Battered Pound Sterling Looks to Claw Back Losses against Euro and Dollar Amidst Stock Market Recovery

- Stock market moves impacting GBP

- Central bank commitment to easing aids recovery

- Bank of England eye March rate cut

Image © Bank of England

- Spot rates at time of writing: GBP/EUR: 1.0808, -1.75% | GBP/USD: 1.1852, -2.15%

- Bank transfer rates (indicative): GBP/EUR: 1.0520-1.0596 | GBP/USD: 1.1537-1.1620

- Specialist money transfer rates (indicative): GBP/EUR 1.0650-1.0701 | GBP/USD: 1.1650-1.1745 >> More details

The British Pound was seen attempting to regain ground lost to the Euro, U.S. Dollar and other major currencies on Tuesday with a recovery in global stock markets proving supportive.

We have noted that the Pound appears particularly vulnerable to any coronavirus-inspired stock market sell-offs, largely because the currency is so heavily dependent on the flow of international investor capital into the UK.

In times of global investor stress, these inflows tend to fade and support for Sterling drops.

Investor sentiment has shown a noticeable improvement over the course of the past 48 hours, thanks largely to signs that global central banks will intervene to minimise the risk of a hit to global economic activity caused by the coronavirus.

"Hopes of a coordinated response to the Covid-19 outbreak by governments and major central banks led to a rebound in Wall Street, which followed through into Asian trading. The ECB yesterday was the latest major central bank to say it stands ready to take measures. The Reserve Bank of Australia overnight cut interest rates to a record low of 0.5%," says Hann-Ju Ho, Economist at Lloyds Bank.

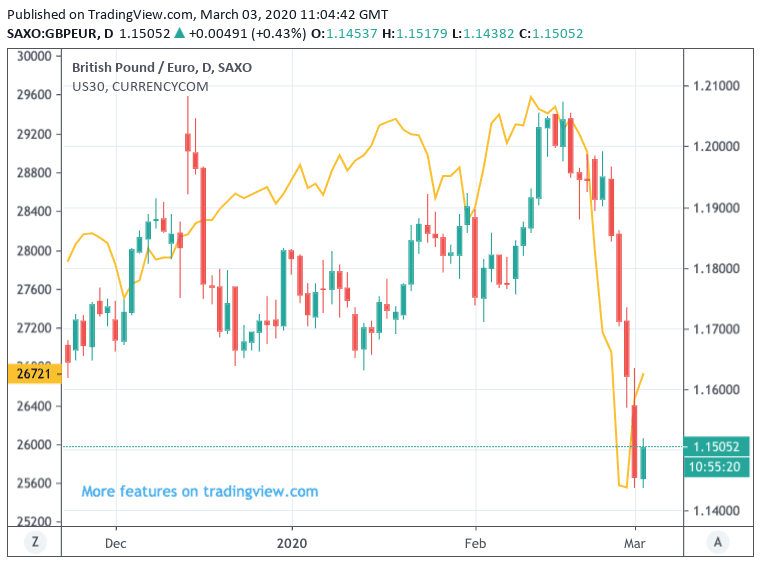

In line with our view that broader sentiment is driving Sterling at present, it appears rising stock markets are in turn offering the currency support: the Pound-to-Euro exchange rate is at 1.15, having been as low as 1.1434 over the course of the past 24 hours. The Pound-to-Dollar exchange rate is at 1.2780, the week's low is at 1.2730.

We would therefore imagine that any renewed market anxieties over the virus outbreak will have a negative impact on Sterling, any further and sustained recovery in stock markets could meanwhile provide the required underpinning for a more concerted recovery in the currency.

Above: GBP/EUR (bars) with the Dow Jones 30 (yellow line). We are particularly interested in the correlation since late-February which saw a decline in both, inspired by the coronavirus

"We appear to be within a stimulus phase, where the virus is cast aside in exchange for a renewed stimulus-led optimism. The pricing of a whole raft of central bank easing is difficult in the face of an ongoing health crisis. Traders will hope that today’s meeting between G7 finance ministers results in a commitment to raise fiscal spending in response to this crisis. The expectation of a sharp rise in monetary and fiscal stimulus provides plenty of short-term optimism, yet pessimists will likely wait for that initial bullish wave to pass before once again hitting the sell button should the virus continue to spread," says Joshua Mahony, Senior Market Analyst at IG.

The Pound has not only fallen owing to investor capital movements, there is the added issue of rising expectations for a Bank of England interest rate cut with the market's expectation for a 0.25% interest rate cut at the Bank at the end-March meeting have risen to a non-neglible 63%.

A cut would form part of a coordinated global policy response to the virus outbreak and would come in sympathy with today's cut at the Reserve Bank of Australia and an expected cut at the Federal Reserve. The European Central Bank has meanwhile signalled it is committed to easing monetary policy conditions in the wake of the virus, particularly as the Italian economy is likely to be severely affected by the outbreak there.

So, with all central banks seemingly committed to easing, surely this should be a factor that has a neutral impact on currencies: if the Fed, ECB and BoE are all cutting rates then surely the net impact on the Dollar, Euro and Pound is cancelled out?

Not so. The Bank of England has interest rates set at 0.75%, the Fed has interest rates set at a band of 1.50-1.75%, the ECB meanwhile has rates set at -0.50%.

The scope for cuts at the Bank of England and Fed are therefore significantly greater than at the ECB, therefore markets would see a greater impact on the Dollar and Pound, relative to the Euro, stemming from a round of interest rate cuts. In short, the Fed and Bank of England can go further.

Hence, in a world of rising interest rate cut expectations the Euro has less to lose and this is perhaps one of the reasons that the single currency has proven to be a winner of the recent bout of market anxieties stemming from the coronavirus outbreak.

"In our view, investors may have maintained long positions on the euro, as the ECB is expected to cut by the smallest percentage, and perhaps due to recent reports that Germany’s finance ministry is seriously considering to boost fiscal spending, due to growing pressure to support the nation’s sluggish economy, something that will lessen the need for aggressive easing by the ECB," says Charalambos Pissouros, Senior Market Analyst at JFD Group.

However if the virus outbreak does fade in severity and markets stabilise we would expect expectations for a rate cut at the Bank of England to potentially fade somewhat. After all, the UK economy remains in decent shape and the post-election bounce continued into February according to survey data.

In normal times the Bank would be happy to maintain a wait and see approach. With a new governor in Andrew Bailey taking over at the helm, there could be chance the Bank in fact opts to stay still.

This all leaves the Pound looking heavily discounted and a cheap buy at current levels.