Pound Sterling and the "Mother of All U-turns": Analyst and Economist Views

- Written by: James Skinner

"We remain completely committed to our mission to go for growth, but growth requires confidence and stability – which is why we are taking many difficult decisions, starting today," - Chancellor of the Exchequer Jeremy Hunt.

Image © Gov.uk

The Pound rallied significantly early in the new week following the "mother of all u-turns" on the government's September spending plans that has prompted a rally by Sterling while eliciting a range of responses from analysts and economists, some of which are reproduced below.

Sterling returned to levels not seen since before late September's infamous mini budget on Monday and remained buoyant against many currencies early on Tuesday after the latest Chancellor of the Exchequer announced sweeping revisions to the recent fiscal statement.

Monday's announcement left almost no part of the earlier plans untouched when substantially reversing most of the measures announced, although it also forwarned that HM Treasury is still likely to seek further savings through cutbacks to public spending in the near future.

"We cannot control what is happening in the rest of the world, but when the interests of economic stability mean the government needs to change course, we will do so - and that is what I have come to the House to announce today," Chancellor Jeremy Hunt said.

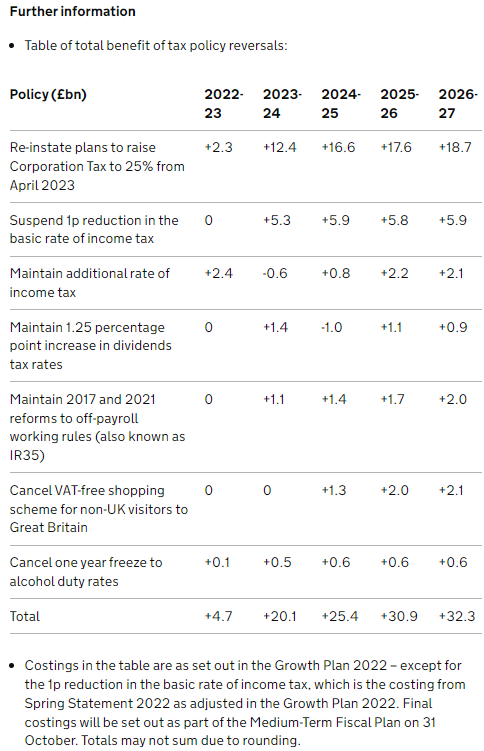

Above: Estimated savings from measures announced on Monday. Source: HM Treasury.

"We remain completely committed to our mission to go for growth, but growth requires confidence and stability – which is why we are taking many difficult decisions, starting today," he later added in a statement to parliament.

Spending reductions are expected to be announced on October 31 and could have long-lasting implications for the economy but on Monday the markets were concerned solely with whether or not there would be a credible and sincere effort to balance the national books over the medium-term.

The broad rally by Sterling and the bond market was indicative of investors having been satisfied with what they heard but that response says little of what Monday's events might imply about the outlook for the Pound and UK economy.

With this there is below a selection of remarks from analysts and economists setting out what the latest policy changes are likely to mean on both counts.

Chris Weston, chief market analyst, Pepperstone

"A huge day for the capital markets but in the FX markets the rally in GBP has stood out, gaining 1.7% vs the USD and 1.8% vs the JPY."

"Level wise, we’ve started to see better sellers in cable into last Thursday’s highs, with 1.1400 the line where much of the ‘fiscal U-turn is now priced’. Clients are split in their directional views, with an even balance of long and short positions in both GBPUSD and EURGBP."

"The UK gilt (bond) market has driven the show not just the GBP but broad markets sentiment, with a truly emphatic rally."

"In the interest rate market, the UK ‘terminal’ bank rate – the highest point of future UK rate expectations priced by the market - declined 49bp to 5.15% - this will be a small, but welcome, relief to any UK household eyeing a near-term expiring fixed rate mortgage."

"The bigger question now is where to from here? That is where he’ll [current Chancellor] earn his crust, with the UK‘s growth position still in a far worse place than any other G10 FX nation and further spending cuts in the works."

Samuel Tombs, chief UK economist, Pantheon Macroeconomics

"Mr. Hunt still has to find at least a further £39B of savings to get the debt ratio falling in three years’ time. He also likely will want to build some headroom, so that he can be confident he will not have to announce further measures just before the next election."

"Accordingly, we think Mr. Hunt will aim to find further annual savings of about £50B in the Medium-Term Fiscal Plan on October 31. That’s still a huge number, and the Chancellor now must announce measures that will make households and firms worse off, rather than just cancelling future windfalls."

"Meanwhile, the Chancellor’s energy price announcement has potentially transformed the inflation outlook for the worse. Current wholesale prices imply that energy bills will rise by about 73% in April for households that will not be entitled to further support. That increase would boost the headline rate of CPI inflation by 4.8pp."

Paul Robson, EMEA head of G10 FX strategy, Natwest Markets

"It’s not often political/economic drama in the UK that shifts the needle on global market sentiment, but it’s definitely the case this week. At the time of writing, the UK government’s fiscal plans appear to be quickly unravelling."

"But meeting (already high) expectations may already be difficult as a large part of the fiscal stimulus is the energy price cap package rather than tax cuts. Everything is unlikely to be resolved today, and this leaves us not wanting to chase Sterling’s rally. That said, not everything leans to Sterling weakness."

"Pressure from high energy prices is acute, but prices have come down of late and if that persists borrowing will be noticeably lower than assumed from this very costly policy. Throw in a few delayed tax cuts and windfall tax increases, lower market yields and less aggressive BoE tightening cycle and suddenly, the future doesn't look as challenging for Sterling."

Paul Dales, chief UK economist, Capital Economics

"While the Chancellor has reduced fiscal uncertainty, by guaranteeing that utility prices will be frozen only until April 2023 rather than October 2024, he has introduced more economic uncertainty."

"It is possible this means that inflation will be higher than otherwise for longer, that households’ real incomes will fall by more and that the recession will be deeper."

"There are a lot of moving parts, but our existing forecasts that interest rates will rise from 2.25% now to 5.00% and that GDP will fall by 2% during a recession don’t seem that wide of the mark."

Stephen Gallo, European head of FX strategy, BMO Capital Markets

"We're currently expecting that a full change in leadership could occur within 1-2 weeks, though there may be considerable volatility in gilts and in the GBP until that change occurs. We are expecting a moderate rally in cable when this change occurs."

"We’re growing a bit more confident in our view that 1.0350 marked the low in the pair for this cycle, which implies that 1.10 and the 1.05-1.10 range should offer value for GBP buyers with a 6M horizon."

"We think a rally into the 1.15-1.17 range within 1M on a leadership change will be brief, however. In addition to the flows dynamic, the net position of leveraged funds does not appear to be excessively short of GBPUSD."

Andrew Goodwin, chief UK economist, Oxford Economics

"With the fiscal stance now set to be less loose than previously planned (the tax U-turns alone equate to a tightening of around 1.3% of GDP) and the risk premia on UK assets falling, the BoE will be under less pressure to take an aggressive approach to raising interest rates."

"Indeed, market expectations have already fallen back, with Bank Rate now predicted to peak at 5% next spring, down from 6% two weeks ago. We think investors' expectations will continue to retreat, coming down closer to our forecast of a peak in Bank Rate of 4%. All else equal, this is good news for the economic outlook."

"But the tax burden will now be higher than previously expected, putting more pressure on households suffering from high inflation and falling real incomes. Raising taxes and restraining public spending in an economy facing recession is far from an orthodox approach and risks making the economy weaker."

Parisha Saimbi, G10 FX strategist, BNP Paribas Markets 360

"While this does make a test of parity in GBPUSD less likely, in our view, we expect the GBP to weaken back, with UK risk premia likely to remain elevated."

"With tail risks alleviating, though, we moderate our bearish end-2022 forecasts slightly, projecting EURGBP at 0.93 (previously 0.95) [GBP/EUR: 1.0752] and GBPUSD at 1.08 (previously 1.05)."

"Indeed, while we think the government’s approach will now be more fiscally responsible, and the Bank of England may not need to hike as aggressively, the economic outlook looks more bleak, with spending cuts and tax hikes likely on the horizon."

"This at a time when the Bank of England will likely continue to raise rates, does not pose a good backdrop for the currency, in our view."

Kallum Pickering, senior economist, Berenberg

"After 4.1% growth in 2022, largely due to base effects from a weak 2021, we now expect the economy to contract by 1.3% instead of 1.6% in 2023 – but this is still below our pre-budget call of a 1.0% fall. With a less deep recession in 2023 combined with tighter fiscal policy, we lower our 2024 call to 1.9% from 2.1% previously. The risk to watch is that the government goes too far with austerity – beyond what would be needed to shore up confidence – which would hamper the recovery during 2023."

"It is now our base case that, sooner (probably) or later, the Conservative parliamentarians will replace Liz Truss. The scrapping of large parts of her policy manifesto suggests she is in power in name only. We would not be surprised if UK politics turns noisy in coming days as the Truss government breaks down. We have been here before with previous PMs. Once the resignations start and the letters of confidence go into the party’s head committee, it is usually a matter of time before the PM resign."

Michael Every, global strategist, Rabobank

"We’ve tried the Hunt (Osbourne) fiscal austerity path before. We did the same after 2008, while bailing out the financial sector and doing QE to make the rich richer, which the market is also clamouring for again now. It was a disaster that entrenched populism."

"Financial markets are cheering a repeat --even as I suspect post-Hunt opinion polls will continue to point to the Tories disappearing as a political entity, and the UK becoming a de facto one party state under Labour-- because they are looney and know only one tune: “tight fiscal policy, loose monetary policy”. They just aren’t going to get it."

"Markets are cheering this, and the BOE, regardless of this being a disaster with a lag. Even if we don’t see worse populism --and despite ECB market action ‘helping’ get rid of Berlusconi in the past, Italy has since ended up with Meloni-- the UK will see collapsing tax revenues and larger deficits anyway."

"Firms will fail. Unemployment will soar. GDP will shrink. Everyone with half a brain knows this to be true. Then again, no one with half a brain has been anywhere near fiscal policy for years – and I include the IMF in that, not just No. 10 and 11."

John Hardy, head of FX strategy, Saxo Bank

"As the week gets underway, the market seems satisfied that the UK government has learned its lesson and will reverse a sufficient percentage of the new Truss government’s spending and tax cuts intentions to avert further catastrophe for the UK gilt market, where yields are rapidly retreating, and for sterling, which already stabilized last week versus the euro upon the exit of former Chancellor Kwarteng."

Let’s see where sentiment takes sterling after the speech today from new Chancellor Jeremy Hunt (at 1430 GMT). There is still a bit of support left for the [EUR/GBP] pair in the 0.08625-0.8575 if the pair is to fully reclaims its former rangebound status. Without a more significant reversal in sentiment and the growth outlook for the UK and Europe on lower energy prices, I fail to see much further upside for sterling, with a best case that sterling merely manages to stabilize in the crosses and versus the euro here."