Pound Sterling 'Cheap' says Citi, Overturns Monthly Losses vs. Euro and Dollar

- Citi says Sterling is 'cheap'

- DNB Bank says Sterling 'immune' to downside forces

- Demand for UK assets seen propping Pound up

- Short-term focus remains on Friday's PMI release

Image © Adobe Images

- Spot rates at time of writing: GBP/EUR: 1.0808, -1.75% | GBP/USD: 1.1852, -2.15%

- Bank transfer rates (indicative): GBP/EUR: 1.0520-1.0596 | GBP/USD: 1.1537-1.1620

- Specialist money transfer rates (indicative): GBP/EUR 1.0650-1.0701 | GBP/USD: 1.1650-1.1745 >> More details

The British Pound is now recording an advance against the Dollar and Euro for the period that covers the past month, as the weakness in the UK currency that characterised the first part of January starts to fade.

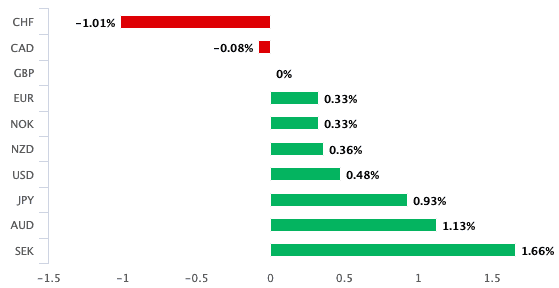

Sterling really should not be recording such gains given heightened expectations for a Bank of England interest rate cut at month-end and lingering fears over tough EU-UK trade negotiations in coming months, but it is now up by 0.33% against the Euro and 0.48% against the Dollar in the four-week period leading up to today.

The gains in Sterling justify a bullish stance held on the UK currency at Citi - the world's largest FX dealer - who this week say they intend to maintain a fundamentally bullish stance despite elevated concerns over trade negotiations and Bank of England interest rate cut expectations.

"While short-term GBP softness into the BoE meeting is possible, a 25bp cut would not change our fundamental bullish GBP thesis based on capital inflows from underweight Real Money, FDI and M&A activity," says a note from Citi FX.

The probability of an interest rate hike from the Bank of England increased further over the course of the last week, with financial markets ascribing such an outcome to be close to 70%, following a set of speeches from Bank of England policy-setters and some underwhelming economic data releases.

The rising expectations for a rate cut in turn saw Sterling come under pressure and means that the rally that characterised the second half of 2019 came to an abrupt end in January. However the Pound has yet to really convince us that it is ready to enter a more protracted downtrend.

Buyers boosted the valuation of the currency on Tuesday, January 21 following the release of UK labour market data that beat expectation. An increase in employment by 208K in the three months to December and wage growth of 3.2% came in ahead of market expectations and traders question whether it is prudent for the Bank of England to cut interest rates in the current climate.

"It's remarkable how supported GBP has been in recent sessions," says Jordan Rochester, a foreign exchange strategist at Nomura. "Risk reward is not in favour of chasing GBP lower into a rate cut: With the BoE rate cut priced with a 66% chance, the risk reward is that they delay their decision until later this year to evaluate how the data and fiscal stimulus plays out. GBP/USD would naturally head higher as a result."

The Pound is Cheap

Fears that EU-UK trade negotiations will ultimately fail at some point in coming months was said by analysts to be one reason why Sterling's multi-month rally came to an end in late December.

However, these fears are yet to manifest in sustained downside for the Pound and Citi say the outcome of the December General Election should negate some of the concerns over trade negotiations, ultimately leaving the Pound attractively valued for investors at this juncture.

"A government with a strong majority now has increased potential to negotiate and ratify a longer term trade deal with the EU. GBP is cheap on a real effective basis (15% below its historical mean). It’s arguable that GBP remains an underweight from asset allocators," say Citi.

Citi's bullish stance on the Pound leave them forecasting the Pound-Dollar exchange rate to rise as high as 1.38 in the next six to twelve months. Given their Euro-Dollar exchange rate forecast for the same period is for 1.16 to be achieved, this leaves their Pound-Euro exchange rate forecast for the next six to twelve months at 1.19.

The bullish stance on Sterling is echoed elsewhere in the analyst community.

"Surprisingly, despite being one of the G10 currencies that actually saw some action last week, the GBP looked fairly immune. While it could seem as if the GBP remains hostage to the Brexit process – which currently yields few directional signals as trade negotiations with the EU have not yet started – speculative long positions in the GBP are building, signalling some optimism ahead of the formal Brexit date," says Magne Østnor, an analyst at DNB Bank ASA.

DNB Bank are forecasting the GBP/EUR exchange rate to be at 1.1765 in three months and 1.15 in 12 months.

Short-Term Fireworks

A big crunch point for Sterling in the near-term is the release of the flash PMI numbers on Friday, which will give us the first real insight into how the UK economy has performed since the December General Election.

Currently markets are anticipating an uptick in activity, however the scale of that uptick is up for debate and will determine how the Pound closes out January.

If the data smashes expectations, expect the Pound to move sharply higher as the market moves to swiftly cut out expectations for an interest rate cut at the Bank of England on January 30.

A disappointing result will almost certainly ensure the Bank cuts interest rates and could add a heavier feel to Sterling over the short-term.

"This Friday’s UK PMI has a higher than usual level of market attention on it," says Rochester. "Given it will likely move the needle on whether the BOE will cut this month or not (market now prices 66% chance) we’ve been digging into all the potential leading indicators that suggest a potential positive surprise on Friday."

Analysis by Nomura on the pricing in the options markets - that in turn give an insight into the volatility that can be expected in Sterling on the day - confirm that markets are giving the release a great deal more attention than is typically reserved for PMI data releases.

"FX volatility markets assign a 4 vol add on in GBP/USD, which is high for a UK PMI where the standard level would be just 0.3. Implied overnight is therefore ~11 vols so requires a 0.5% move in GBP/USD on Friday to breakeven," says Rochester.

In short, markets are of the opinion that the data will provide enough fireworks to trigger a move in the region of at least half a percent.

"We remain long GBP/USD with a 1.34/1.36 call spread (5 March expiry) with lot resting on Fridays PMI and next week’s BOE to set that mini trend higher in motion," says Rochester.