Pound Sterling Punished Amidst Savage Stock Market Sell-Off, Down over 0.75% against Euro and Dollar

- Stock market being routed

- Trump's poor handling of coronavirus outbreak cited

- GBP prone to capital outflows from the UK

- Funding currencies like JPY, EUR and CHF performing well

Image © Adobe Images

- Spot rates at time of writing: GBP/EUR: 1.0808, -1.75% | GBP/USD: 1.1852, -2.15%

- Bank transfer rates (indicative): GBP/EUR: 1.0520-1.0596 | GBP/USD: 1.1537-1.1620

- Specialist money transfer rates (indicative): GBP/EUR 1.0650-1.0701 | GBP/USD: 1.1650-1.1745 >> More details

Global stock markets are in free-fall once more and the British Pound is finding itself under significant pressure against a number of, but not all, currencies in the current market atmosphere.

Our immediate reading of the situation is that the Pound is being sold against the likes of the Dollar, Euro and Yen owing to outflows of capital from the UK, which is related to the broader deterioration in global investor sentiment stemming from coronavirus concerns

Let's look at the numbers:

The FTSE 100 is down 6.0%, Germany's DAX is down 6.8% and the Dow Jones looks set to open a further 5.0% lower. These are staggering numbers and will ultimately shift global stock markets into bear territory following years of ascent.

The Pound-to-Dollar exchange rate is meanwhile down 1% at 1.2688, the Pound-to-Euro exchange rate down 1.04% at 1.1262 and the Pound-to-Yen rate is down 1.50% at 131.82.

But, Sterling is still up against those currencies we would expect to be particularly prone in times of investor fear: the Pound-Australian Dollar is up 0.65% at 1.9910 and the Pound-Krone exchange rate is up an eye-watering 2.67% at 12.76.

The message from the above is that investor sentiment has a firm grip on the market, with the main takeaway for readers being that Sterling is particularly prone to some currencies but is doing OK against others.

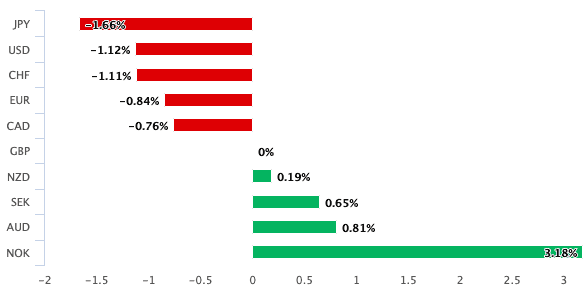

Above: GBP's performance at mid-day London time.

Let's look at the basic mechanics at play.

The currencies that are doing well against Sterling are what are known as 'funding' currencies, they belong to countries where interest rates are so low investors can borrow at rock-bottom prices to fund forays into global stock markets.

These currencies tend to decline in times of investor exuberance.

However, in periods of fear these same investors sell their stock holdings and repatriate the capital to their creditor accounts. Therefore, the Yen, Franc and Euro would be expected to do well, as is the case now.

This dynamic is particularly useful in explaining the sizeable decline in GBP/EUR we have seen since late February.

Regarding the Dollar, there is a clear theme playing out today: get hold of cash. When gold prices are on the move lower, (gold is 4% lower today) it would suggest a market that is not placing a premium on safety so much as the ability to hold cash.

The U.S. Dollar is the world's reserve currency, therefore it tends to benefit when markets exhibit the extraordinary panic we are currently witnessing in which only cash will do.

"Absolute meltdown in FX markets. Real scramble to get hold of USD liquidity and funding (where's the Fed when you really need them). Some of the biggest moves in G10 pairs for a long time. Will only stop once the mayhem in stocks/bonds stop," says Viraj Patel, FX and Macro Strategist at Arkera.

The Pound is meanwhile particularly prone to sell-offs owing to its sizeable and pervasive current account deficit; in short this is a deficit that results because the UK imports more than it exports.

Sterling is therefore ultimately sustained by an offsetting inflow of foreign capital. The UK is traditionally seen as a destination for investors, for a number of reasons, but should investors run scared suddenly Sterling finds this source of support disappearing.

Yes, the budget and Bank of England actions from March 11 were deemed ultimately supportive, but the measures appear to be no match for the impact of gargantuan flows of investor capital.

We would expect the Pound to only start recovering against the Euro, Dollar, Franc and Yen should markets believe a corner in the coronavirus scare has been turned.

For now, the turning point looks to be quite some distance off.

The culprit behind the most recent losses appears to be the inability of the U.S. administration to convince markets it has a grip on the situation.

An error-laden speech delivered to the nation by Trump on the night of March 11 was interpreted by markets as being evidence the U.S. administration not only does not fully understand the gravity of the situation, but does not have the answers.

We recommend this article by Justin Sink at Bloomberg for a cutting analysis.

You can also watch the speech here:

"The U.S. is woefully underprepared and the odds of containment are pretty much gone now," says Bipan Rai, North America Head, FX Strategy at CIBC Capital Markets. "What’s happening in the credit space is absolutely concerning. And it’s a symptom of a supply chain that has been compromised globally. As such, our recommendations remain the same. Stay defensive – hold long JPY, CHF on the crosses (especially versus commodity currencies like the CAD and NOK). EUR/USD should stabilize for now."

There is a fear amongst investors that Trump has lost control of the situation and has been shown to have been lacking when decisive global leadership was required. Falling back on America First jargon - as was seen in the address to the nation - is unhelpful in the current environment.

Markets are rapidly pricing in a sharp global downturn, with the depth of the selling suggesting an expectation that many elements of the economy might not be able to recover the lost output once the virus outbreak dies down and all returns to normal.

"The global market selloff has continued apace today, with European markets crumbling in the face of an impending global shut-down," says Joshua Mahony, Senior Market Analyst at IG. "Trump’s decision to cut travel ties with Europe highlights the common perspective that Europe is fast becoming the biggest hub for coronavirus in the world."

Mahony says the travel and tourism are the most at risk sectors at present and the failure of FlyBe just last week might be a precursor to other business failures.

"As the coronavirus spreads globally, a buy-the-dip mentality is falling away as the sheer scale of this crisis becomes apparent. For traders, chances to short indices and stocks provides the opportunity of a lifetime. However, from an investor’s perspective, cash is king until we see any light at the end of a darkening tunnel," says Mahony.