Brexit Trade Deal "Landing Zones" in Sight, Could Support Sterling this Week

- Stock markets driving FX at start of new week

- GBP rallied last week, but can gains continue?

- Brexit trade talks in focus once more amidst talk of a "landing zone"

- Watch Sunak's mid-week as Govt. spending plans announced

Above: File image of David Frost, Michel Barnier. Photographer: Dati Bendo, © European Union, 2020. Source: EC - Audiovisual Service

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The British Pound starts the new week by registering losses against the Euro, Australian and New Zealand Dollars but is seeing gains against the U.S Dollar, Yen and Franc, courtesy of a rally in global stocks and commodity prices which suggests broader investor sentiment is in the driving seat.

Specifically, Tthe gains for stocks and commodities implies investors are in a 'risk on' mode which is typically a negative for the likes of the U.S. Dollar, Yen and Swiss franc which are considered safe havens, but tends to be positive for the likes of the Australian, New Zealand and Canadian Dollars.

Monday therefore sees Sterling being a passenger of broader market currents; "USD is drifting lower against all major currencies except JPY. The forces of reflation (loose monetary "and fiscal policies and the pick‑up in the business cycle) are outweighing concerns over a resurgence of coronavirus infection," says Elias Haddad, a foreign exchange strategist at CBA.

"Sterling rose back above 1.2500 as China equity gains boosted global risk sentiment and weakened the Dollar, focusing attention away from UK Brexit vulnerabilities that still threaten the Pound," says Paul Spirgel, a Reuters market analyst. "However, lingering risk of a chaotic Brexit – which may nurture negative BoE rates speculation – should limit Sterling gains, particularly against the Euro."

While Sterling is taking instruction from elsewhere on Monday, we remind readers that foreign exchange markets remain anxious over the outcome of EU and UK trade negotiations which will continue in London this week, while Wednesday sees the Chancellor Rishi Sunak give further details of how the Government intends to spend its way out of the covid-19 economic slump.

"GBP is underperforming most major currencies because of the uncertainty associated with post‑Brexit trade negotiations. Both EU and UK chief negotiators warned significant divergences remain following last week’s round of trade talks," says Haddad.

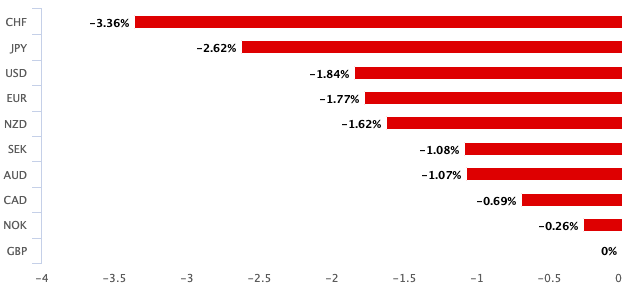

Above: Sterling has fallen against all its major peers over the course of the past month

The EU and UK concluded last week's talks earlier than expected at mid-day on Thursday, suggesting the deadlock had only deepened. However, newswire reports suggested this not to necessarily be the case, and that the two sides do in fact have a 'landing zone' in sight.

According to a Bloomberg report, officials with knowledge of the negotiations said the two teams are beginning to coalesce around a general "landing zone" that could form the basis of an agreement on trade and other areas of cooperation

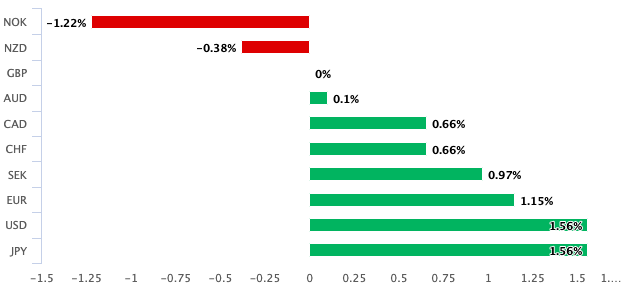

The news helped Sterling snap a multi-week losing streak against the Euro and Dollar - indeed the currency was starting to look oversold anyway - ensuring the Pound-to-Dollar exchange rate advanced 1.18% last week and is quoted at 1.2492 on Monday.

Above: Sterling recovered from oversold conditions last week

Meanwhile the Pound-to-Euro exchange rate rallied 1.0% last week to trade at 1.0697 at the time of writing on Monday.

Despite these gains, the trend in GBP/EUR remains lower, and as can be seen in the below graph the pair appears to be respecting a trend line that remains pointed lower:

We believe that leaked details of the talks could provide Sterling with some support, but would only expect any material gains to result from official confirmation of progress.

A source told Bloomberg the two sides are heading for a stripped-down agreement that includes a free trade deal eliminating tariffs and quotas, but it will probably fall short of the broader accord the bloc had originally proposed, an EU official said, speaking on condition of anonymity.

"We currently have a much more bearish GBP forecast for the current quarter on the basis of no deal being reached until very late in the day. We have been very dubious of the UK deadline of a deal being outlined by the end of July. So if that assumption proves wrong, we would certainly see grounds for GBP outperformance with limited downside from current levels," says Derek Halpenny, Head of Research at MUFG.

Analysts at Standard Chartered have told clients a Brexit deal has become their base case again as both sides intensify trade talks and they see the early sketches of a landing zone appearing.

"Negotiators face a tighter timetable than 2019 and any deal would require concessions from both sides," says Christopher Graham, an economist with Standard Chartered. "Multiple issues could still derail negotiations, so a no-deal outcome remains a distinct possibility."

But even with a deal, Standard Chartered see trade frictions emerging in 2021 and they warn any no-deal outcome could severely impact 2021 growth.

"But it is not all negative. The mood music appears to have changed around negotiations. Both sides are ostensibly more committed to reaching an agreement than previously and have agreed to an intensification of talks in the coming weeks. We are also starting to see more flexibility creep into negotiating positions. This makes the prospect of a deal being reached more likely in our view," says Graham.

Standard Chartered say markets are "too downbeat on the potential for a ‘good’ outcome" and they forecast GBP/USD at 1.40 at year-end based on a good outcome, taking EUR/USD to 1.16 and GBP/EUR to 1.2068.

However, a 'bad' outcome could see both GBP and EUR trade to 1.10 versus the USD (and hence EUR/GBP to parity).

A good outcome has a 70% probability attached.

Standard Chartered have assessed the key sticking points to negotiations and believe that in all areas there are signs of progress and opportunity for compromises.

On fishing, the EU is seen to be dropping a 'maximalist' approach that would allow them unfettered access to UK waters. The UK could however yet allow EU fleets catch sizes equivalent to current levels, "if key stakeholders were brought into the process and signed off," says Graham.

On the issue of financial services, while a 'soft' June deadline for some sort of accord has passed a deal is yet still possible. "The UK has recently stepped back from its threat to withhold equivalence from EU firms. Given both sides start from a point of alignment, assessments of equivalence should, in theory, be verifiable at some point later in the year," says Graham.

Level playing field (LPF) provisions are however seen as the most difficult issue to navigate for the two sides. Standard Chartered believe that the UK won't accept a dynamic alignment approach whereby they accept new EU rules and regulations as they are created.

Instead, a sliding-scale approach will likely be adopted whereby "the UK will depart the transition period essentially fully aligned and will therefore be able to make decisions over time as to how far it diverges. If the market access available to the UK is delineated up front, this may be sufficient for the EU to agree to," says Graham.

On the issue of dispute resolution, Standard Chartered says the UK would likely be agreeing to maintain EU law/sign up to new EU law, meaning there would be a clear role for the European Court of Justice (ECJ) in any future dispute settlements.

"Reports suggest that the UK is willing to accept some form of role for the ECJ in any future relationship, which if confirmed would be positive for negotiations," says Graham. "Although it remains unclear to what extent this would be the case. If it could be agreed that the UK would be signing up to static alignment, but via passage of domestic legislation, this would limit any power the ECJ would have. The EU may be willing to allow for this, if there was a clear mechanism for sanctioning in cases of divergence."