"Steer Well Clear" of Pound Sterling says Analyst as 'No Deal' Brexit is Still in Play

Image © Pound Sterling Live, Ruptly

- UK formally requests Brexit delay to June 30

- Sterling supported on Tusk offer of 'flexible' extension

- 'No deal' Brexit is not 'off the table'

- Pound-to-Euro exchange rate @ 1.1673 today

- Pound-to-Dollar exchange rate @ 1.3109

The Pound is supported ahead of the weekend on reports European Council President Donald Tusk is proposing to offer the UK a 12-month "flexible" Brexit delay to the UK, but Prime Minister Theresa May has today formally requested a delay to June 30.

The prime minister has proposed that if UK MPs approve a deal in time, the UK should be able to leave before European Parliamentary elections on 23 May, but she said the UK would prepare to field candidates in those elections in case no agreement is reached.

The proposals will likely be put to European leaders at next week's European Council summit.

The Tusk proposal will be an attractive one in that, if accepted, would allow the UK to leave as soon as Parliament ratifies a an exit deal.

The offer by Tusk will calm nerves amongst market participants that the EU's approach to a Brexit extension would be an uncompromising one, an approach which risked hardening the resolve amongst Conservative Party MPs to advocate for a 'no deal' Brexit.

"If a long extension leaves us stuck in the EU we should be as difficult as possible. We could veto any increase in the budget, obstruct the putative EU army and block Mr Macron’s integrationist schemes," says Jacob-Rees Mogg, Chair of the European Research Group, a bloc of Conservative party MPs largely opposed to the EU-UK Brexit deal.

If anything, the Tusk offer could play into Prime Minister Theresa May's hands as it makes clear the only way out of the current Brexit stalemate is for a Brexit deal to be agreed, and when faced with a lengthy Brexit delay or a Brexit based on May's deal we feel more Brexiteers might be willing to fall behind her offer.

May is looking to seek a delay to Brexit in order to avoid leaving the EU without a deal in place on April 12, an outcome foreign exchange analysts say would see the Pound fall sharply lower.

But, a leading foreign exchange analyst tells us he remains wary of the Pound regardless of talk of a Brexit delay, and advises traders to steer clear of the currency as the popular notion that a 'no deal' Brexit will be avoided is entirely misplaced.

"British politicians had more than enough time," says Ulrich Leuchtmann, an analyst with Commerzbank in Frankfurt. "It is impossible to take a decision without time pressure. From a game theory point of view an extension is even counterproductive."

Leuchtmann says he believes a 'no deal' Brexit could still occur as 1) UK politicians might not approve any Brexit extension that is offered and 2) Europe might not grant an extension.

Indeed, while Tusk has put forward a plan it must be stressed that all EU leaders must agree to it. The BBC's Europe Editor Katya Adler says "EU leaders are not yet singing from the same hymn sheet on this. Expect closed-door political fireworks."

Leuchtmann continues to recommend to clients: "steer well clear of any GBP positions, long or short."

The warning on Sterling from the Commerzbank analyst comes after UK parliamentarians this week approved a bill that would force the UK government to seek a Brexit delay in order to avoid a 'no deal' Brexit.

By voting through the so-called Cooper Bill, named after Labour political Yvette Cooper, parliament has also given itself the power to revise the length of the extension if not deemed sufficient.

Any suggestion that a 'no deal' Brexit will be entirely avoided would typically be associated with a strong rally in the British Pound, which has over the course of 2019 tended to gain on such developments.

However, the Pound merely shrugged at the passing of the Cooper Bill and has opted to consolidate and trade increasingly tight ranges.

"The lack of more upside on this latest news actually suggests some degree of underlying weakness," says John Hardy, an analyst with Saxobank. "We’re sceptical that Sterling can put much more together here even if a clear path to a soft Brexit emerges. Stay tuned."

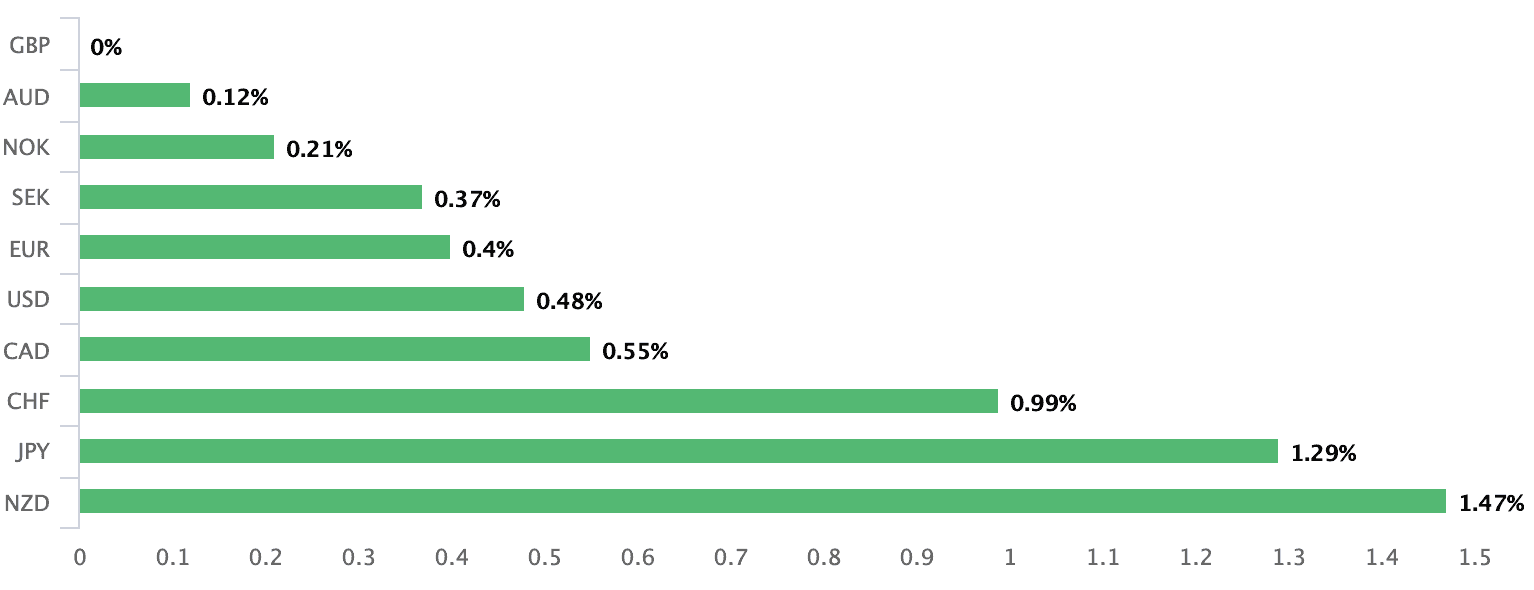

The Pound is the week's best performer...

Above: Sterling's 1-week performance on Friday morning

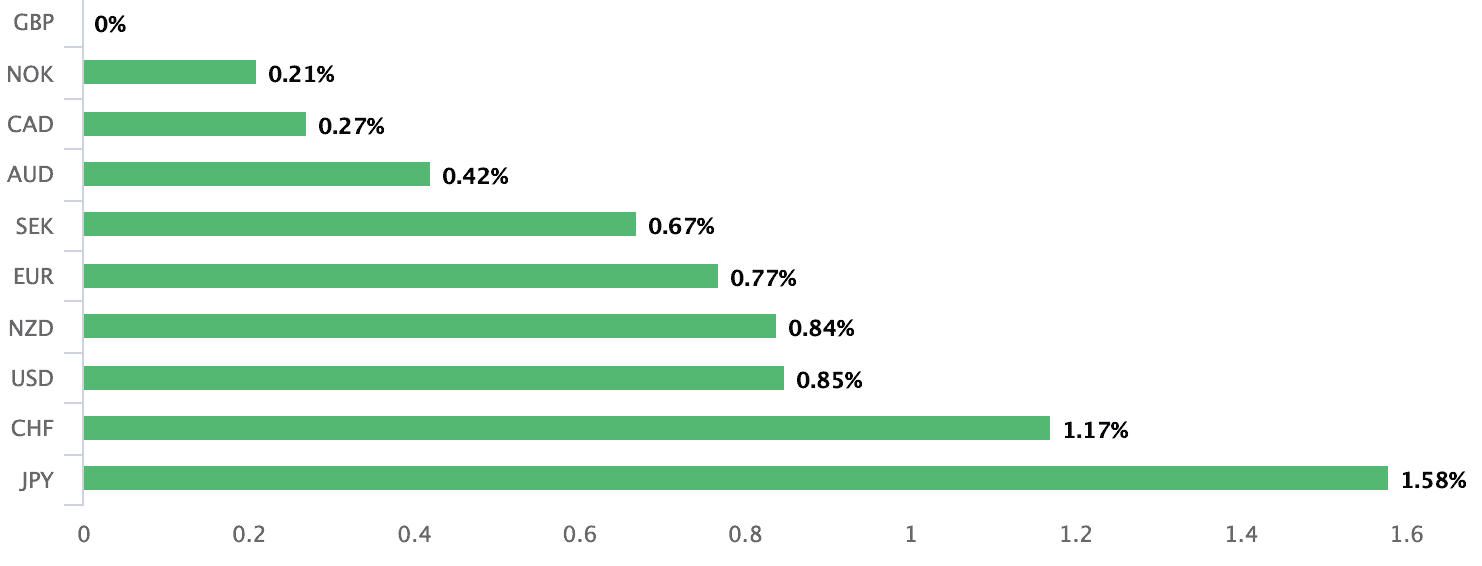

... but, the gains have been pared back:

Above: Sterling's 1-week performance on Thursday morning

Commerzbank's Leuchtmann says a 'no deal' Brexit is in fact not off the table, as some press reports rather clumsily suggest.

"It is quite obvious that nothing could be further from the truth. The law forces the government to get Parliament to vote on the next application to extend the Brexit deadline," says Leuchtmann.

A delay is therefore by no means a cancellation of Brexit, and the fact remains, without a deal being voted through 'no deal' takes place.

The problem for the UK parliament, and perhaps the British Pound by extension, is that time really is now running out, and with it the space to manoeuvre.

"The whole process becomes more complicated and as a result – and in view of how very little time remains – the risk of 'no deal' increases, rather than it being off the table," says Leuchtmann.

The EU will however most likely offer either a very short, or very long extension, and we assume the House of Commons would have to approve the final offer in order to avoid a 'no deal' on April 12.

May will therefore have to present the EU's offer to the House of Commons on Thursday April 11 which would have to be agreed to avoid a 'no deal' the following day.

"There would be no time left for a further iteration," says Leuchtmann.

To us this looks like an incredibly tight ask, and given past form in the House of Commons it is by no means guaranteed that parliamentarians would pass any 'take it or leave it' offer from the EU.

Next week Thursday will therefore be an incredibly important date for the British Pound, and we find it unsurprising that foreign exchange participants would opt to take their money off the table and cut back exposure to Sterling with the risks being so high.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

Why the EU might not grant a Brexit extension

As mentioned, a risk for the coming week is the EU simply fails to grant an extension to the UK, or grants a very short extension.

The problem for the EU lies with the European Elections on May 22.

"This is not primarily an issue of Britain preparing for the elections - another fact that is hardly mentioned in the British press," says Leuchtmann.

The analyst uses an example of the French wanting to know whether they are voting for 74 or 79 mandates, Spain whether 54 or 59 seats are at stake etc.

A convincing plan justifying a delay will be required of May.

"If May is unable to present the EU with a credible plan on 10 April, the EU may refuse her request for a further delay. We thus raise the risk of a hard Brexit to 20% from 15% that could come as soon as 12 April," says Kallum Pickering, Senior Economist at Berenberg.

And even if an extension is granted, we doubt it will be a catalyst to strong gains in the UK currency as an argument can be made that it fails to solve the fundamental problem of there being no majority in the UK parliament for any kind of Brexit deal.

An extension potentially opens the door to a flood of further uncertainty as options that have recently been killed-off over recent weeks are given room to be resuscitated.

Remember, Sterling dislikes uncertainty.

"In the absence of parliamentary agreement the most likely next step is to request a long extension from the EU. That would present familiar problems for the Pound, as recent history hints at little room for agreement between Bremainers and Brexiters within Labour or Tory ranks. A long delay puts the full selection of options on the table, including general elections, second referendum and new amendments of all kinds," says Paul Spirgel, an analyst on the Thomson Reuters Currency Desk.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement