Pound Sterling Sees "Aggressive" Surge in Speculative Buying as Sentiment Improves

- Written by: Gary Howes

Image © Adobe Images

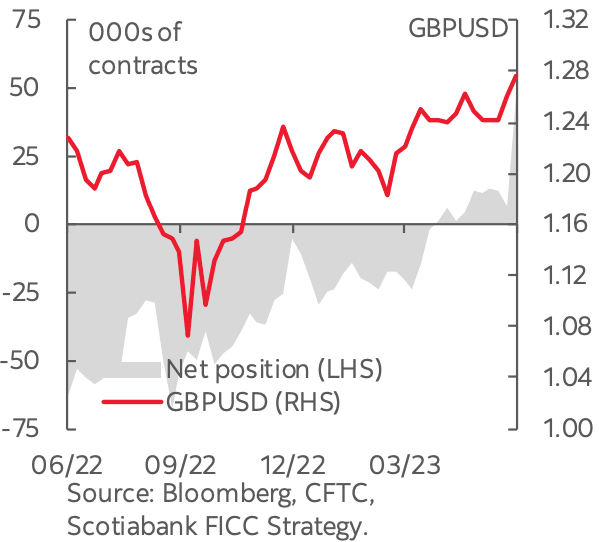

Speculative traders have significantly increased their bets for Pound Sterling to strengthen amidst a notable shift in sentiment for the better in the UK currency.

According to the most recent data from the Commodity Futures Trading Commission (CFTC), bullish positioning on the British pound rose by a substantial $3.2 billion in the week ending last Tuesday.

This surge in positive sentiment propelled the number of 'long' contracts to 37,114, indicating growing optimism in the currency's prospects.

A long position is whereby a speculator or commercial hedger takes out a contract on a financial asset that will derive a profit when that asset rises in value

"Speculative traders boosted net GBP longs aggressively," says Shaun Osborne, Chief FX Strategist at Scotiabank.

Above: Net GBP position vs. GBPUSD exchange rate. Image courtesy of Scotiabank.

Derek Halpenny, Head of Research for Global Markets, EMEA & International Securities at MUFG, says the boost leaves the largest net long position on the Pound held by Leveraged Funds since August 2022.

In terms of the one-week change, it was the largest one-week increase since March 2016.

But Osborne reckons the net GBP long now stands at its largest since 2014.

"Positioning has been light but leaning bullish on the GBP since April, but this week's jump is very significant," he says.

The surge in bullish positioning on the British pound reflects the belief among leveraged fund investors that the aggressive monetary tightening measures by the Bank of England (BoE) will have a positive impact on the currency.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Halpenny explains, "The Leveraged Fund sector has clearly taken the view that aggressive monetary tightening by the BoE is currency positive, focusing on the yield driver and ignoring for now at least the potential negative growth consequences that will inevitably come from further aggressive rate hikes from here."

The Bank of England surprised markets last week by hiking interest rates by 50 basis points, an acceleration from a run of 25bp hikes as it grapples to get back on top of inflation.

Markets now expect the UK's base rate to end at or above 6.0%, giving the UK the highest rate amongst G10 economies.

"We can understand the logic here and we are not surprised that the initial response is to focus on yields as being FX positive although that could quickly turn if the economic data was to weaken suddenly," says Halpenny.

Christopher Wong, FX Strategist at OCBC, points out several factors that contribute to the positive outlook for Pound Sterling in a new mid-year foreign exchange market assessment.

Wong highlights the possibility of a better-than-expected growth outlook, the BoE's hawkish stance, improved EU-UK relations post-Brexit, and the alleviation of pressure on government finances, businesses, and households due to softer energy prices.

Wong suggests that these factors, along with a moderate-to-soft USD profile, fading Brexit concerns, and a tentative improvement in the growth outlook, create favourable conditions for the recovery of GBP.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes