Pound Sterling the Biggest Loser as Central Banks Head for the Exit

- Written by: Gary Howes

Above: Governor Andrew Bailey delivers the February MPR. Image copyright Pound Sterling Live, Bank of England.

The British Pound was the biggest loser on a day of intense central bank action and some analysts say the UK currency's direction of travel is unlikely to flip in the near term.

The Bank of England raised interest rates on Thursday and provided guidance suggesting it is nearing the end of its rate hiking cycle; but so too are the European Central Bank and the U.S. Federal Reserve according to the latest round of central bank guidance.

Yet it was the Pound that appeared to bleed the most value despite the Euro and Dollar also facing a relatively similar monetary policy trajectory.

In fact, the Pound was the second worst-performing major currency on the day the Bank of England raised interest rates by 50 basis points but said a decision on whether to hike again over the coming months would be entirely data-dependent.

Sterling saw losses against all G10 rivals - apart from the Krone - which is a testament to the pervasive negative sentiment it is subject to.

"The FX market remains in pound-selling mode and the break higher in EUR/GBP could draw in further GBP weakness," says Derek Halpenny, Head of Research for Global Markets EMEA at MUFG.

Above: GBP performance following a trifecta of central bank policy decisions.

The Pound to Euro exchange rate retains a heavy tone around the 1.12 level but had been as low as 1.1167 in the wake of the Bank of England update.

The Pound to Dollar exchange rate meanwhile saw a sharp fall in the 24-hour period that saw all three major central banks deliver decisions, taking it back to mid-January levels at 1.2263.

"The Bank of England suggested UK interest rates might peak at the country’s new rate of 4% cent, below the 4.5% previously expected by financial markets, which has wounded the pound. GBP/USD has traded under the $1.22 handle for the first time since early January and is flirting with its 50-day and 100-week moving averages," says George Vessey, FX & Macro Strategist at Convera.

The Federal Reserve meanwhile opted to endorse market expectations that rate hikes would soon end at its midweek policy update, which initially sent the Dollar lower as a multi-week trend extended.

But that trend is now tiring and the Pound-Dollar rate failed to make any material progress above 1.24 and ultimately capitulated as the crowded short-USD trade unravelled.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Sentiment towards the Pound was not helped by the Bank of England repeating forecasts for a UK recession that would last until the first quarter of 2024 while saying the Eurozone and U.S. economies would not suffer the same fate.

The Bank signalled it no longer thought "forceful" interest rate hikes were required in response to high inflation and that any future hikes would be entirely dependent on data.

Specifically, Governor Andrew Bailey said wage and inflation data would be of particular interest as the Monetary Policy Committee entered a purely reactive mode.

The Bank raised economic growth forecasts but said risks to inflation were tilted to the upside and therefore it was too soon to say Thursday's was the final hike of the cycle.

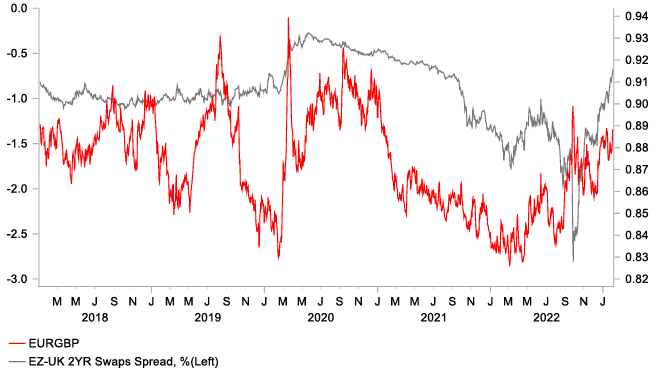

Nevertheless, money market pricing reveals investors continue to expect more by way of hikes from the ECB as a 50bp move in March was all but promised at Thursday's policy update in Frankfurt, and according to analysts, this could provide further support to the Euro.

MUFG says it expects EUR/GBP to move higher as the risk is skewed toward the market fully pricing out the prospect of an additional Bank of England interest rate hike, which would further bolster the Euro's rate advantage.

Underscoring this view are money market dynamics which remain firmly in favour of the Euro advancing further on the Pound:

The issue for the Pound appears to be what is going on in the money markets where the yield on UK bond yields has fallen sharply in the wake of the Bank of England's guidance.

Falling bond yields are consistent with a repricing in expectations for a lower future profile in Bank Rate.

"The BoE’s policy update has encouraged market participants to price in a bigger adjustment lower in UK yields than elsewhere," explains Halpenny's colleague, Lee Hardman, FX Strategist at MUFG.

Developments mean investors are now more confident in pricing in rate cuts from the Bank of England later in the year.

In fact, for currency markets, the big topic going forward will likely be speculation over the shape and scale of future central bank rate cuts.

"The BoE is less confident over the need for further hikes, and that has also given UK rate market participants more confidence to price in cuts after the upcoming pause in rates," says Hardman.

Underscoring the market's move to price in a rate cut later in the year is the Bank's economic forecast projections that maintain the UK will fall into a recession lasting until the first quarter of 2024.

Granted, the Bank raised its forecast profile for the UK, based on improved energy prices and a shallower expected peak in interest rates, but the UK nevertheless compares unfavourably to other regions.

Exchange rates are, at their most basic, an expression of the relative fortunes of two economies. On this basis, the Pound requires a material improvement in economic data and expectations to sustain a rally.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes