Pound Sterling and Euro Pounce on a Faltering Dollar

- Written by: Gary Howes

Image © Adobe Images

The Pound and Euro are taking advantage of a faltering Dollar to clamber further above their recent multi-month lows.

The moves are peculiar in that the Dollar's weakness comes alongside a slump in global equity markets: typically the safe-haven U.S. currency has tended to outperform in times of souring investor sentiment.

And there was sour investor sentiment aplenty during the Wednesday and Thursday sessions, sparked by a jump in fears the U.S. economy could suffer a notable slowdown.

These fears rose after U.S. retailer Target released some dire trading guidance, prompting investors to worry the U.S. economy would slow sharply over coming months.

It is perhaps this dawning realisation that U.S. economic exceptionalism is not a cast-iron guarantee, as has been the assumption of recent years, that prompted a recalibration in Dollar positioning.

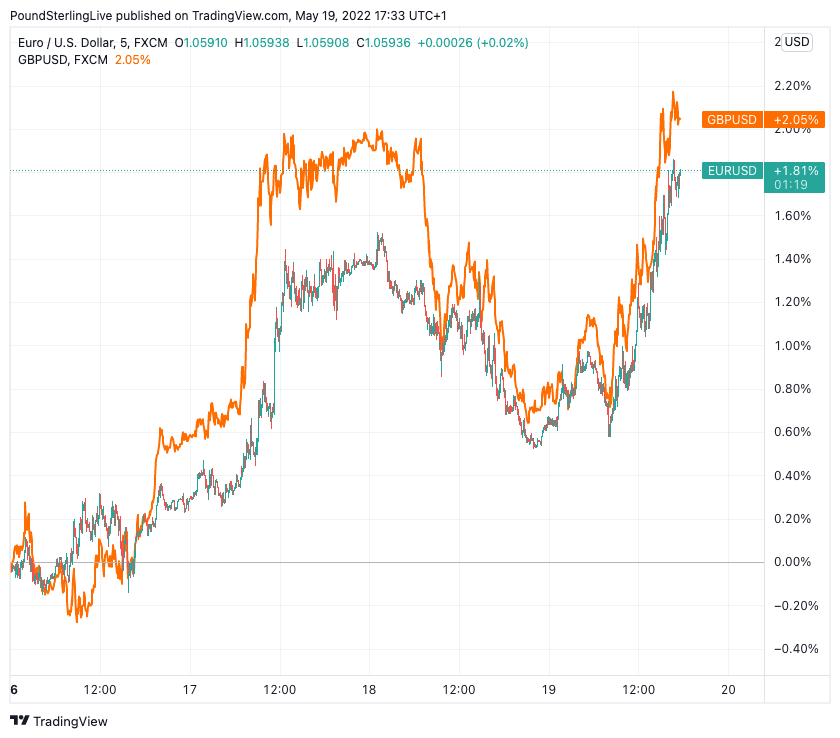

The Pound to Dollar exchange rate surged by 1.30% to trade at 1.25 at one point, the Euro to Dollar rate rose a percent to trade at 1.0580.

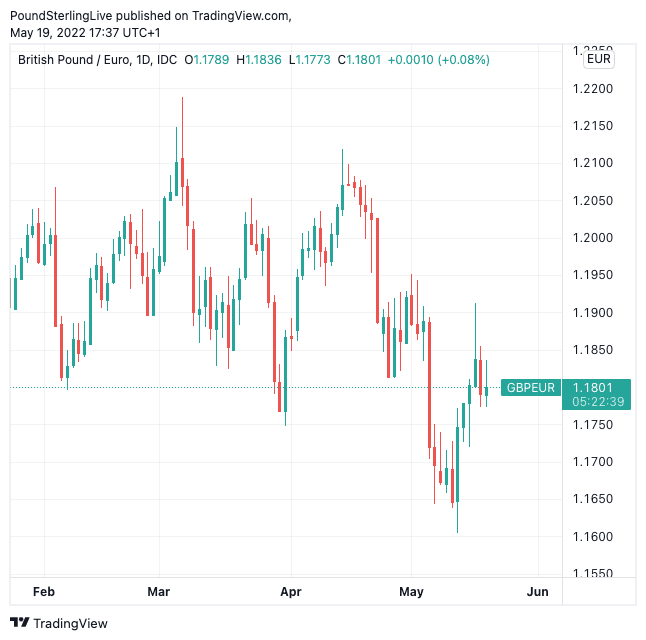

The Pound to Euro exchange rate at one stage climbed by a third of a percent to 1.18, highlighting the outsized move in GBP/USD relative to EUR/USD, although the Eurozone's single currency is looking better supported given rising expectations for a 50 basis point ECB rate hike in July.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Shares in Target fell 25% on Wednesday after the U.S. retailer said rising costs would hit its annual profits, echoing a warning from rival Walmart.

"Earnings disappointments from WalMart and Target sent markets lower on fears of a consumer-driven recession," says economist Ajay Rajadhyaksha at Barclays.

Further U.S. sentiment decline was driven by Existing Home Sales data which showed a decline of 2.4% to 5.61M from 5.75M.

"The third straight decline in sales is no fluke; activity is now clearly responding to the drop in mortgage demand, which indicates that bigger declines are coming, very soon," says Ian Shepherdson, Chief Economist at Pantheon Macroeconomics.

Falling mortgage demand is the first clear sign that rising interest rates at the Federal Reserve are starting to be felt and with further hikes coming the economy will likely cool further.

"In the U.S., rapidly rising key interest rates are threatening to choke off demand and trigger a recession. In contrast, there is less of a shortage of demand in Europe than of intermediate products and labor. This means that, unlike in the U.S., there is no threat of a classic recession - with consequences for inflation and the financial markets," says Dr. Jörg Krämer, Chief Economist at Commerzbank.

Could the FX market finally be witnessing the end of the Dollar rally, which turns one year old this May?

Kit Juckes, Head of FX Strategy at Société Générale says the Dollar’s 'only safe haven currency around' status is wobbling.

But for now he says he will "treat any sort of euro bounce with suspicion... it seems unlikely we are seeing a turning point for the Euro or Sterling".

Above: EUR/USD and GBP/USD (orange) performance this week. (Set your FX rate alert here).

Paul Spirgel, a Reuters market analyst, says GBP/USD will struggle to make gains above its recent May high at 1.2638. Such an advance "may be unrealistic as traders are likely to sell GBP against currencies with more rate-related upside potential".

Such currencies now include the Euro, which has apparently benefited from a ramping up of expectations for a European Central Bank rate hike of 50 basis points.

The minutes from the ECB's April policy meeting were released Thursday and showed members of the Governing Council were worried the rise in inflation expectations could become "unanchored".

This describes a scenario were an inflationary shock - in this case via surging energy and commodity prices - becomes embedded more broadly in the economy.

For instance businesses could hike the prices on goods and services they offer, while employees could demand higher wages.

Some members of the Council thought that the ECB could not wait for actual wage developments to confirm inflation expectations were rising and the time to raise rates was therefore fast approaching.

"ECB members have continued to send hawkish signals, prompting the market to price in a clear risk of a 50bp rate hike in July," says Jan von Gerich, Chief Analyst at Nordea Markets.

"Relative rates have supported GBP vis-à-vis EUR for quite some time but not anymore with markets pricing in more aggressive ECB rate hikes," says Mikael Milhøj, Chief Analyst at Danske Bank. "Looking forward, relative rates seem more supportive for EUR/GBP".

Above: GBP/EUR has lost altitude over recent weeks. (Set your FX rate alert here).

Sentiment towards the Pound meanwhile remains resolutely poor, with investors maintaining historically elevated positioning against the currency.

A cost of living crisis and fears of stagflation underpin this bearish consensus, but some economists warn it is too early to write off the UK economy.

Toscafund Asset Management's chief analyst Savvas Savouri says the three crucial elements of the UK economy (labour, property and banks) are fundamentally sound shape, "I am confident, as things stand (sic), there is no chance of the UK toppling into recession."

"Weak confidence doesn’t make a spending crash inevitable," says a new research note from Capital Economics, the independent economic research consultancy.

"A consumer-led UK recession is not inevitable," says a new note from investment bank and lender Investec.

(For an in-depth look at these views, please see here).

Should the UK economy perform better than is currently anticipated the Bank would be inclined to raise interest rates closer to what the market is expecting (the market currently sees the peak in Bank Rate at 2.50%).

This would help underpin the Pound and at the very least draw a line under recent declines.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks