Pound Sterling Outperformance Keeps it in Top Spot for 2022

- Written by: Gary Howes

- February economic rebound underway

- Footfall and travel up

- But 1.2050 is GBP/EUR's limit say analysts

Image © Bank of England

The British Pound's strong start to 2022 extended through mid-February and the UK currency looks set to benefit from a post-Omicron economic growth rebound and expectations for further Bank of England interest rate hikes.

It was reported Friday that UK retail sales rose 1.9% month-on-month in January, beating the consensus estimate for 1.0% and beating December's -4.0% reading.

"As expected, UK retail sales (data released this morning) rebounded fiercely in January, as the Omicron-induced slump dissipated," says Francesco Pesole, FX Strategist at ING. "The pound also appears relatively less exposed than other European currencies to the adverse swings in geopolitical sentiment."

Near-term data meanwhile shows commuter travel in the UK's largest cities is recovering to pre-Omicron levels, confirming economist expectations that February will be a month that marked a solid growth rebound.

"London workplaces are now about as busy as they were pre-Omicron, based on the latest bus, train and mobility numbers," says James Smith, an economist at ING.

The developments come in the wake of England dropping all Covid-19 related restrictions - including strict testing measures for the travel industry - after it was assessed that the Omicron wave far less severe than preceeding waves.

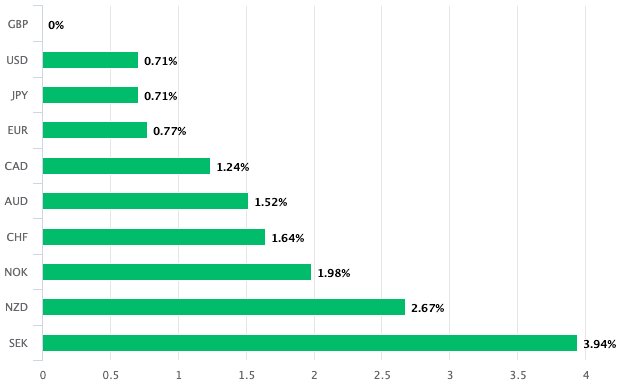

Above image courtesy of ING.

Near-term gauges of economic data showed an economy that was coming back to life following a fallow December-January period: the ONS on February 17 reported a fifth consecutive week of increasing retail footfall (week ending Feb. 12).

They also reported the seven-day average estimate of UK seated diners increased by 17 percentage points in the week to Feb. 14 to 129% of the level in the equivalent week of 2020.

The data could provide cover for the Bank of England to proceed with another interest rate hike in March, extending the hiking cycle that has underpinned rises in the value of Sterling in late-2021 and 2022.

Above: GBP is 2022's best performing G10 currency.

- Reference rates at publication:

GBP to EUR: 1.1976 \ GBP to USD: 1.3619 - High street bank rates (indicative): 1.1740 \ 1.3338

- Payment specialist rates (indicative): 1.1916 \ 1.3550

- Find out more about specialist rates and service, here

- Set up an exchange rate alert, here

"The Bank of England’s next rate step is likely to follow in March," says Antje Praefcke, an economist at Commerzbank. "We currently expect three further rate steps over the course of the year."

The Pound has also this week been aided by two sets of consensus beating data releases.

Job and wage figures released on Tuesday confirm the country's job market is 'tight' with fewer candidates being available to fill record-high job vacancies.

Bank of England rate hikes are symptomatic of the economy's elevated inflation levels; which reached 30-year highs in January according to the ONS.

"As long as the fundamental data allows for it the market is likely to stick to its expectations which points towards Sterling initially remaining strong against the euro," says Praefcke.

A number of foreign exchange strategists however caution that the market is now pricing in more rate hikes from the Bank of England than they are likely to deliver.

Any disappointment on here could stem gains by the Pound.

"Markets are pricing in a total of nearly 125bp rate hikes this year, which is more than our base case (75bp), although we recognise that risks are skewed towards more rate hikes," says Mikael Olai Milhøj, Chief Analyst at Danske Bank.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

"We now believe that a base rate of 1.00% by year-end is possible, but not more. Thus, the pound may be supported by further action in March or May, but will then see hikes being priced out and lose its early mover advantage," says David Alexander Meier, an economist at Julius Baer.

Praefcke says market expectations "have gone a long way" and the European Central Bank (ECB) is also likely to hike its key rate in the autumn.

"We therefore assume that the situation for the euro will then change, in particular as the market will in all probability have to adjust its expectations for British key rate to the downside at some point," says Praefcke.

Danske Bank says for the market to push up rate hike expectations - and the Pound - more meaningfully, UK inflation expectations must move notably higher.

"If anything, relative rates may become a drag if markets start to price in more aggressive actions from the ECB/less aggressive actions from the BoE," says Milhøj.

"We are still of the view that 0.83 was the bottom in EUR/GBP," he adds. (A Pound to Euro peak at 1.2050)

Commerzbank's Praefcke agrees that 0.83 in EUR/GBP would be where "the end of the line" for sterling strength is likely to have been reached.

"Levels below that do not seem sustainable to me, but will only be short excursions – if we see them at all," says the analyst.

Julius Baer holds a forecast of 0.82 for EUR/GBP in three months, which gives a GBP/EUR point forecast of 1.22, but looking ahead six months the bank forecasts EUR/GBP at 0.84, which translates into GBP/EUR at 1.19.

"A downbeat growth outlook and inflation expected to drop below target in three years suggest that markets have priced in too much action this year (four hikes). We expect one more hike in May or earlier and possibly one more in the summer, followed rather by a hold until next year," says Meier.