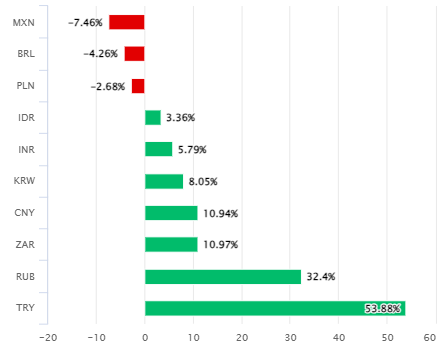

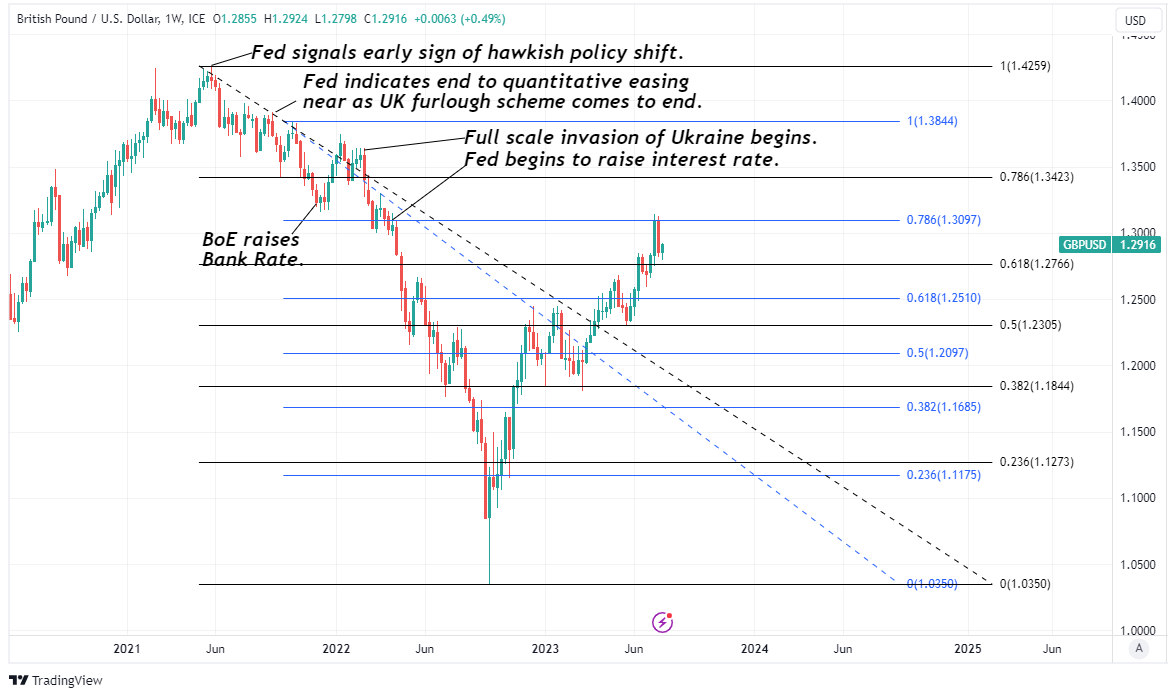

But major technical resistance levels now loom overhead on the charts for both of those currencies as well as in a number of other pairs while market assumptions about the Bank of England (BoE) Bank Rate are potentially, if not very likely, at significant risk of a course correction next Thursday.

"It's a close call, but we now think the MPC will settle for a 25bps hike, lifting Bank Rate to 5.25%," says Sanjay Raja, an economist at Deutsche Bank.

"We see two further quarter point rate hikes on the table, with Bank Rate peaking at 5.75%. Rate cuts, we think, will commence from Q2-24. But risks are skewed to a later and more shallow easing cycle," he adds in a Wednesday research briefing.

Above: Pound Sterling relative to G10 and G20 currencies in 2023. If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.

Analysts and economists have raised projections for Bank Rate significantly since interest swap markets first responded to the employment and inflation figures released in May and June with the envisaged peak for the year-end period having risen as high as 6.5% before tailing off to 5.75% by Wednesday.

The conventional presumption, belief or claim is that without these additional increases in borrowing costs, inflation would be unlikely to return to the 2% target sufficiently soon, although other recent economic developments in both the UK and Europe indicate that Bank Rate may already have risen far enough, if not too far.

With last week's UK inflation data set aside, the ongoing experience of the European Central Bank (ECB) and Eurozone economy might both also be making this argument.

"It’s not just supply that is contracting. Demand for borrowing from businesses looks to be collapsing, dropping to the lowest since the survey started in 2003 – yes, that includes the 2007-2008 credit crunch," says Stefan Koopman, a senior macro strategist at Rabobank, in reference to the ECB's Bank Lending Survey out on Tuesday.

"The numbers highlight how rising rates and economic uncertainty are severely dampening credit appetite. Credit growth faces persistent headwinds, underscoring risks of ECB overtightening," he adds when citing money supply and credit data released by the ECB on Wednesday.

Above: Pound to Dollar rate shown at weekly intervals with Fibonacci retracements of selected downtrends indicating possible areas of technical resistance for Sterling.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Europe's economy was reported to have contracted for a second time last quarter, placing it in a technical recession at least partly as a result of recent increases in interest rates while the European Central Bank has frequently said higher borrowing costs are now being "transmitted forcefully" into the economy.

This is relevant for the BoE and Pound because changes in Bank Rate impact existing UK mortgage borrowers sooner and so also to a larger extent than the equivalent European benchmark does due to differences in the typical lengths of time over which mortgage interest rates are fixed for.

"While we agree with the IMF that eurozone GDP growth will pick up moderately next year, our forecasts for both this year and next are more conservative than theirs," says Ben May, director of global macro research at Oxford Economics.

"Meanwhile, given the need for the Bank of England to continue tightening monetary policy given the high rate of underlying inflation, we are sceptical that UK GDP will stage any rebound next year," he adds in a Wednesday research briefing.

That means the interest rate burden is likely to be much heavier for the UK than for the Euro Area over coming years and potentially enough to have negative implications for the Pound, which has often fallen heavily as borrowing costs have approached their extremes during severe monetary tightening cycles.

While currencies like the Pound often rise alongside interest rates, the correlation turned negative in September 2022 when the idea of Bank Rate reaching 5.75% was first entertained in the current period with other instances being early in the new millennium, the early 1990s and during parts of the 1980 decade.

Above: Pound to Euro rate shown at weekly intervals with Fibonacci retracements of selected downtrends indicating possible areas of technical resistance for Sterling.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

All of the above may be why Monetary Policy Committee members have not actually endorsed the latest market assumptions in any of their most recent public appearances.

While many professional forecasters do disagree, the implication is there may be an underappreciated risk of the Monetary Policy Committee differing with the market either next Thursday or soon after, and history suggests this would come at a cost to the outperforming Pound.

"A further moderation in inflation, our base case, is expected to allow central banks to reach terminal rates this summer. However cumulative tightening over the last 18-months is expected to generate a slowdown in activity, with recessions in the US and UK," says Philip Shaw, chief UK economist at Investec, in a Tuesday research briefing.

"We are leaning towards the view that concern over sticky services inflation and persistent private sector regular wage growth will on balance lead the majority on the MPC to vote to do more now. Our base case is for a half point move to 5.50%, on the assumption that if this does prove too much, it can be undone at a later date," he adds.

Readers needing to sell Pounds for foreign currencies in the near future can do so with Pound Sterling Live's advertising partner including through the use of forward agreements whereby transactions are agreed on a given date with delivery of foreign currency taking place up to two years into the future.