Traders Increase Bets against Pound Sterling

Image © Adobe Images

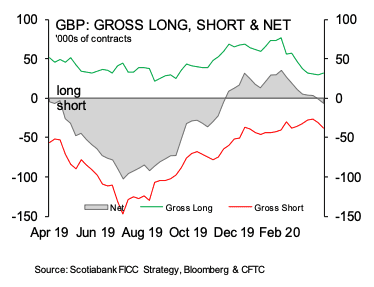

Speculative investors maintain a risk-off stance on Pound Sterling, according to the latest Commitment of Traders data from the Commodities Futures Trading Commission.

CFTC data - which is the largest and most timely snapshot of how the FX market is thinking - shows investors grew bets for Sterling downside for the ninth consecutive week.

"This is likely a function of the resurgence of some shorts related to Brexit uncertainty, which recently crept back onto investors’ radars. GBP net positioning is now at -4% of open interest, but the risk of additional downside in the gauge is quite material, especially when adding the rising concerns about the economic fallout of extended lockdown measures in the UK," says Francesco Pesole, FX Strategist with ING Bank N.V.

Despite the increase in bets against Sterling, it is worth pointing out that positioning on the currency remains relatively light and is by no means nearing over stretched levels. This tells us that further bets can build before the market starts to fatigue, suggesting scope for further downside in the spot exchange rate.

Above images courtesy of Scotiabank

Investors had built up speculative bets for appreciation (long positions) in Sterling in the run-up to the December general election, with the long position growing in the wake of the Conservatives securing a large majority in parliament.

However, the advent of the coronacrisis saw Sterling fall sharply as markets turned defensive, ensuring these bets for Sterling upside were ultimately liquidated, which in turn added to further downside in the currency.

Also in the week ending April 28, speculative traders made net purchased of around $1.1bn USD, following 8 consecutive weeks of net sales of USD, an outcome which won't come as a surprise as the Dollar has seen demand fall as global markets rallied.

Data shows asset managers drove the net purchases, as leveraged funds USD flows were net neutral.

The net USD purchases were largely against EUR.