The Euro to US Dollar Short-Term Up-Trend Intact At End of Week

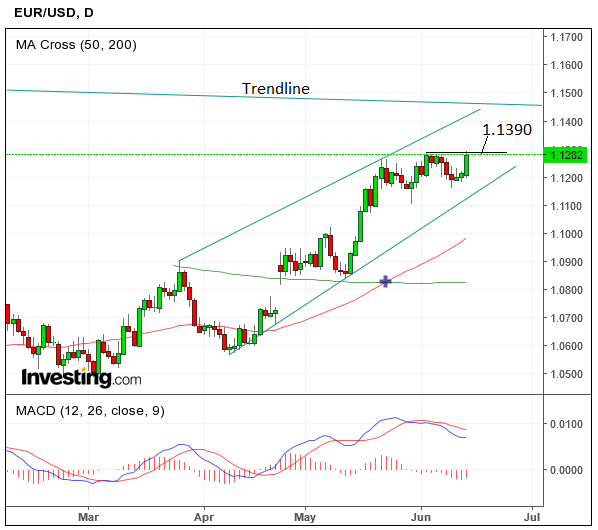

No change to our forecast of the pair reaching 1.1390 as per our June 11 weekly report.

After breaking above the 1.1287 highs before the Fed meeting due to poor US data, the pair then pulled back again after the meeting due to the Fed decided to increase interest rates.

Overall the Euro to US Dollar pair remains in a short-term uptrend as we enter the last phases of the week.

EUR/USD will probably now continue higher and reach the 1.1390-1.1400 resistance zone which includes several tough levels, including a major multi-year trendline and the R1 monthly pivot at 1.1395.

Sellers are expected to enter the market at these levels, however, in the hope of profiting from a pull-back, thus the pair will likely stall and possibly even reverse.

Momentum, as measured by MACD, appears to have peaked and is rolling over, which is not a particularly bullish sign, but also does not discount the possibility of further upside, particularly after a pause, either.

There is substantial risk of volatility from the Federal Reserve rate meeting later on today (Wednesday) at 19.00 BST.

The outcome most expected – a ‘dovish hike’ - might propel the pair even higher if the Fed start to question their previously hawkish medium-term outlook.

Data for EUR/USD

Probably the most important release for the Euro is inflation data out at 10.00 BST on Friday, which is forecast to show core CPI remaining at 0.9%, headline at 1.4% and monthly CPI falling by -0.1% in May.