Pound Sterling, Euro and Dollar to be Driven by Powell's Jackson Hole Address Today

- Pound remains well supported as central bankers take the helm

- U.S. Fed's Powell is day's main event

- "Risk the USD bounces" - RBC

- Bank of England's Bailey due to speak Friday

- Disappointment from Powell could spark FX volatility

Above: Federal Reserve Chairman Jerome Powell. Image © Federal Reserve.

- GBP/EUR spot: 1.1159 | GBP/USD spot: 1.3203

- GBP/EUR bank rates: 1.0947 | GBP/USD bank rates: 1.2930

- GBP/EUR specialist rates: 1.1060 | GBP/USD specialist rates: 1.3084

Learn more about market beating exchange rates, here

The British Pound trades towards the top of its August ranges against the Euro and Dollar, but we expect some potentially significant financial market volatility on Thursday and Friday as central bankers address the Jackson Hole symposium.

The annual symposium, hosted by the Kansas City Federal Reserve in Jackson Hole, Wyoming, has often been used by central bankers to test major new policy ideas and given the incredible events of 2020 markets will be paying more attention to this year's event than normal.

U.S. Federal Reserve Governor Jerome Powell speaks at 14:10 BST in what should be the highlight of the symposium, "today's main event, is of course Powell's speech at the Jackson Hole conference," says Lars Merklin, Senior Analyst at Danske Bank.

The Jackson Hole Symposium has been held each year since 1978 and this year's event will be held virtually, with Powell's address titled “Monetary Policy Framework Review” which hints at the potential for some significant policy shifts.

"Our focus is on further USD-negative policies versus the fairly high bar set by consensus expectations. We continue to see near-term risks tilted to the downside in spot but will obviously reflect on such views after having heard Powell speak," says Merklin.

"Powell’s speech focuses on the Fed’s policy review and is expected to touch on the inflation target (a move to some form of average rather than point target is very widely expected) and possible changes to forward guidance, including state-contingent guidance. The former in particular is a USD-negative risk," says Adam Cole, Chief Currency Strategist at RBC Capital Markets.

"As long as the Fed chairman hints at 'flexible' average-inflation targeting, thus indirectly suggesting lower for longer interest rates in the U.S., the USD weakness is likely to continue," says Roberto Mialich, FX Strategist at UniCredit Bank in Milan.

Dollar weakness has become an emerging theme since March when the currency embarked on a trend of depreciation, this has in turn lifted the likes of the Pound-to-Dollar exchange rate which heads into today's events at 1.32, putting it within touching distance of 2020 highs.

Above: GBP/USD in August

"From here, GBP could continue to strengthen but the odds for a sustained rise above last week’s top near 1.3265 are not high, there is another strong resistance at 1.3300," says Quek Ser Leang, FX Strategist at UOB.

The Pound also meanwhile tends to benefit against a host of other currencies when the Dollar is falling, including the Euro, and we would therefore expect to see the Pound-to-Euro exchange rate relatively well supported around current levels at 1.1180 should Powell spark Dollar weakness.

Above: GBP/EUR in August

"The USD to remain vulnerable in coming months given growing risks to the US growth outlook from the Covid- 19 pandemic and the prospect for less business-friendly policies if the Democrats gain control over the Presidency and Congress after the November elections. This could force the Fed to adopt a more dovish forward guidance and even consider using Yield Curve Control, which, in turn, could encourage further diversification out of the USD," says Valentin Marinov, Head of G10 FX Research & Strategy at Crédit Agricole.

We are however wary that expectations going into the Jackson Hole event appear to be tilted towards U.S. Dollar weakness, and therefore the bar is set high for Chairman Powell.

If he disappoints - perhaps by offering no major new initiatives - the Dollar could bounce back and other assets like the Pound, stock markets and commodity prices could fall back. (If you would like to lock in current levels in the Pound, Euro or Dollar for use at a future point, or would like to automatically book a higher exchange rate, please learn more here).

"It is likely that recent USD losses partly reflect a build-up of expectations that the Fed will shift the balance of its policy focus in favour of stronger growth, while tolerating inflation overshoots. Generally, it is hard to see how Powell can out-dove markets that are already set up for policy remaining so accommodative and there is some risk that USD bouncesm," says Cole.

Bank of England Governor Andrew Bailey will speak at the event on Friday, which could mean a volatile end to the week for Sterling.

Markets will be keen on finding out how the Bank of England's thinking has progressed on further interest rate cuts as we know the Bank is actively considering cutting rates to 0% or even below, if warranted.

However the UK's economic recovery has accelerated in the July-August period and the Bank has suggested it is intent to keep both interest rates and quantitative easing unchanged while the recovery unfolds.

Should Bailey hint at further easing - such as rate cuts or a sizeable expansion of monetary easing - Pound exchange rates could come under notable pressure. However the bar to such an outcome remains high in our view and we would expect any knee-jerk reactions to what Bailey says to ultimately be faded.

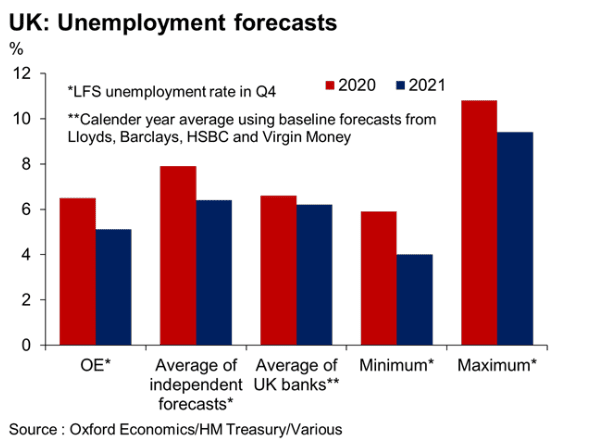

We would expect the Bank of England wants to wait until November before making any major policy announcements as this will allow them to assess how the ending of the Government's furlough scheme has impacted on unemployment. There is a concern that the ending of the scheme will see unemployment rise sharply and consumer confidence dip, which would in turn invite further easing from the Bank of England.

"We expect rising unemployment to put a brake on the recovery later this year," says Ruth Gregory, Senior UK Economist at Capital Economics.

Indeed, Autumn promises to be a testing time for the British Pound given the potential economic repercussions of ending the furlough scheme and that Brexit trade negotiations will be due to reach their climax.

However if the rise in unemployment is less severe than many economists are expecting, the Pound could head into year-end relatively well supported.

"We see a stronger bounce in 2021 than most forecasters," says Ben May, Director of Global Macroeconomic Research at Oxford Economics. "The coronavirus pandemic has resulted in a wide divergence among forecasts for the UK economy. This reflects different assumptions about policy changes, issues over the reliability of recent economic data, and a heavy dose of epidemiological speculation."

"Our forecast sees a deeper contraction in GDP this year (-10.9%) but a stronger bounce back in 2021 (+10.3%) compared to the consensus among forecasters, particularly the commercial banks. We also anticipate a lower rate of unemployment," says May.

Goldman Sachs on What to Expect from Powell

David Mericle, an Economist with Goldman Sachs in New York gives his expectations for the details to be unveiled by the Fed's Powell when he delivers his address:

"We expect the FOMC to adopt average inflation targeting (AIT). We think AIT will mean aiming for 2-2.5% inflation when the economy is at or near full employment, but not explicitly tracking and committing to make up for past downside misses. In the tools section of the review, we expect the FOMC to note that front-end yield caps or targets (YCT) could be useful in the future in certain circumstances, but without expressing any intention to implement them anytime soon. In the communication practices section of the review, we think the FOMC might aim to better convey the flexibility of the reaction function.

"We continue to expect changes to the forward guidance and asset purchase program to come at the November FOMC meeting, but it has become a closer call versus the September meeting. We expect the FOMC to adopt outcome-based forward guidance that delays liftoff until the economy achieves both full employment and 2% inflation, and to transition to a more traditional asset purchase program that aims to ease financial conditions and tilts purchases toward longer maturities."