Nord Stream 1 Poses Biggest Two-way Risk for the Euro this Week

- Written by: Gary Howes

Image © Adobe Stock

Euro exchange rates face the prospect of a highly volatile few days of trading as this week brings with it the European Central Bank's policy meeting as well as the planned restart date for the Nord Stream 1 gas pipeline.

The ECB rate decision certainly has the potential to move the Euro, but the expected interest rate rise has been telegraphed well in advance and news of an anti-fragmentation tool is also expected.

The wild card for currency markets therefore is whether or not Nord Stream 1 is restarted, given it remains Russia's geopolitical trump card.

If gas flows do resume foreign exchange strategists say the Euro will likely recover, with Goldman Sachs analysts estimating the gains to be in the region of 0.5-1.0%.

But by far, the biggest risks for the Euro lie to the downside in the event gas supplies are not resumed.

"The prospect of a prolonged gas flow disruption is likely to hang over the Euro throughout the week," says Zach Pandl, Co-head of FX Strategy at Goldman Sachs.

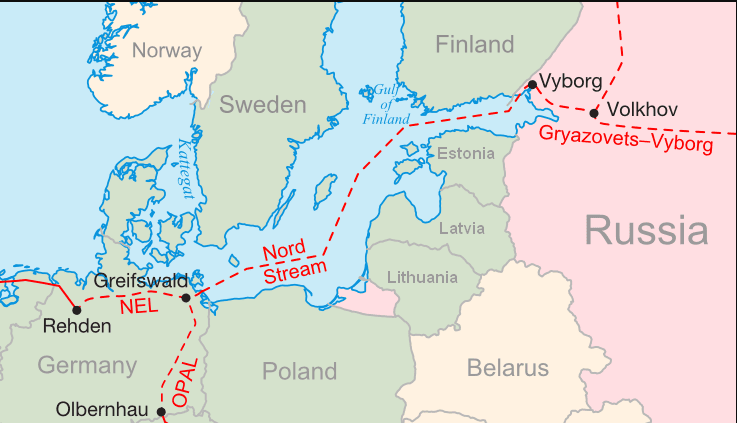

Nord Stream 1 transits gas via pipeline from Russia to Germany and is currently undergoing its planned annual maintenance, due to be completed on July 21 making this potentially the most important item on the Euro's calendar this week.

There are fears Russia could delay the reopening and undermine Europe's efforts to refill depleted capacity ahead of the winter.

"Let's prepare for a total cut-off of Russian gas; today that is the most likely option," French Economy Minister Bruno Le Maire said last week, echoing similar fears expressed by his German counterpart Robert Habeck.

Image source: Wikipedia.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Ahead of Thursday's key date Russia's Gazprom has declared force majeure on gas supplies to Europe to at least one major customer, according to the letter from Gazprom dated July 14 and seen by Reuters on Monday.

The letter said Gazprom, which has a monopoly on Russian gas exports by pipeline, could not fulfil its supply obligations owing to "extraordinary" circumstances outside its control.

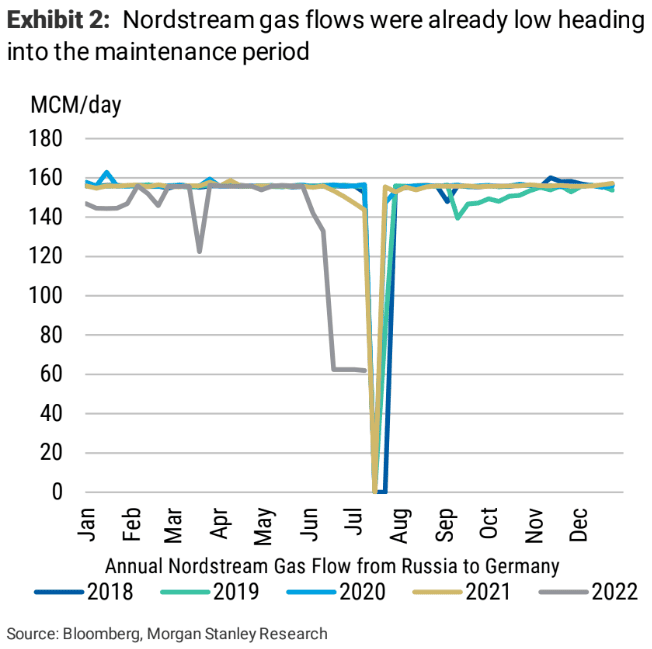

This already suggests gas supplies to the European Union will be well below capacity on any restart.

"Even in our baseline scenario that gas flows will partially return (to about 40% of normal), it is important to keep in mind that anything less than 100% will almost certainly require some form of demand destruction," says Pandl.

He says demand destruction would involve either higher prices or government rationing in parts of Europe, leading to recessions in Germany and Italy says Goldman Sachs.

"The question is, how much gas will flow on July 22? The fear in Europe amongst households, businesses, and politicians is that no gas will flow," says Matthew Hornbach, Global Head of Macro Strategy at Morgan Stanley.

"If no gas flows, even if only for a short time, then risks for Europe will tilt toward a deep slump rather than the technical recession our European economists currently expect," he adds.

This therefore promises to be a risky week for the Euro which only last week fell below parity against the Dollar, albeit briefly.

"We believe this shift in the growth outlook, and the prospect of a much more severe downturn, explains much of the Euro’s recent fall to parity," says Pandl.

The Euro-Dollar exchange rate nevertheless started the new week with a gain back above 1.01, but against Pound Sterling the currency was softer. (Set your FX rate alert here).

The Pound to Euro exchange rate opened in the green going to 1.1816 on Monday, meaning bank accounts were offering euros at around 1.1580 for international payments and independent payment specialists were offering rates towards 1.1780.

Pound Sterling would likely advance against the Euro if gas prices are restricted, or cutoff, as the UK's main sources of gas are extracted from the North Sea and imported from Norway.

Morgan Stanley analysts say European gas prices have already surged but would likely spike considerably higher should Europe face a full cut off of gas flows from Russia.

"An additional headwind for EUR may come from the potential announcement of an extended '10-day maintenance period of NordStream1 pipelines this Thursday, further depleting German gas inventory ahead of winter and worsening the growth outlook in Eurozone," says Marek Raczko, an analyst at Barclays.

Goldman Sachs estimates if gas flows partially resume EUR/USD could rise by 0.5-1%, but they warn of a potential 5% depreciation in a severe downside scenario involving a full and prolonged disruption.

Morgan Stanley says their institutional clients are thinking about the level at which gas flows would resume following the maintenance period.

"Would it be back to 1⁄3 of the seasonal norm, zero, or somewhere in between? Few believe that higher level is likely, though given our negative sentiment has become that scenario would have a strong positive effect on the EUR," says Hornbach.

An alternative scenario investors should be aware of sees the maintenance period simply extended by some period of time.

"If, on July 21 it was announced that the maintenance period would be extended by one week, and so no zero gas would flow during that period, we believe markets would take that negatively as it prolongs the uncertainty," says Hornbach.

This is a highly likely outcome particularly because an important gas turbine integral to the pipeline's running is en route back to its home in northern Russia.

It will take another five to seven days for the turbine, serviced by Germany's Siemens Energy to reach Russia if there are no problems with logistics and customs, Kommersant reports.

The newspaper reports the turbine will be sent from Germany by ferry and then transported by land via Helsinki.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes