Pound Sterling in "Whopping" Recovery against the Euro and Dollar

- GBP makes strong gains

- Improved market sentiment drives advances

- Analysts question sustainability of market recovery

- Barclays forecast softer GBP in 2020

Image © Adobe Images

![]() - Spot GBP/EUR rate at time of writing: 1.1077

- Spot GBP/EUR rate at time of writing: 1.1077

- Bank transfer rates (indicative): 1.0780-1.0870

- FX specialist rates (indicative): 1.0950-1.0980 >> More information![]() - Spot GBP/USD rate at time of writing: 1.2226

- Spot GBP/USD rate at time of writing: 1.2226

- Bank transfer rates (indicative): 1.1900-1.1990

- FX specialist rates (indicative): 1.2080-1.2114 >> More information

The British Pound has increased in value over the course of the past 24 hours in line with an ongoing improvement in investor sentiment, however the currency remains vulnerable to the return of bad news as coronavirus numbers in some of the world's major economies are still only expected to peak in the next few weeks.

Sterling has recovered back above 1.20 against the Dollar and 1.10 against the Euro over the course of the past 24 hours as investors believe the negative impact of the coronavirus will be softened by a generous package of support from global central banks and governments.

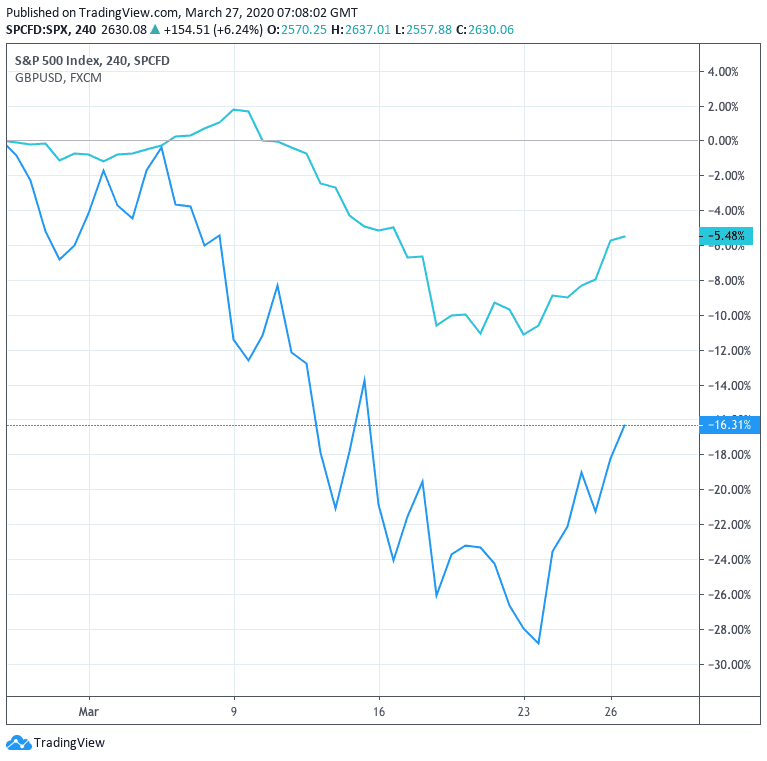

The improved investor sentiment is evident in global stock markets with the FTSE 100 up 12% this week while the S&P 500 is up 14%. The Pound remains highly sensitive to investor sentiment in the current atmosphere and tends to benefit when markets are in recovery mode as is currently the case. The Pound derives a significant degree of valuation from the flow of international investor capital into the UK's economy and markets, therefore the mood of the global investment community is an important consideration for the currency.

What we have witnessed over the course of this past week is a return in investor appeitite for 'risk on' assets such as stocks and commodities which has in turn had a pass-through effect into the currency market which has ultimately benefited Sterling.

The Pound-to-Dollar exchange rate rate rallied 2.25% yesterday and another 0.5% on Friday to reach 1.2217.

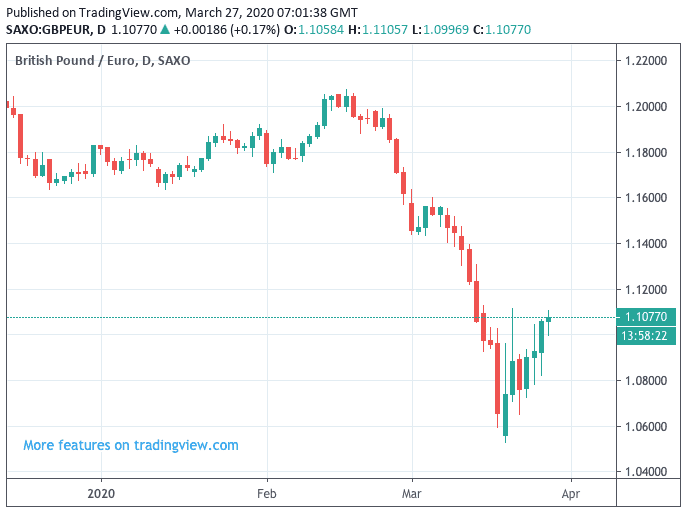

The Pound-to-Euro exchange rate meanwhile went 1.23% higher to reach 1.1076:

"The rally in GBP could extend," says Quek Ser Leang, analyst at UOB, "the strong rally in GBP that resulted in a whopping gain of +2.84% came as a surprise. Upward momentum remains robust and while overbought, the current rally could extend towards 1.2330."

Dollar weakness is a significant theme at present as the U.S. currency took a significant tumble in the wake of the release of weekly labour market data that showed a record surge in unemployment claims. Measures to contain the spread of the coronavirus resulted in a new all time record for Initial U.S. Jobless Claims which revealed 3.2 million Americans applied for unemployment support in the week ending March 21, which was well above the 1.7 million that markets were expecting, a number that amounts to more than 2% of the employed population.

The previous record for weekly jobless claims was set back in 1982 when 695K people applied for state support.

A chart of unemployment claims. Today's figure is a 30X standard deviation from norm pic.twitter.com/SO6FVDNbBC

— Nouriel Roubini (@Nouriel) March 27, 2020

"There were suggestions that state websites and phone systems were struggling to cope with the volume of applicants, implying that today's figure could actually understate the number of people losing their jobs and suggesting that we will see further very high claims numbers in the weeks to come," said Andrew Grantham at CIBC Capital.

The data should serve as a timely reminder to markets that while central banks and governments have stepped forward to help, the full negative economic extent of the virus is yet to be quantified. It therefore seems strange that markets are showing such exuberance at this stage and we wonder how long it can last.

This is important for the British Pound as any fresh capitulation in investor sentiment will ultimately undo the recovery.

"U.S. stocks have been rising for three days in a row for the first time since February. While both central banks and governments have done a lot to tackle the economic side of the coronavirus crisis, we think one should be careful stating that this is the bottom," says Mikael Olai Milhøj, Senior Analyst at Danske Bank.

Above: A correlation in performance between the Pound and stock markets. The GBP/USD (turquoise line) and the S&P 500 (blue line).

Further aiding Sterling's advance was the decision by the Bank of England to leave interest rates and levels of quantitative easing unchanged at their scheduled March 26 meeting.

The decision was expected, considering that the Bank has already unleashed a sizeable support package for the economy via the decision to cut interest rates to the bone at 0.10% and inject an additional £200bn into the economy via its quantitive easing programme.

The key message from the Bank at today's meeting is however that it stands ready to act by increasing its quantitative easing programme, if need be.

In its entirety, the event offers little by way of fresh information for markets and the direct impact on Sterling will be negligible.

However, that the Bank is fast running out of firepower removes a potential headwind to the currency in the future. The Pound tends to fall in anticipation of interest rate cuts and quantitative easing; remove that threat and a key driver of downside disappears.

"The GBP may well continue to benefit from the improved situation, especially since the Bank of England didn't deliver any special surprises," says Marc André Fongern, Head of FX Spot & Options at Fongern Global Forex.

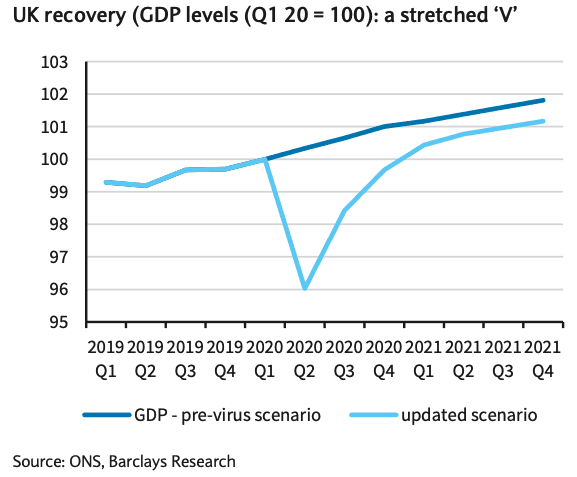

Barclays says Pound Sterling Destined for a Year of Pain

The British Pound is forecast to maintain a subdued tone through the course of 2020 by UK high-street lender Barclays, whose latest analysis shows there is no likelihood of a sustained revival in the currency.

Barclays have told clients the impact of the coronavirus on the global economy is likely to trigger a sharp global economic economic recession that will favour the likes of the U.S Dollar and Japanese Yen, while currencies such as Sterling will likely suffer.

"We have revised our GBP forecasts meaningfully lower and expect only limited reprieve vs. the EUR, from levels of significant undervaluation," says Ajay Rajadhyaksha, Head of Macro Research at Barclays.

Barclays now forecast a global recession almost as large as in 2009, with a massive contraction in the first half of the year; the world economy will basically be at a standstill in 2020.

Barclays are forecasting China to grow at 1.3% and expect contractions in the euro area (-5.5%), Japan (-1.6%) and the US (-0.6%).

Barclays' base case expectation for UK GDP is a decline of 1.1% year on year in 2020 with the recovery unlikely to be sharp with the economy ultimately sustaining some long-lasting and potentially permanent damage:

"There is a wide range of risks around this forecast, with most skewed to the downside," says Rajadhyaksha.

With a global recession looming, Barclays say they expect reserve currency outperformance versus riskier and cyclically sensitive currencies, "such as G10 commodity FX and European satellites."

The likes of the Australian, New Zealand and Canadian Dollars are considered commodity currencies and we would imagine that the Pound is now considered to fit into the 'European satellite' category.

The Pound-to-Dollar exchange rate is forecast at 1.16 by the end of June, 1.15 by the end of September and 1.14 by year-end.

The Pound-to-Euro exchange rate is forecast at 1.0750 by the end of June, 1.0870 by the end of September and 1.10 by year-end.

Other key forecasts for the global currency sphere include:

"Uncertainty shocks and liquidity demand continue to dominate FX markets, providing strong support for the USD, over and above the typical safe haven demand.

"Continued EUR/USD depreciation, given the potential for a significant downturn to EA activity as the US enters the COVID19 outbreak in a more robust position than the EA.

"Compression of absolute and risk-adjusted return expectations between the US and Japan imply JPY outperformance over the forecast horizon."