Short GBP/USD say Soc Gen While Credit Agricole say the Brexit Vote's Damange has been Done

- Written by: Gary Howes

A strong rally in GBP/USD back above 1.32 presents a conundrum for traders - do they enter fresh longs in anticipation of the recovery extending, or do they sell in anticipation of the broader downtrend resuming?

The GBP/USD has cracked the 1.32 ceiling this week as a combination of GBP-positive events conspire with a damp USD.

Sterling strength comes on the back of 1) a short-covering rally as markets correct from oversold conditions, 2) the questionable success of the Bank of England's market operations concerning long-dated Gilt purchasescover ratio achieved and 3) stronger-than-forecast economic statistics.

From a strategic point of view, the rally will see many traders will be looking to enter fresh shorts on GBP/USD.

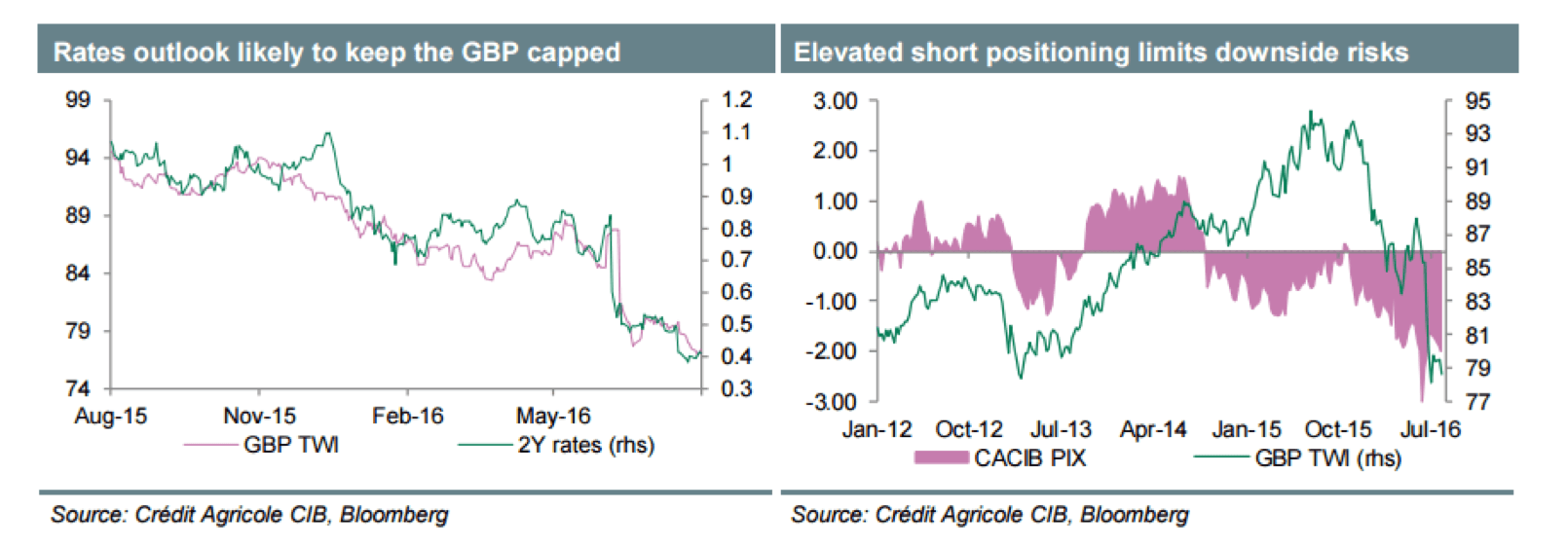

Analysts at Credit Agricole have written to clients telling them that they believe there is little downside in GBP on offer at current levels, particularly for those who are looking to bet on further British Pound downside.

“The GBP has been stabilising for most of the past few trading days, mainly on the back of somewhat better than expected labour, inflation and retail sales data,” says the note, provided to us by the eFXNews agency.

Credit Agricole say that based on elevated speculative short positioning, further expectations for the Bank of England to cut rates again and further boost quantitative easing may be needed in order to push the GBP considerably lower from the current levels.

Incoming data, such as this week’s Q2 GDP release, is unlikely to trigger such a development, especially as it should be regarded as more backward-looking.

Credit Agricole note:

“Nevertheless, as there is not much room for rising monetary policy expectations, we believe GBP upside is likely to prove limited too. In conclusion, we believe the currency is most likely to stabilise around the current levels.

“When it comes to majors such as GBP/USD, it will increasingly depend on the USD angle to drive a more sustained and directional movement from the current levels.”

Barclays, Nordea Also See end to Sterling Weakness

The call from Credit Agricole follows similar observations made by strategists at Barclays and Nordea Bank.

According to Barclays, the decline in trade-weighted GBP following the announcement of the Bank of England’s larger-than-expected easing package on 4th of August has taken GBP to about 10% below its pre-Brexit level.

This is also one standard deviation (10%) below the estimated fair-value for the GBP it is argued.

Nordea meanwhile observes that while the Bank of England is responsible for near-term pain, it will also likely be the source of a GBP recover:

“The BoE easing, UK data worsening... not much optimism around the GBP. However, the short positions are stretched, and the ongoing - and upcoming - easing will help the UK economy, and thus ultimately the GBP.”

Nordea argue that the 10% fall in Sterling’s effective nominal rate has led to a, “substantial easing in financial conditions,” which will ultimately create a feed-back loop that should help Sterling arrest its fall.

Apart from the precipitous drop in the currency she sees little impact on other assets, except interest rates which have effectively been halved.

Go Short on Sterling say Soc Gen

With the GBP having bounced there are a good number of strategists smelling fresh selling opportunities.

Kit Juckes at Societe Generale in London is one of them.

Juckes reckons the sterling short-covering bounce ought to be nearing completion and, "short GBP/USD is a good place to start."

"The UK MPC has further easing ahead; the press, at least, sounds complacent about the economy, and there’s no reason to alter a long-term target of 1.20-1.25. I think shorts make sense here and are a good place to start rebuilding Dollar longs generally," says Juckes.