Pound Sterling Outlook: "Fear July 1" Trade Negotiation Deadline says Analyst

- Brexit talks underway once more

- Looming July 01 deadline poses difficulties for GBP

- Fresh covid-19 outbreaks to prompt transition & negotiating extension

Image © European Commission Audiovisual Services

![]() - Spot GBP/EUR rate at time of writing: 1.1450

- Spot GBP/EUR rate at time of writing: 1.1450

- Bank transfer rates (indicative): 1.1191-1.1271

- FX specialist rates (indicative): 1.1322-1.1390 >> More information![]() - Spot GBP/USD rate at time of writing: 1.2402

- Spot GBP/USD rate at time of writing: 1.2402

- Bank transfer rates (indicative): 1.2068-1.2155

- FX specialist rates (indicative): 1.2146-1.2290 >> More information

Brexit trade negotiations have restarted and should introduce another dimension to British Pound trading over coming weeks, with one analyst saying markets should "fear" an initial July 01 deadline.

The UK and EU have until July 01 to agree to extend the transition period which is due to run out by year-end in order to reach a free-trade agreement, if no such extension is agreed analysts warn the Pound could come under notable pressure through the second half of 2020.

"GBP dealers should fear July 1, when it will be too late to extend the Brexit transition past Dec. 31, 2020, and GBP would rightly suffer. The UK government has been vehement about not asking for an extension, and the UK parliament won't be able to force one this time, since Prime Minister Boris Johnson's huge Conservative majority will back his decision," says Richard Pace, an options analyst at Thomson Reuters' research desk.

The call comes as the Pound enters a period of consolidation against the Euro, Dollar following a strong recovery from the floors it hit in mid-March at the height of the coronacrisis market meltdown. While the coronavirus remains the main driver for foreign exchange markets, we would expect Sterling to become increasingly sensitive to newsflow concerning trade negotiations now that they have restarted.

Owing to a delay to negotiations following the coronavirus outbreak, the EU have said they would be open to extending the Brexit transition period to allow talks to continue, however the UK have repeatedly said they would not countenance such a request.

"As we prepare for the next rounds of negotiations, I want to reiterate the Government's position on the transition period created following our withdrawal from the EU. Transition ends on 31 December this year. We will not ask to extend it. If the EU asks we will say no," said David Frost, the UK's chief negotiator on Thursday.

"Extending would simply prolong negotiations, create even more uncertainty, leave us liable to pay more to the EU in future, and keep us bound by evolving EU laws at a time when we need to control our own affairs. In short, it is not in the UK's interest to extend," added Frost.

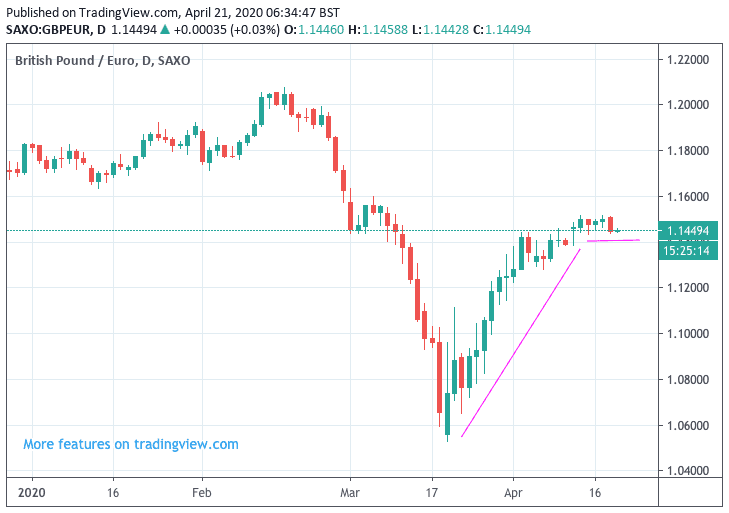

We note that the resurgence of Brexit related headlines has coincided with a stalling in the British Pound's recovery sequence against the likes of the Euro, Dollar and other major currencies:

The Pound-to-Euro exchange rate's recovery from March lows appears to be topping out around 1.15 while the Pound-to-Dollar exchange rate does not appear to be able to shake the gravity of the 1.25 region, while maintaining a heavy bias.

Above: The GBP/EUR recovery appears to have paused over recent days

While Sterling appears to have stalled, some analysts saying Sterling direction could flip into outright declines.

"Dealers don't seem to appreciate the gravity of this risk, with coronavirus taking centre stage, but GBP is likely to suffer as July approaches and take a big hit thereafter if Boris isn't bluffing and puts Britain on course for a no-deal Brexit just six months later," adds Pace.

Talks between the EU and UK stalled over recent weeks owing to the more pressing coronacrisis, with the lead negotiators from both sides having to go into isolation due to the covid-19 virus. Only one of the three formal rounds of negotiations meant to have taken place by now were completed because of the outbreak.

Last week chief negotiators Michel Barnier and David Frost met via video link to agree a timeline to resuscitate talks, arriving at three more rounds of negotiations:

- Week commencing 20 April

- Week commencing 11 May

- Week commencing 1 June

"The second round of negotiations between the United Kingdom and the EU begin today, and will continue throughout the week. Save for a significant softening of positions on either side, considered unlikely for now, Sterling is at further risk of downswings," says Asmara Jamaleh, Economist at Intessa Sanpaolo.

Numerous negotiating teams will engage via video link, each task with thrashing out the details of a different component of the negotiations.

Of particular concern will be an early indication of disagreement over access to UK waters by fishing fleets; with nations such as France and the Netherlands looking particularly exposed to the UK's promise to reclaim its territorial waters for its fishing fleets.

It is believed France want to link the broader trade negotiations to fishing rights, something which the UK will be eager to push back on.

"Belt up for UK-EU trade talks," says George Vessey, Currency Strategist at Western Union. "Sterling is vulnerable to downside risk if discussions don’t advance as it will increase fears of a no-trade deal Brexit."

If the UK and EU fail to agree a trade deal by year-end the trade relationship between the two economic areas will default to World Trade Organization (WTO) rules, which are believed to be sub-optimal for both economies.

Such an outcome, "would hurt both the Euro and the Pound," says Vessey.

Government says even if EU requested an extension to trade negotiations, it would say no. Prolonging the transition period means continuing to pay into the EU budget /1

— katya adler (@BBCkatyaadler) April 16, 2020

Vessey says there is political motive for the government to stick to its deadline of December 31, but the economic risk of doing so amidst the coronavirus crisis, threatens to aggravate what is already a disruptive and uncertain environment for UK businesses trading internationally.

However, it is widely agreed by analysts that progress on the matter of trade negotiations - particularly if an extension is requested - would unlock the upside potential in Sterling and could contribute to a broader long-term recovery for the currency.

"A positive tone from next week’s talks will likely benefit the pound," says Vessey.

James Smith, UK Economist at ING Bank N.V. in London says the incentives for the UK government to make a request for an extension to the transition and negotiating period by July 01 are high, particularly if the global economy is facing further rounds of covid-19 outbreaks in the latter half of the year.

"Given the risks involved with a sharp change in trading conditions at the start of 2021, particularly if that were to coincide with another Covid-19 outbreak, we think an extension looks increasingly likely," says Smith.

ING believe the civil service resources previously assigned to support negotiations on either side of the channel have been reallocated to deal with the coronavirus emergency response.

"Admittedly many of the thornier issues were always likely to be left untouched until after the summer. But these are tough, political choices, and with the health crisis likely to persist for many more months to come, Brexit simply isn't going to be high up politicians' list of priorities - on either side of the channel," says Smith.

ING believe an extension to the transition period remains likely, and it's really a question of 'when'.

If they are correct, we would expect the British Pound to benefit.