Pound Sterling Vying with Swiss Franc for “Dubious Title of Europe’s Yen”

- Written by: James Skinner

- GBP/USD’s heavy losses comparable to other low yielders

- Sees GBP appearing as “Europe’s Yen,” Credit Suisse says

- UK inflation, BoE’s limitations & strong USD all key drivers

- But financial sector's FX hedging is another possible driver

- USD & yield rallies can trigger margin calls & GBP outflows

Image © Adobe Stock

The Pound to Dollar exchange rate has slipped to a fresh two-year low, making for almost a ten percent 2022 loss following a turbulent six week period that has left Sterling appearing to be in competition with Switzerland’s Franc for what Credit Suisse describes as the “dubious title of Europe’s Yen.”

Pound Sterling was testing the round number of 1.22 against a strengthening Dollar on Thursday with losses coming hard on the heels of a grim first-quarter GDP report that warned of tough times ahead for the UK economy.

The first quarter outcome was below market expectations and weaker than even the more modest estimation of the Bank of England (BoE), which hinted strongly this month that pressure on household’s incomes could lead it to disappoint market expectations for UK interest rates later this year.

That has already weighed heavily on the Pound and the GDP data was not helpful for the currency either, although with GBP/EUR trading higher alongside a range of other Sterling pairs on Thursday, price action was indicative of other factors having a more dominant influence on Sterling.

“The larger driver of FX markets continues to be developments in China, where realised USD/CNY one-month volatility has spiked to 6% - levels last seen in November 2020. These episodic adjustments in USD/CNY allowed by the People's Bank of China (PBOC) have far-reaching consequences in the FX space,” writes Chris Turner, global head of markets and regional head of research for UK & CEE at ING, in a Thursday note.

"Over the last three months, the currencies most highly correlated with CNH in the G10 space are the Australian dollar (AUD), New Zealand dollar (NZD) and sterling," Turner and colleagues also said on Thursday.

Above: GBP/USD at hourly intervals alongside GBP/AUD, GBP/EUR and USD/CNY. Click image for a closer inspection.

Above: GBP/USD at hourly intervals alongside GBP/AUD, GBP/EUR and USD/CNY. Click image for a closer inspection.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

China’s Renminbi has recently begun to fall from two-year highs and the trend change has had seismic implications for many currencies but especially those of large trade partner economies such as the Europe and Australia, with knock-on effects for other currencies too.

That trend change comes amid an economic slowdown in China that has weighed heavily on Renminbi assets and suppressed Chinese government bond yields at the same time as an exceptionally hawkish Federal Reserve (Fed) monetary policy stance is lifting U.S. government bond yields sharply.

(Set your FX rate alert here).

“What has clearly changed is that US breakevens are now falling sharply too, which is contributing to an ongoing rise in real yields even as nominal yields stop rising, against a backdrop of risk-off price action. This is particularly difficult for pro-cyclical currencies whether emerging market or developed market,” says Shahab Jalinoos, head of FX trading strategy at Credit Suisse.

Recent market concerns about the global economic outlook, which are in part connected to developments in China, have leaned against the epic surge in U.S. government bond yields that has become an increasingly dominant driver of currency market price action since June 2021.

Above: GBP/USD at daily intervals Swiss Franc, Japanese Yen and Norwegian Krone. Click image for a closer inspection.

Above: GBP/USD at daily intervals Swiss Franc, Japanese Yen and Norwegian Krone. Click image for a closer inspection.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

But the rub for other currencies is that the Fed’s determination to bring down U.S. inflation - whatever the economic cost may be - has conspired with the increasingly gloomy global economic outlook to bring down medium and long-term expectations of inflation even more than it has U.S. bond yields.

This has in effect lifted the real or inflation-adjusted value of U.S. bond yields in important segments of the ‘yield curve’ and that has in turn acted as a steroid for the safe-haven U.S. Dollar while crushing other currencies, and especially the lower yielding currencies. (Set your FX rate alert here).

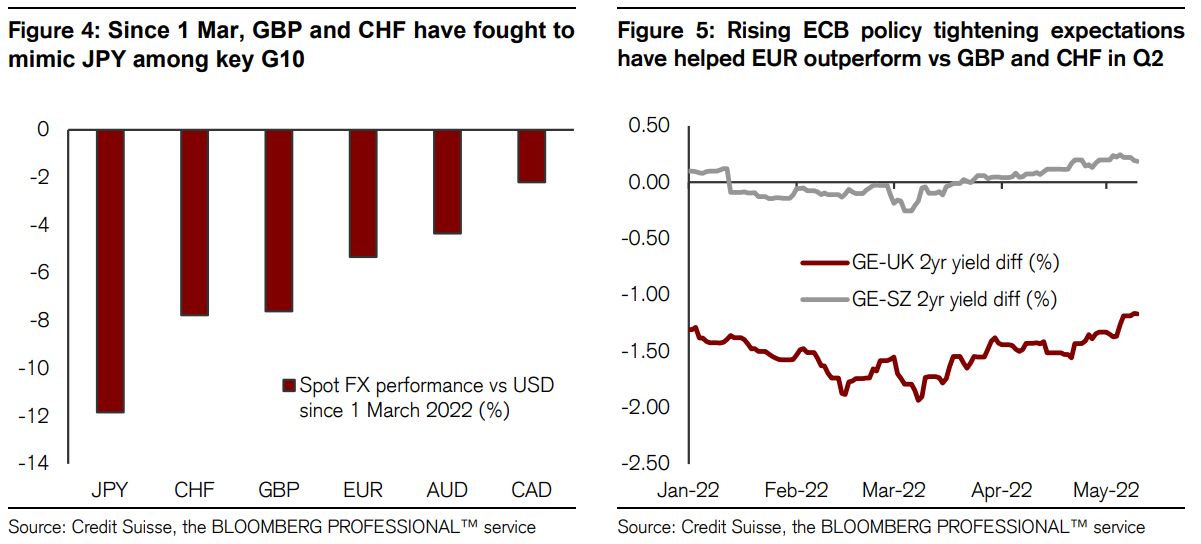

“One very notable feature of the recent phase of USD strength has been the persistent weakness of the key defensive G10 currencies, JPY and CHF. To us, this is a strong testament to the fact that the core driver behind both US asset prices and movements in exchange rates has been the fact that US interest rates have marched higher, taking global yields with them but at a lagging pace,” Jalinoos said in a Wednesday research briefing.

The Bank of England Bank Rate has recently been lifted to a post-2008 high of 1% but with the BoE perceived as unlikely to lift it much further, UK rates are offering investors little compensation for inflation rates that are expected to reach the double-digit percentages in relatively short order.

“With Japanese and Swiss rates among the key laggards, both JPY and CHF have underperformed, with CHF competing with GBP for the dubious title of “Europe’s yen,” Jalinoos and colleagues also said on Wednesday.

Source: Credit Suisse. Click image for a closer inspection.

Source: Credit Suisse. Click image for a closer inspection.

Recent losses have seen the Pound quickly become one of the worst performing major currencies of 2022, leaving it sitting alongside the Swiss Franc, Japanese Yen and the low yielding types that are typically viewed as safe-havens of ‘funding currencies.’

But there is also another factor that could equally explain some of the price action from late April through to the present including the curious case of the Norwegian Krone, which has fallen by some -11.5% in the last month alone.

This factor was touched upon by Credit Suisse on Wednesday and was recently summarised by researchers from the Bank of England including Robert Czech, Shiyang Huang, Dong Lou and Tianyu Wang as being “an unintended consequence of holding Dollar assets.”

“During the March 2020 ‘dash for cash’, 10-year gilt yields increased by more than 50 basis points. This huge yield spike was accompanied by the heavy selling of gilts by mutual funds and insurance companies and pension funds (ICPFs),” they wrote in a February 2022 post for Bank Underground.

“We argue in a recent paper that [insurance company and pension funds'] abnormal trading behaviour in this period was partly a result of the dollar's global dominance: ICPFs invest a large portion of their capital in dollar assets and hedge these exposures through foreign exchange (FX) derivatives. As the dollar appreciated in March 2020, ICPFs sold large quantities of gilts to meet margin calls on their short-dollar derivative positions,” they wrote in summary.

Source: Bank of England, Bank Underground. Click image for a closer inspection.

Source: Bank of England, Bank Underground. Click image for a closer inspection.

It’s possible if not likely that this very same phenomenon may have contributed to, if not perpetuated the recent increases in bond yields outside the U.S. and losses for currencies of economies that have large financial sectors and asset holdings in the U.S. market. (Set your FX rate alert here).

This would potentially explain why the Norwegian Krone has performed even more poorly than Sterling, the Yen and Swiss Franc despite the Norges Bank also raising its interest rate to a similar degree as the BoE, and in spite of Norway's economy benefiting from recent substantial increases in energy costs.

For readers background: Norway is home to the world’s largest sovereign wealth fund, which is estimated to hold some 1.4% percent of all stock market shares and which also has large investments in government bond markets. Many, if not all of these investments would be currency hedged to some extent.

Currency hedging U.S. asset holdings involves betting against the U.S. Dollar in the derivatives market and would be intended to protect those investments against possible declines in the value of the Dollar, although this practice can have unintended consequences too.

This is because when the value of the Dollar rises it can result in investors being asked for cash as collateral insurance against any possible losses on the derivative positions and it's these cash calls that did contribute to Sterling's losses in March 2020 and which could have contributed to its recent losses.

Source: Norges Bank Investment Management. Click image for a closer inspection.