Labour Market Data Enough for a 50bp Rate Hike in August say Economists

- Written by: Gary Howes

Image © Adobe Images

Global market sentiment remains in overall charge of the British Pound on the day the UK reported some mixed labour market data.

The UK's unemployment rate stayed stead at 3.8% in May says the ONS, defying analyst expectations for a rise to 3.9% as 296K people were added to the workforce in the three months to May.

However, average earnings came in well below expectations with growth of 6.2% in May, less than 6.7% expected and down on April's 6.8%.

This confirms real wages in the UK continue to fall and contributes to expectations for a consumer-lead economic slowdown over coming months.

"Real wages in the UK now officially lowest on record. Wage growth starting to moderate in private sectors. Monthly payroll figures were revised sharply lower. Apart from the May employment figure coming in strong... there's not a lot of pretty reading in this jobs report," says Viraj Patel, Macro Strategist at Vanda Research.

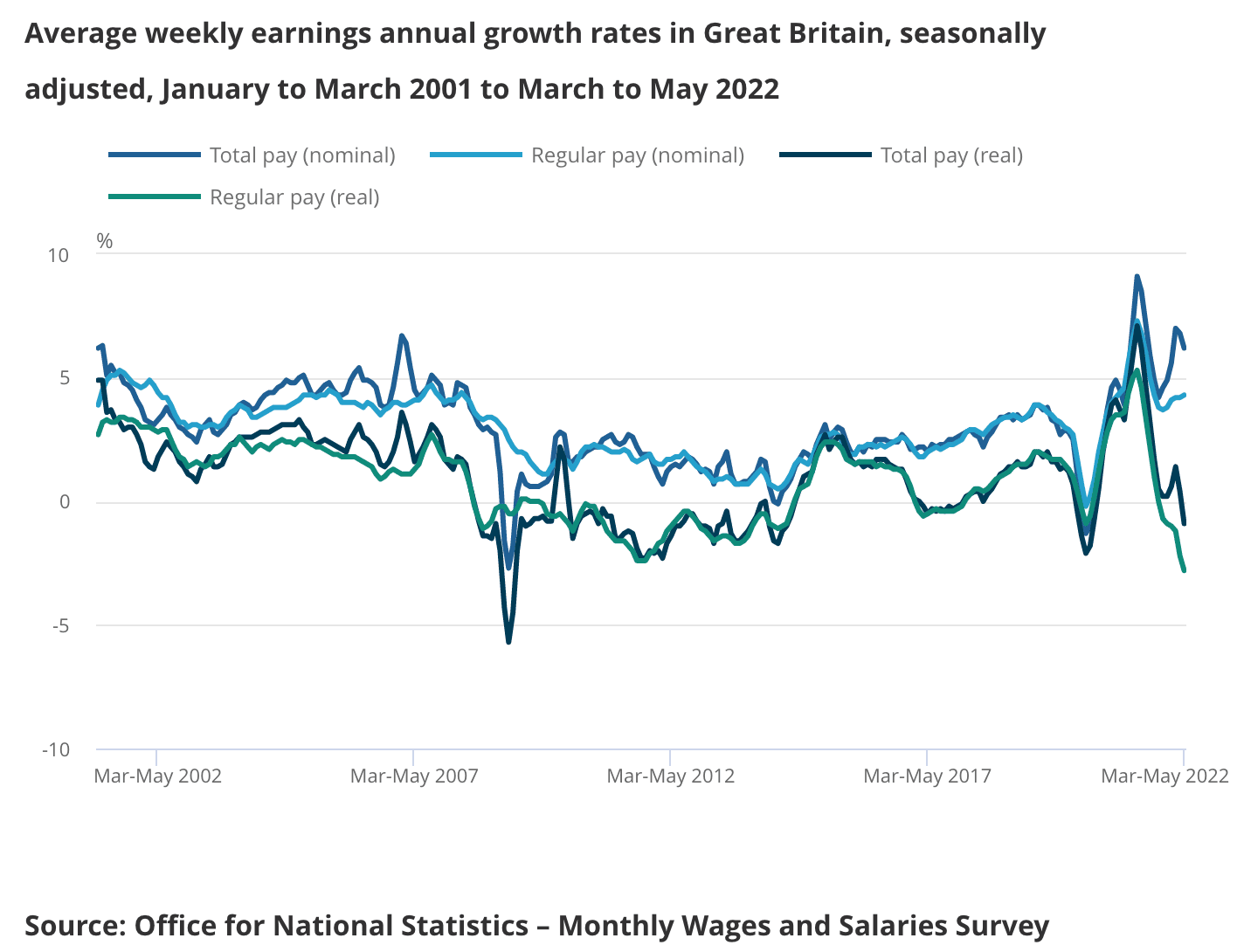

Above: Annual growth in nominal total pay was 6.2%, nominal regular pay was 4.3%, real total pay was negative 0.9% and real regular pay was negative 2.8% in March to May 2022.

In real terms (adjusted for inflation) total pay fell by 0.9% over the year and regular pay fell by 2.8%.

The Pound was largely flat in the wake of the data with little major new signal coming from the numbers.

"It seems that data won’t change the minds and opinions at the Bank of England with money markets keeping up the bets for a 0.5% rate hike in the August meeting and as a result, the impact on the pound has been minimal," says Thanim Islam, Dealer Manager at Equals Money.

Near-term, the UK currency will likely continue taking guidance from global drivers, more specifically European gas prices and broader investor sentiment.

However, whether Sterling remains supported medium-term will continue to depend on where investors expect the Bank of Englnad to take interest rates.

At the very least, for the Pound to remain supported this week's data must underscore the market's belief that a 50 basis point hike is coming in August.

Average earnings (ex bonuses) rose slightly to 4.3% in the three months to May, but the single month figure for May has picked up to 0.6% m/m to 4.6% following a 0.5% rise in April.

Modupe Adegbembo of AXA Investment Managers says she now expects the Bank of England to to hike interest rates by 50bps in August, with the continued strength of the labour market and wages shifting her view.

"Despite some moderation in bonus pay, the continued strength of wages growth is likely to add to Monetary Policy Committee's (MPC) worries of more persistent inflation," she says.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The UK employment rate increased by 0.4 percentage points on the quarter to 75.9%, said the ONS, as the number of full-time employees increased during the latest three-month period to a record high.

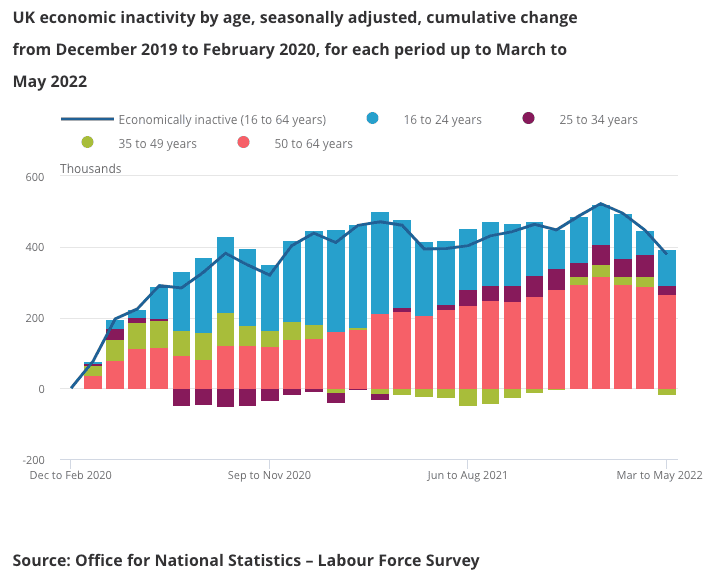

A matter of concern for the economic outlook remains the numbers of people who are not actively looking for work, which acts as a constraint on activity.

According to the ONS this is improving with the economic inactivity rate decreasing by 0.4 percentage points to 21.1% in March to May 2022.

Above: Economic inactivity decreased during the latest three-month period across all age groups.

But labour supply nevertheless remains constrained with ongoing demand from businesses pushing the number of job vacancies in the April to June period higher to 1,294,000.

However, the rate of growth in vacancies continued to slow down.

The labour market data comes amidst expectations for another rate hike at the Bank of England in August, but this next one could be an unusually large 50 basis point hike.

Facing surging inflation the Bank has made it increasingly clear it intends to deal with rising prices and a number of Bank of England speakers have done little to push back against expectations for a 50bp hike over recent weeks.

But, "any data setback could somewhat call into question the market pricing of 50bp rate hikes priced in for the next few BoE meetings, as the MPC has so far proceeded with cautious 25bp tightening steps," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole.

UK inflation is set to be released tomorrow and, when combined with the labour market statistics, should give markets a clearer sense of how the economy is evolving and whether or not a sizeable 50 basis point rate hike is justified.

"The GBP could risk losing some anchor if the outcome of the August meeting appears less of a done deal," says Marinov.