Fed Action Driving Pound Sterling's Resurgence against the Euro, Dollar and Other Major Currencies

- GBP prone to global liquidity shortages

- Large financial sector leaves GBP exposed

- Fed action eases shortages

- Brexit transition period delay increasingly likely

Image © Xiong Mao, Adobe Stock

![]() - Spot GBP/EUR rate at time of writing: 1.1233

- Spot GBP/EUR rate at time of writing: 1.1233

- Bank transfer rates (indicative): 1.0940-1.1020

- FX specialist rates (indicative): 1.1100-1.1130 >> More information![]() - Spot GBP/USD rate at time of writing: 1.2382

- Spot GBP/USD rate at time of writing: 1.2382

- Bank transfer rates (indicative): 1.2050-1.2140

- FX specialist rates (indicative): 1.2230-1.2270 >> More information

The fading shortage of dollars in the global financial system thanks to a series of interventions by the U.S. Federal Reserve appears to be a critical driver behind an ongoing recovery in the value of the British Pound, according to analysts.

The U.S. Federal Reserve on Tuesday launched another programme to pump more dollars into the world economy by launching a temporary repurchase agreement facility for foreign central banks which should support the smooth functioning of financial markets, which in turn benefits the UK's sizeable financial services sector and eases pressure on Sterling.

The Fed's actions appear to have halted a net outflow of capital from the UK which has allowed Sterling to stage a recovery, not just against the Dollar but against the Euro and other global currencies.

The latest programme announced by the Fed will allow participants to temporarily exchange U.S. Treasuries for dollars, which can then be made available to institutions in their jurisdictions, the Federal Reserve said in a statement when announcing the programme.

"The Fed is temporarily allowing other central banks to exchange their holdings of US Treasury securities for overnight dollar loans. The new repurchase agreement facility is different to the US Dollar liquidity swap lines with major central banks that were put in place earlier this month in which dollars are exchanged for foreign currencies. This facility, along with the swap lines, should help ease strains in global US Dollar funding markets. It should help smooth functioning of financial markets, providing an alternative temporary source of US Dollars other than sales of securities in the open market," says George Vessey, Currency Strategist at Western Union.

Demand for dollars spiked during a global market meltdown in the first half of March as investors liquidated investments amid rising fears over the coronavirus outbreak, a period that coincides with a sharp and deep selloff in the Pound. However, the U.S. Federal Reserve soon took action to provide more dollars to the global financial system and the demand for the USD has since eased, coinciding with a broad-based recovery in Sterling.

"Sterling was the currency hit hardest by lack of liquidity and concern about access to dollars in early March, falling by around 10% in value. But it’s also been seen the strongest bounce as the fed has rolled out measures to tackle the issue," says Kit Juckes, Global Head of FX Strategy at Société Générale.

The Pound had been in virtual free-fall up until the Federal Reserve announced an arrangement with global central banks which made it possible to provide dollar-based liquidity. Five major foreign central banks have permanent swap lines with the Federal Reserve while nine additional central banks established temporary programmes with the Fed on March 19.

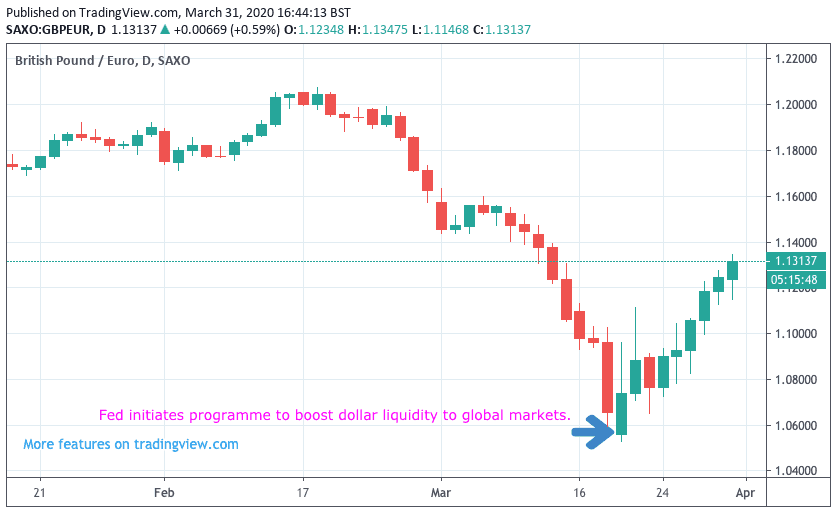

The impact on Sterling is notable, March 19 is the same day that we saw a turnaround in fortunes for the Pound-Euro exchange rate:

The Pound has been in recovery mode against the Euro, Dollar and other majors since this point as shown in the above GBP/EUR graph.

Tuesday's additional measures to provide more dollars into the global system coincides with another notable boost in value in Sterling, we saw the Pound-to-Euro exchange rate rally 1.0% at one point in the day, with the Pound-to-Dollar exchange rate going up half a percent.

The reason why Sterling appears to have benefited is because the UK has a substantial financial services sector and it appears that dollar shortages in the world's financial system coincide with outflows from UK financial institutions, which places downward pressure on Sterling not just against the Dollar but against a host of the world's currencies.

"The UK has a large and systemically important banking sector which is particularly exposed in times of credit crunches and disturbances in the global funding system - containing Libor-OIS and basis swaps spreads via more USD liquidity is key," says Morten Lund, US and UK Analyst at Nordea Markets.

"After being battered during the dollar liquidity squeeze, the scope for GBP to fall is more limited now. What seems to matter more for GBP at this point is the access to external funding rather than the credit rating," says Chris Turner, Global Head of Markets at ING Bank.

The surge in value by Sterling towards the end of the month means the currency has recovered much of the ground it lost during the most intense periods of market meltdown that characterised the first half of the month.

We hear from a number of foreign exchange analysts that the worst might now have come to pass for the currency, and further gains over coming days and weeks are possible.

"The currencies that have fared particularly poorly in recent weeks are generally those of countries which have the worst external positions. This is crucial as the UK relied on inflows of investment equivalent to about 4% of GDP in 2019 to finance its current account deficit. This reliance on external finance meant that the sudden deterioration in risk appetite and scramble for US dollars caused a sharp fall in the pound," says Andrew Wishart, UK Economist at Capital Economics.

Wishart says there are good reasons to think that, unlike after 2008, the pound will reverse more of its fall this time.

"The fall in sterling in recent weeks has uncomfortable echoes of 2008, after which it never recovered. But the fact that the pound looks somewhat undervalued give us reason to think that sterling will make up the lost ground this time around," says Wishart.

Brexit Transition Period Might be Extended

Above: Boris Johnson appears by video link as he self-isolates owing to being infected by covid-19. © Andrew Parsons / No 10 Downing Street

While the global financial system's behaviour in response to the coronavirus pandemic is the most important issue for Sterling at present, the issue of Brexit is once again being cited as a factor driving Sterling.

"Some chatter is making the rounds that the UK will be forced to ask the EU to delay the post-Brexit transition period by a year or two, because trade talks have apparently “ground to a halt” amid the coronavirus pandemic," says Erik Bregar, Head of FX Strategy at Exchange Bank of Canada.

Bregar says it is arguable that this development "is GBP bullish" and perhaps explains a large part of Pound-Euro exchange rate's advance since the broad U.S. Dollar funding issues began to abate over a week ago.

Robert Howard, an analyst at Thomson Reuters says Sterling might get a boost if UK Prime Minister Boris Johnson asks the European Union for Britain's post-Brexit transition period to be extended by a year or two.

If he does, Howard says it would remove the GBP-negative risk of the EU and UK failing to agree a trade pact to begin Jan. 1, 2021 – the day after the post-Brexit transition period is due to end.

"Negotiations on a trade pact have ground to a halt amid the coronavirus pandemic; several British civil service sources told Reuters many officials previously focussed on the trade talks have been shifted to dealing with the coronavirus outbreak. On Monday, EU diplomats said they expected a transition extension request in May or June," says Howard.

However, a spokesman for Prime Minister Boris Johnson told a regular press briefing that the December 31 transition period deadline remains "enshrined in law".

However it is becoming increasingly difficult to see the government push ahead with a year-end Brexit, considering the significant hit to cashflow and operations experienced by both British and European firms during the ongoing coronavirus outbreak.

"Under the current circumstances, it is hardly feasible for British firms to adequately prepare for the UK's withdrawal from the EU, so Boris Johnson may very soon be forced to consider an extension of the transition period," says Marc-André Fongern, Head of FX Spot & Options at Fongern Global Forex. "Extending the transition period would indeed automatically lead to more uncertainty for UK firms. I think the Pound Sterling currently reflects such a scenario, at least to some degree."