Pound Sterling Outlook: Looming Political "Deadlock is without Modern Precedent"

File photo of Prime Minister Boris Johnson. Image © Chatham House, Accessed Flickr, image subject to CC licensing.

- EU delay decision on extension

- Labour to reject call for a General Election in December

- Prospect of Govt. shutdown looms

- Paralysing uncertainty to keep Sterling soft

- Pound-to-Euro exchange rate @ 1.1548, down 0.12%

- Pound-to-Dollar exchange rate @ 1.2835, down 0.02%

The British Pound is likely to retain a soft tone in the short-term as the UK political environment descends into crippling uncertainty, after the Government said it would table a vote for an early General Election on Monday but opposition parties indicated they would once again reject the request.

Those watching Sterling should expect it to retain a neutral to negative bias in the current environment that is characterised by growing political uncertainty.

The EU has today confirmed that a much-anticipated decision on a Brexit delay will be delayed until Monday, perhaps a sign of disagreement amongst the 27 member states as to the length and reasoning attached to any delay.

The EU's task of rubber-stamping a delay will have been complicated by the fact the UK has not have given a reason for any dealy: recall, the EU have said any extension would only be considered for the UK to hold a General Election or another referendum.

Government on Thursday night said it would offer the UK Parliament a vote on a holding a snap General Election on December 12, however it appears opposition parties are all but set to reject the offer, ensuring the 2/3 majority threshold required for Parliament to trigger such an outcome will be unachievable.

If an election was approved, Johnson said he would bring the Withdrawal Agreement Bill back to Parliament, giving MPs until November 6 to pass judgement on the legislation and deliver Brexit.

Should opposition parties refuse to vote for an election, as appears to be the case, "we would campaign day after day for the people of this country to be released from subjection to a parliament that has outlived its usefulness,” Johnson told the BBC.

A Downing Street official is quoted by the Financial Times as having suggested that under such circumstances parliament would have little work to do as "nothing will come before parliament but the bare minimum."

"Labour has instructed its MPs tonight to block Johnson’s attempt on Monday to have 12 Dec election. So Johnson will shelve the Withdrawal Agreement Bill. He will cancel the budget. There will be no government worth the name. Parliament will become a zombie Parliament, unless and until the opposition find a way to wrest control from Johnson or hold an election. This deadlock is without modern precedent," says Robert Peston, ITV's Political Editor.

A spokesperson for the Prime Minister told a regular press briefing that the Government will continue to pursue a domestic agenda through Parliament.

EU leaders have consistently said they would only grant another Brexit extension if the UK were to have a good reason for it, namely a General Election or a referendum.

Neither are in the pipeline, something that places pressure on the EU to justify why they would offer a long extension until January 31.

"We expect an imminent general election, which will bring more near-term uncertainty and depress Sterling." say @PantheonMacro - nice charts on potential outcomes of a vote. They add Conservative majority likely smaller as undecideds tend to favour the left. pic.twitter.com/xGn3tPiGC6

— The Pound Live (@thepoundlive) October 24, 2019

"The EU are still debating the UK’s request for a Brexit extension. However, the debate appears to be less about whether or not an extension will be granted, but rather for how long the extension should be. The EU are expected to make its decision early next week. GBP will likely continue to trade in a tight range around 1.2800 until the decision is made," says Kim Mundy, a foreign exchange strategist with CBA.

Because no EU decision on the length of the Brexit extension was announced today, it signals there is discord amongst member states, with France said to be arguing for a short, two week extension.

The Reuters newswire on Friday afternoon said France are wanting the UK to "clarify the situation and that an extension is not a given."

Quoting a source close to President Emmanuel Macron, Reuters add France wants a Brexit extension to be justified and proportionate, "but we have nothing of the sort so far," according to the source.

Macron will surely feel emboldened to push for a short extension having noted that opposition parties are intent on blocking an election, and Parliament would only feel obliged to ratify the EU-UK deal if the threat of a November 'no deal' materialises once more.

"With Labour blocking an election and Johnson shelving Brexit legislation, a Brexit extension to 31 January - the delay written into the Benn Act - will achieve precisely zilch. It guarantees the UK will request another extension at the end of January," says ITV's Peston.

The Pound has fallen over the course of the past 24 hours as it tends to perform poorly when political uncertainty rises, and we expect to remain heavy until such a time as clarity on the way forward is delivered.

"Tail risk for a 'no deal' event remains substantially smaller than just a few weeks back but prolonged uncertainty about a final Brexit date is likely to (continue to) weigh on the economy, on rates and possibly on GBP in turn. We hold a forecast of 0.875 in EUR/GBP and thus see some downside for Sterling from here," says Jakob Ekholdt Christensen, Chief Analyst at Danske Bank.

For Sterling to push higher, clarity must not just come from progress on Brexit, but progress on unpicking the UK's looming political breakdown.

The friendly winds of progress that pushed Sterling to multi-month highs just last week appear to have diead down, leaving the currency bobbing in the doldrums:

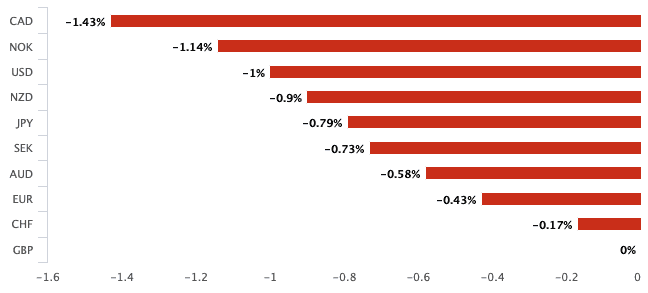

Above: Sterling has fallen against all the major currencies this week

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of a specialist foreign exchange specialist. A payments provider can deliver you an exchange rate closer to the real market rate than your bank would, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

An election is seen by the Government as the only way of breaking the Parliamentary deadlock which has this week seen the passage of Brexit legislation stalled in the House of Commons after MPs voted down the Government's timetable to deliver Brexit by the October 31 deadline.

Leader of the House Jacob Rees-Mogg confirmed in Parliament that Monday's vote will be held under the terms of the Fixed Term Parliament Act which stipulates that for Parliament to be dissolved and an election called a two-thirds majority must be achieved.

Johnson on Thursday wrote to leader of the opposition Jeremy Corbyn saying he would hand Parliament more time to approve his Brexit deal but that lawmakers must back a December election. "This parliament has refused to take decisions. It cannot refuse to let the voters replace it with a new parliament that can make decisions," he said to Corbyn.

"It’s now all about how Jeremy Corbyn will respond. Given it will be a vote on Monday under FTPA it will require a 2/3rds of the House (434MPs) and therefore Corbyn's response the key as it won’t pass unless he agrees," says Jordan Rochester, a currency strategist with Nomura.

"A healthy reminder," adds Rochester, "Corbyn can still argue against an election until "a Hard Brexit is off the table" and point out Boris may choose an election date that could risk that… so we continue as we were."

According to Petr Krpata, a foreign exchange strategist at ING, "we see prospects of an early election as negative for GBP given that it would tame optimism about the withdrawal agreement being reached – the key driver of GBP gains this month – and reintroduce uncertainty into Sterling."

"Given that the odds of a hard Brexit has decreased (in the case of a Conservative majority scenario after the election) compared to the state of affairs three weeks ago, we see GBP downside as more limited now too," says Krpata.

ING now see 1.11 as the as the possible low for the GBP/EUR exchange rate "if Parliament fails to ratify the deal and we head into early elections - with the accompanying pre-election non-market friendly rhetoric," says Krpata.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of a specialist foreign exchange specialist. A payments provider can deliver you an exchange rate closer to the real market rate than your bank would, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement