Pound Sterling's Month-end Washout Ends, Sees Gains against Euro and Dollar

- Written by: Gary Howes

Image © Adobe Images

Recent weakness in the British Pound has raised questions about whether it was a result of position wash-out linked to month-end rebalancing in currency markets.

Fund managers often adjust their portfolios at the end of the month to account for exchange rate movements, potentially leading to significant shifts in currencies.

If this is the case, suggestions of a more pronounced downturn in the British currency could prove premature.

Technical repositioning in the past few days may have been particularly pronounced as the new quarter and the second half of the year approaches.

"Recent sterling weakness may be a matter of simple profit-taking, as traders lighten longs after the pound's recent rise," says Paul Spirgel, an analyst at Reuters.

Ahead of the weekend, the Pound to Euro exchange rate has rebounded a third of a per cent to 1.1650 and the Pound to Dollar rate 0.40% to 1.2664. The former had been as low as 1.1549 midweek with the latter as low as 1.2592 on Thursday.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

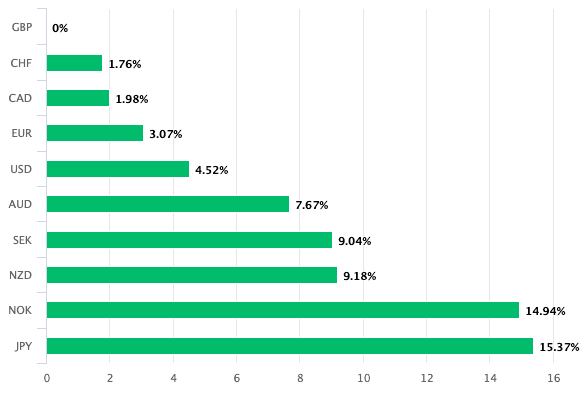

The Pound's 2023 rally culminated in multi-month highs against the Euro and Dollar and multi-year highs against the New Zealand Dollar, Australian Dollar and Yen.

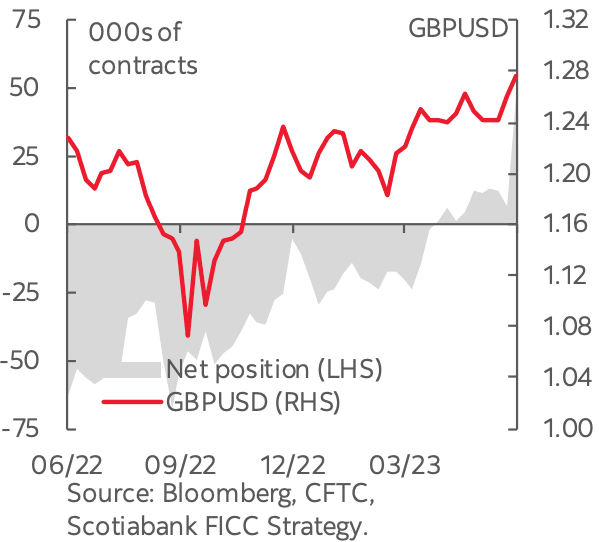

The advance reflects a surge in bets for further upside amongst investors who took the net GBP 'long' position to its greatest level since 2014. "Speculative traders boosted net GBP longs aggressively," says Shaun Osborne, Chief FX Strategist at Scotiabank.

When positioning moves into extended territory the risk of technical corrections can grow, adding fuel to a theory that recent Pound Sterling weakness is a technical phenomenon.

Above: GBP remains 2023's top-performing major currency.

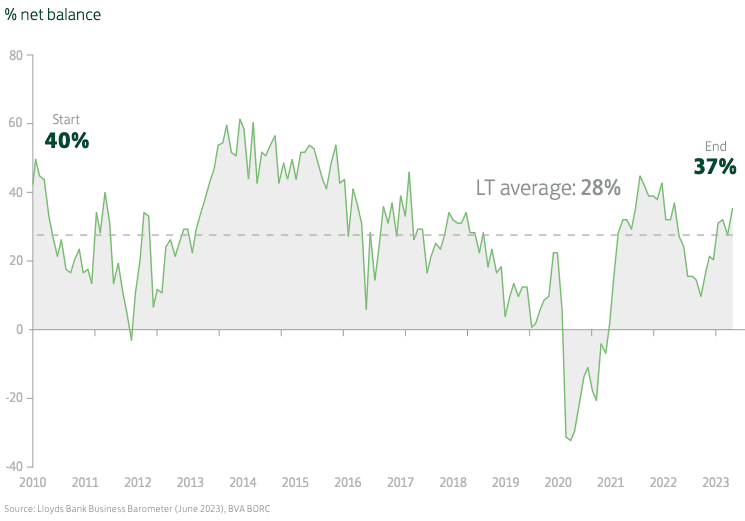

But there was also some fundamental news for GBP bulls to chew on ahead of the new month as the Lloyd Business Barometer reported UK businesses were at their most optimistic in 13 months in June.

The business survey follows the GfK consumer sentiment survey that last week revealed a fifth consecutive improvement in consumer confidence.

Lloyds reports business confidence in June bounced back after last month's dip and has risen in three out of the last four months. The overall confidence index increased by 9 points, its biggest monthly rise since March, to reach a 13-month high of 37%.

Above: Net GBP position vs. GBPUSD exchange rate. Image courtesy of Scotiabank.

The data is at odds with growing pessimism regarding the outlook for the UK economy with an increasing number of economists warning of impending recession as rising interest rates start to bite.

"Although the economy has proved resilient to the cost of living crisis, which is coming to an end, we think the cost of borrowing crunch will send it over the edge. The drag on activity from higher interest rates is the main reason why we think real consumer spending and real private investment will fall," says Paul Dales, Chief UK Economist at Capital Economics.

Lloyds however reports the improvement in the Business Barometer survey was driven by rises both in firms' trading prospects and their optimism regarding the wider economy, which is at odds with an imminent recession.

The Barometer also reports the hiring upswing resumed after last month's dip and has risen in six out of the last seven months.

Above: The Lloyds Business Barometer is giving readings inconsistent with imminent recession.

This would suggest the UK labour market remains 'tight', which would keep wages supported. This is therefore a frustrating development for the Bank of England which has raised interest rates to 5.0% in an effort to unwind labour market tightness and bring down inflation.

Until data deteriorates markedly the Pound might find itself supported by elevated expectations regarding the outlook for the Bank of England's policy rate, which is currently expected by markets to rise as high as 6.0%.

These expectations are in turn reflected in higher UK bond yields relative to those in economies where central banks are unlikely to hike as high. International investors hunting superior returns will favour UK's high-yielding bonds - in what is known as a carry trade - creating demand on currency markets that boosts the Pound.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes