Pound Sterling Volatile as Nerves Build Ahead of Thursday's Bank of England Meeting

- GBP volatility on "coin toss" BoE rate decision

- GBP worst performing major currency of past 24 hours

- GBP/USD could go as low as 1.2692 says options analyst

Image © Adobe Images

- Spot rates at time of writing: GBP/EUR: 1.0808, -1.75% | GBP/USD: 1.1852, -2.15%

- Bank transfer rates (indicative): GBP/EUR: 1.0520-1.0596 | GBP/USD: 1.1537-1.1620

- Specialist money transfer rates (indicative): GBP/EUR 1.0650-1.0701 | GBP/USD: 1.1650-1.1745 >> More details

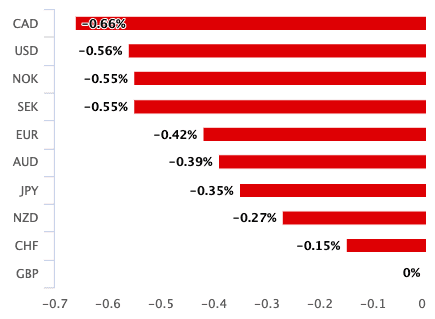

The British Pound is the worst performing major currency of the past 24 hours as foreign exchange traders reduce exposure to the currency ahead of a too-close-to-call decision on interest rates at the Bank of England due on Thursday, and we expect volatility to remain heightened into the event.

The Pound dropped 0.40% against the Euro and 0.56% against the Dollar ahead of the London market close, but has since recovered some of that lost ground as markets move through the mid-week session: the Pound-to-Euro exchange rate is at 1.1822, the Pound-to-Dollar exchange rate back above 1.30 at 1.3024.

Both exchange rates continue to look heavy and biased to the downside in the short-term.

Above: Sterling suffered some chunky losses on Tuesday, January 28.

The Pound has zig-zagged over recent days as markets adjust expectations for an interest rate cut; rising when the odds of a cut fall and falling when they rise. The consensus in the market - according to money market pricing - is that the odds of a rate cut are in the 50-55% region.

The outcome is therefore a tight one and will ultimately deliver the surprise factor that is so often required to move currency markets.

"A rate cut or dovish commentary by the BoE is likely to test 2020 lows and open the way for further losses near the 100-DMA at 1.2852 and the 200-DMA by 1.2692," says Paul Spirgel, an options analyst at Thomson Reuters.

"A BOE rate cut later this week is priced at even odds, suggesting some volatility ahead pending the decision. In the interim, expect the pair to stay heavy on the back of softening short term implied valuations and resilient USD," says Terence Wu, an analyst at OCBC in Singapore.

If the Pound continues to move lower ahead of Thursday, it would suggest a market that has decided to front-run a rate cut, with investors opting to take money off the table. The further Sterling falls ahead of the interest rate decision, the stronger the recovery will likely be if the Bank leaves rates unchanged.

"We are not ruling out the prospect of rates coming down at some stage this year. Instead we are arguing that given recent evidence, economic conditions do not currently appear to justify an easing in policy. That said we expect the economy to carry a modest degree of momentum and our base case remains that the Bank rate will remain at 0.75% throughout 2020," says Philip Shaw, Economist at Investec.

We will not be surprised to see further movement both higher and lower in the run up to Thursday as traders shift their positions but ultimately drify sideays as there is unlikely to be any fundamental event that materially shifts the odds for a cut in a substantial way.

Volatility is therefore assured to be a feature of Sterling markets this week, and we wouldn't bet on any moves either higher or lower sticking for too long.

"This week's MPC rate decision is basically a 'coin toss'. But our preference is to look through the noise of this week's events and focus on the medium-term picture, which we consider to be supportive for the GBP," says Stephen Gallo, a foreign exchange strategist at BMO Capital Markets.

Gallo thinks foreign exchange markets "are still underpricing the trajectory of UK fiscal policy, and we do not think the UK government will aim to diverge radically from EU rules in the first 12-18 months after Brexit (so the risk of a "WTO Brexit" at the end of the transition is probably quite low)."

BMO Capital see declines in GBP/EUR into the 1.1760/1.1696 range as offering buying opportunities.

"This so-called consolidation phase in GBP/USD and GBP/EUR may extend into February, though the Bank of England’s (BOE) policy meeting this Thursday could fuel some volatility. There may be scope for Sterling upside if the BOE does not cut rates, but if one or two more policymakers vote for a cut than the previous 7-2 split, then this may weaken Sterling," says George Vessey, foreign exchange analyst at Western Union.

Above: Price action in the Sterling-Euro exchange rate over the past 24 hours.

The primary argument for the Bank of England to keep interest rates unchanged are the various economic surveys released in January that suggest a sharp recovery in sentiment and economic activity since the December 12 General Election.

The CBI's business survey for January showed a sharp improvement in sentiment, while the Deloitte CFO survey showed a substantial boost in sentiment. The IHS Markit PMI survey for January confirmed the trend, with the manufacturing PMI rising from 47.5 to 49.8 and the Services PMI rising from 50.0 to 52.9.

Typically a central bank would not cut interest rates as activity is picking up, lest they risk stoking unnecessary inflation.

Another reason why the Bank might opt to keep rates unchanged lies with the prospect of the Government announcing an increase in spending in the March budget. Increases in Government spending ultimately has the same effect on the economy as lower interest rates at the Bank of England in that they are both stimulatory.

If the Government is looking to stimulate the economy, following years of austerity, the Bank risks overcooking the economy by cutting rates.

"A further reason we expect policy to stay on hold is the likelihood of a fiscal splurge being announced at the 11 March Budget, which will come before the next MPC meeting on 26 March," says Bill Diviney, an economist with ABN AMRO, "This paves the way for some potentially big spending plans to be announced."

Diviney notes Chancellor of the Exchequer Sajid Javid has already made the changes to the rules governing UK fiscal discipline to allow for increased spending, for instance allowing net public investment to rise to 3% of GDP from the previous 2% limit. The Chancellor has also commented that low bond yields are a "signal to me from the market — from investors — that here’s the cash, use it to do something productive."

Regardless of the Bank of England's Thursday decision, lingering anxiety over upcoming EU-UK trade negotiations should keep investors cautious on Sterling.

"The evidence of a post-election bounce in confidence and activity may be enough to stave off a rate cut this time round, but with post-Brexit trade talks in focus and risk-off market conditions dominating, it’s difficult to forecast a sustained uplift for the Pound," says Vessey.

Technical studies also warn that the Pound's outlook has deteriorated somewhat and if key levels give way the doors could well open to further declines.

"With both GBP/USD and GBP/EUR approaching key support levels, Sterling downside risk may be brewing," says Vessey.

Turning to GBP/USD specifically, there is a growing sense amongst the analyst community that some form of 'breakout' - i.e. a more substantive move higher or lower, is looming.

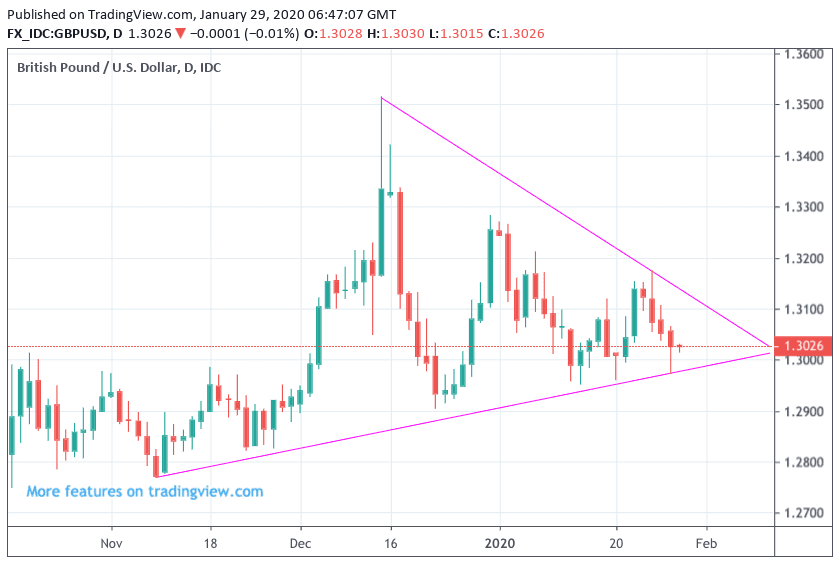

Much rests with the shape of the chart, which shows the market is consolidating into an ever tighter range, much like a coiling spring, that is ultimately waiting for a release:

Above: Sterling-Dollar consolidation, a technical breakout beckons over coming days.

"The GBPUSD chart has been triangulating for weeks and needs to break one way or another – risk is to the downside in the nearest term on USD strength and risk from positioning – but two-way risk over the BoE tomorrow," says John J Hardy, Head of FX Strategy at Saxo Bank.

"Prices are again holding the ‘triangle’ support region. A rally through 1.3215 and then 1.3280 resistance is needed to suggest a broader upper range is actually developing for an eventual test above the 1.3500 December highs. Until then, our studies still suggest this ‘triangle’ pattern will see a deeper setback towards 1.28-1.27, maybe an overthrow to ~1.25 – confirmed by a breakdown through 1.2980 and 1.2905," says Robin Wilkin, Cross Asset Strategist with Lloyds Bank.