Pound Sterling Bid vs Euro and Dollar, Data Shows Investors "Highly Complacent" Brexit View

- Sentiment on Sterling at 5-month high

- Investors ignore troubled EU-UK trade negotiations

- Dollar softer amidst stock market rally

Image © Adobe Images

- GBP/EUR spot rate at time of writing: 1.1117

- Bank transfer rates (indicative guide): 1.0805-1.0882

- FX specialist rates (indicative guide): 1.0950-1.1017

- Get a bank-beating quote here

The British Pound remains well supported having shaken off a bout of Brexit-related nerves triggered by confirmation that EU and UK negotiators remain deadlocked after a seventh round of trade negotiations.

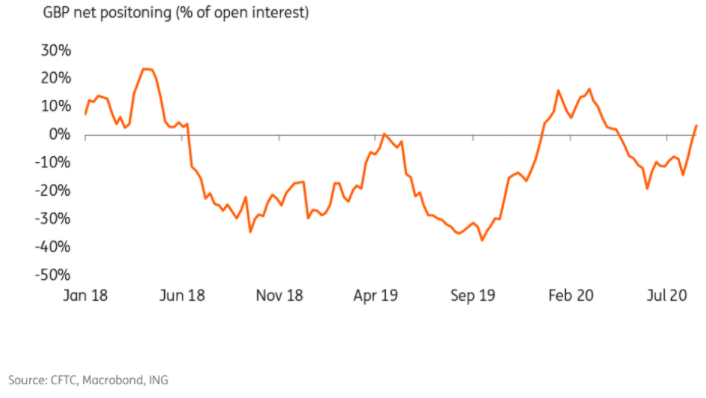

Investor sentiment on the British Pound has turned increasingly positive over recent weeks, with the latest data from the Commodity Futures Trading Commission (CFTC) showing traders have flipped from being overall bearish on Sterling to being overall bullish.

The CFTC data is released once a week and offers an unique insight into how investors expect a currency to trade in the future.

The most recent set of data shows a further reduction in active bets against the Pound, extending a trend that has been in place for a number of weeks now and comes despite the clock ticking down on EU-UK trade negotiations.

The closing of 'short' positions on Sterling creates a technical bid for the currency, and is one reason analysts say the Pound has advanced against the Euro and Dollar over the past four weeks.

The past month has seen the Pound-to-Dollar exchange rate rally 1.5% to reach 1.3125 at the time of publication, the Pound-to-Euro exchange rate has meanwhile rallied half a percent in this timeframe to reach 1.11.

"Sterling’s net positions jumped to a 5-month high, moving into net longer territory (+3% of open interest) in the week ending 18 August. The move in positioning is hardly surprising considering the recent good performance of GBP positioning: actually, the jump in net positioning appears to be lagging the move in spot by a few weeks," says Francesco Pesole, FX Strategist at ING Bank.

Above: ING graph showing investor positioning in GBP.

"GBP positioning is a good indication of how investors are currently keeping a highly complacent approach to the Brexit story. While the collapse of Brexit negotiations late last week will only be mirrored in next week’s CFTC positioning report – and we may see the rebuild of some GBP shorts – sterling’s positioning is still far from the levels it hovered around when markets were pricing in a no-deal Brexit," adds Pesole.

The Pound dropped on Friday August 21 when the 7th round of negotiations ended in Brussels, with EU Chief Negotiator Michel Barnier saying "at this stage, an agreement between the United Kingdom and the European Union seems unlikely. I simply do not understand why we are wasting valuable time."

The UK's Chief Negotiator David Frost said, "the EU is still insisting not only that we must accept continuity with EU state aid and fisheries policy, but also that this must be agreed before any further substantive work can be done in any other area of the negotiation, including on legal texts. This makes it unnecessarily difficult to make progress."

Sterling's knee-jerk reaction to the assessment was to decline, however we wrote ahead of the update that the two sides would declare a deadlock and that a breakthrough is only likely when EU and UK leaders meet directly.

The Pound's performance of late therefore likely reflects an assumption that the two sides will agree a deal in October, as is typical of the EU's modus operandi.

"The GBP is growing a bit more resilient to Brexit risks. This comes as several media outlets are reporting that Barnier told other EU members that the UK’s blueprint for a free-trade agreement (tabled last week) was unacceptable. For GBP/USD, price action remains within the 1.3000-1.3250 range for now," says Bipan Rai, North America Head of FX Strategy at CIBC Capital Markets.

However, ING's Pesole says there is a risk foreign exchange markets are guilty of being too complacent on Sterling's prospects heading into Autumn.

"This continues to highlight how GBP is underpricing the risk of a no-deal outcome of current UK-EU trade negotiations, which in turn flags a non-negligible risk of more stress being built into sterling in the coming weeks," says Pesole.

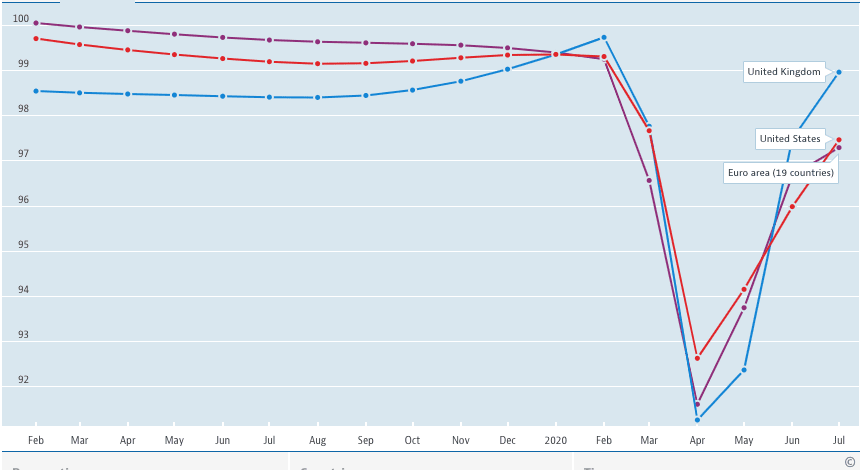

The improvement in Sterling's performance relative to the Euro and Dollar might have another contributing driver: the acceleration in the UK's economic recovery.

Pound Sterling Live has been keeping an eye on how the UK's recovery has compared to that of the United States and the EU using the OECD's Composite Leading Indicator, which has shown the UK's starting to pull ahead:

Above: OECD Composite leading indicator.

The indicator provides a timely snapshot of how an economy is evolving and - importantly - provides a benchmark against other economies.

A strong rebound in the UK economy should see markets push back expectations for further monetary easing to be delivered by the Bank of England over coming months. Most analysts expect another batch of quantitative easing to be announced towards the year-end, however expectations for negative interest rates have declined dramatically.

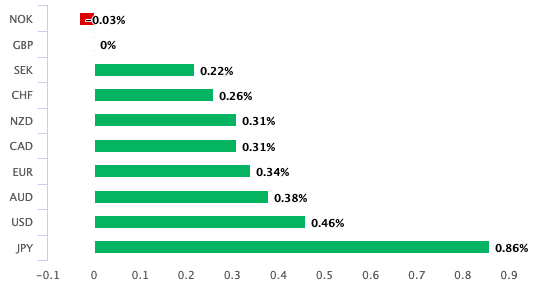

"A weaker U.S. dollar put a sturdier floor under Sterling. The Pound rose as the safe-haven dollar slid as a confluence of risk-friendly factors bolstered broader markets. That helped the pound sidestep disappointing news on the domestic consumer, as a gauge of retail sales unexpectedly contracted in August. A dearth of British data this week has led the pound to look to external drivers for direction," says Joe Manimbo, Senior Market Analyst at Western Union Business Solutions.

A general rule of thumb is that a currency should appreciate when expectations for lower interest rates decline; this appears to be an important theme for Sterling at present.

The broader market backdrop is meanwhile also judged to be supportive of the Pound, with rising stock markets confirming an underlying positive investor sentiment that tends to benefit Sterling against the Dollar in particular.

"Markets like the idea of falling Covid-19 cases and hints and promises of treatments and vaccines, even when the scientists tell us they are wishes, not facts, and a goodly amount of outright lies," says Barbara Rockefeller, Chief Economist at Rockefeller Treasury Services. "Also contributing to giddiness is the US claiming the Phase One deal with China is just fine; Treasury Secretary Mnuchin and Trade Rep Lighthizer told the press the two have affirmed the commitment and China has taken 'significant' steps".

Above: GBP outperformed the majority of its peers on Tuesday, August 24.