Pound Sterling: Multiple Pressures Start to Build, Pointed Lower against Euro, Dollar and Other Majors

- GBP @ bottom of the barrel

- Fear of -ve interest rates at Bank of England weighs

- UK's slow exit from lockdown a potential concern

- Rising fears that EU-UK trade talks fail

Image © Adobe Images

![]() - Spot GBP/EUR rate at time of writing: 1.1314

- Spot GBP/EUR rate at time of writing: 1.1314

- Bank transfer rates (indicative): 1.1018-1.1090

- FX specialist rates (indicative): 1.1100-1.1210 >> More information![]() - Spot GBP/USD rate at time of writing: 1.2275

- Spot GBP/USD rate at time of writing: 1.2275

- Bank transfer rates (indicative): 1.1945-1.2030

- FX specialist rates (indicative): 1.2030-1.2160 >> More information

The British Pound is now the worst-performing major currency of the past day, week and month according to our data, as multiple pressures start to build on the UK currency in the form of trade negotiation uncertainty, Bank of England policy and the country's slow exit from lockdown.

The Pound has over recent weeks benefited from a broad stock market improvement, and regular readers of Pound Sterling Live will recall we said that when stock markets improve the Pound tends to appreciate against the Dollar, Euro, Yen and Franc.

However, we also warned that the time would soon come when this simple reaction to market 'risk on' / 'risk off' would fade and fresh fundamental drivers would take hold.

We appear to be entering this phase as the Pound looks to have been overlooked by another broad round of stock market gains over the past 24 hours, with investors now starting to place increasing emphasis on UK-specific issues.

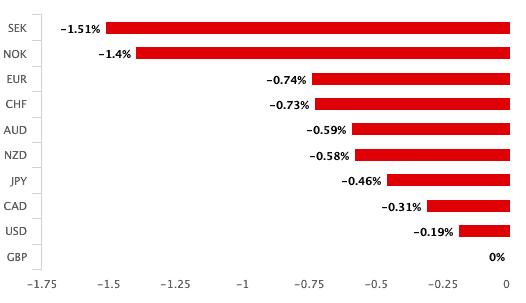

The below chart shows Sterling's performance over the past 24 hours:

A trigger to the bout of recent weakness is widely cited as being comments from Bank of England Deputy Governor of Monetary Policy who said Tuesday that more 'easing' at the Bank of England will be needed in due course and that all policy tools are under review in order to deliver this.

Broadbent told CNBC that the Bank is prepared "to do what's needed" which suggests the Bank won't hesitate to intervene in the market if need be.

From a currency market perspective, Broadbent's comments on interest rates are perhaps the more interesting as he said cutting interest rates into negative territory "would potentially do more harm than good".

Mathias Van der Jeugt, an analyst at KBC Bank in Brussels says Broadbent "didn’t fully dismiss the possibility of negative rates."

As such, the market could be factoring in the prospect of the UK entering a negative interest rate environment, as is currently the case in Japan and the Eurozone.

Such a move by the Bank would prove to be particularly unsupportive of Sterling valuations over the foreseeable future.

Regardless of the speculation surrounding negative interest rates, the comments will at the very least reinforce market beliefs that the Bank of England will likely expand its asset purchase programme - aka quantitative easing - by as early as the June meeting.

The Pound-to-Euro exchange rate edged below the 1.14 level in the wake of the remarks, and is currently quoted at 1.1315 at the time of writing, which places it at the bottom of a range that extends all the way back to early April.

Erik Bregar, an analyst with Exchange Bank of Canada says there has also been steady accumulation in the GBP/EUR exchange rate over the last week, and he thinks Euro buyers will feel even more emboldened should the cross produce a strong close below the 1.1390 level.

The Pound-to-Dollar exchange rate meanwhile trends lower and is quoted at 1.2275, which also puts it at the bottom of the range that has been in place since early April.

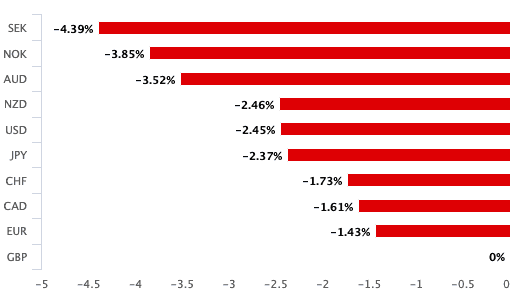

If we take a look at the Pound's performance over the past month, we can see it also underperforms over this timeframe, which suggests a more persistent negativity towards the currency:

"From a fundamental perspective, we think traders continue to focus on the UK’s lockdown-easing plans and the state of EU/UK Brexit transition talks; neither of which appear to be going well," says Bregar.

The analyst notes that one of the negatives weighing on Sterling over the past 48 hours on the Brexit front relates to comments made by German Finance Minister Heiko Maas, when he voiced the following concern about the state of EU/UK trade talks:

"A hard Brexit is becoming increasingly likely, as negotiations between Britain and the European Union have stalled, German Foreign Minister Heiko Maas told the Augsburger Allgemeine newspaper.

"It's worrying that Britain is moving further away from our jointly agreed political declaration on key issues in the negotiations," Maas said, in an interview published on Saturday. "It's simply not on, because the negotiations are a complete package as it's laid out in the political declaration," he added. "If it stays like this, we'll have to cope with Brexit as well as coronavirus," he said.

The UK and EU have this week begun the penultimate round of negotiations aimed at securing a provisional agreement ahead of the July European Council meeting, at which it must be determined whether an extension be granted to extend trade negotiations.

Despite the slow progress towards reaching a deal, the UK has been steadfast in its unwillingness to extend negotiations, and if the tone on talks does not improve by Friday we would expect the pressure on Sterling to increase.

"Our preference is to sell rallies," says Stephen Gallo, Head of European Strategy at BMO Capital, of any strength in Sterling. "Crunch time in the UK/EU Brexit talks is already here, and the significant share of services in UK GDP could well be an important drag on the recovery."

BMO Capital do not believe an abrupt and complete end to UK/EU discussions is fully discounted by foreign exchange investors.

"In other words, if such an abrupt end were to occur 5 or 6 months prior to the "real" Brexit deadline of year-end, FX investors would treat this as an unexpected outcome," says Gallo.