Falling Inflation Creates Short-Term Pressures for the British Pound

Above: Record-low inflation is good for the shopper but not necessarily good for the holiday maker hoping for a stronger exchange rate. Image (C) Pound Sterling Live 2015.

“The slide towards deflation is now inevitable but that won’t worry George Osborne one bit ahead of the election.” - Dennis de Jong, managing director at UFX.com

The pound sterling (GBP) was seen under pressure against the euro on Tuesday following the release of record-low inflation data for the month of January.

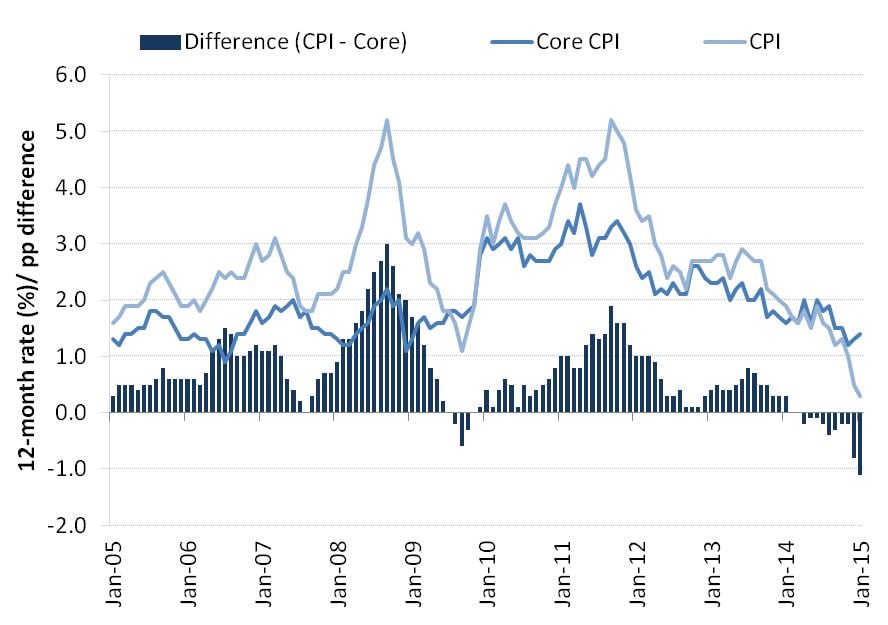

The Consumer Prices Index, which measures changes in the prices of the goods and services bought by households, increased by 0.3% in the year to January 2015, down from 0.5% in December 2014.

When releasing the figures the Office for National Statistics (ONS) all but warned UK prices will start falling; “With the rate of inflation slowing, commentators are considering the possibility of deflation – where prices, overall, become cheaper than they were previously.”

Impact of Inflation Data: Good for the Shopper

The UK consumer will be particularly welcoming of the news prices in the shops are essentially not moving.

“The slide towards deflation is now inevitable but that won’t worry George Osborne one bit ahead of the election. The forecast for UK growth remains strong and with falling unemployment, rising wages and very low inflation, people have more money in their pockets now than for quite some time,” says Dennis de Jong, managing director at UFX.com.

That said, the low inflationary environment will not last indefinitely as oil prices are forecast to increase later in the year, thereby pulling up the prices of goods.

Indeed, we are already seeing signs that the recent slump in crude oil prices is starting to reverse.

Should inflation data start picking up we would likely see GBP find itself bid higher.

Impact of Inflation Data: Bad for Sterling in the Near-Term

The pound to euro exchange rate (GBP/EUR) fell in the wake of the inflation data while the pound dollar rate (GBP/USD) saw earlier gains recede.

“Sterling weakened by around 0.5 cent against both the dollar and the euro following the release, since the disinflationary environment would suggest a neutral or easing monetary policy stance,” says Andy Scott, associate director of FX advisory services at foreign currency specialists, HiFX.

The interest rate regime at the Bank of England remains incredibly important in determining exchange rates at the present time.

The GBP has risen steadily over recent months as markets anticipate interest rates – and thus the return on UK currency – will start to rise. Signs that the first hike is being pushed out will temper demand for GBP.

That said the Bank of England however recently suggested that the next move will be to hike rates, provided there is no major disruption to the global economic growth profile.

Scott says he is forecasting sterling to maintain its bullish tone:

“What this does is provide a boost to households’ disposable income and unless the current economic environment turns sour, it should result in increased levels of consumer spending

“For sterling, the outlook remains fairly positive with the economy in growth mode but May’s General Election is certainly a short-term concern with a hung parliament previously having seen it weaken sharply.”