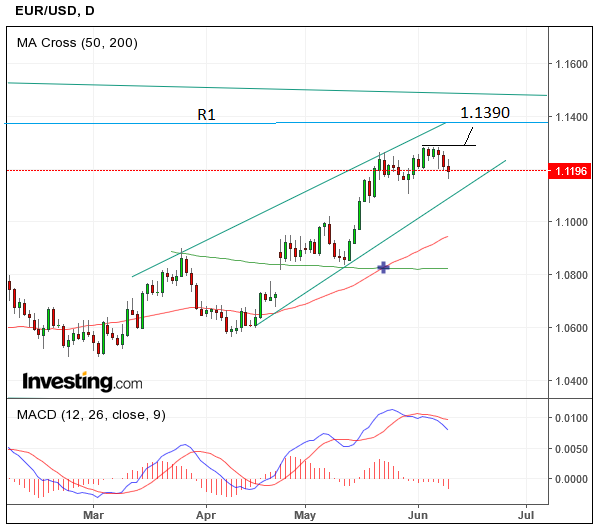

Euro / Dollar Targets 1.1390: Week-Ahead Outlook

The EUR/USD exchange rate remains in a short-term uptrend as the new trading week begins although momentum is somewhat weak price action is still constructive.

Last week’s Eurozone data and commentary from central bank officials came out in line with expectations and so had little effect on the exchange rate.

In the week ahead it will be the Dollar which will probably call the shots as the Euro’s economic data calendar is light.

The Dollar could very well move lower at the start of the week and then recovery on Wednesday evening when the Federal Reserve have their rate meeting and probably decide to increase interest rates.

That would translate into a rise for EUR/USD on Monday and Tuesday, followed by a fall after the Fed meeting on Wednesday.

This dovetails fairly well with the technical picture with its peaking momentum and vulnerability to a pull-back.

Given the uptrend is intact we see a move above the 1.1287 highs as providing confirmation of a continuation higher to a target at 1.1390, which is just below the 1.1395 monthly pivot.

Monthly pivots are levels closely watched by traders who often trade the exchange rate when it touches them, normally the counter-trend pull-back as more sellers enter the market in expectation of lower prices.

"The Euro is hovering around 1.12. The technical picture in the daily chart is bearish, albeit the DMI is still in buy," says Ralf Umlauf at Helaba Bank in Frankfurt. "Data-wise, we do not expect to see any sustained strengthening of US rate expectations this week, with solely the Fed's wording possibly providing tailwind here and potentially weighing on the Euro."

Helaba's favoured trading range is seen between 1.1150 and 1.1280.

Analysts at LMAX Exchange say they believe the market is now showing signs of short-term exhaustion after extending its 2017 run.

"But with the medium-term structure still quite bullish, any setbacks that we do see in the sessions ahead should ideally be well supported in favour of the next higher low and bullish continuation towards key resistance around 1.1365, which represents the August 2016 peak," say LMAX Exchange in a note released on June 12.

For analysts, only a break back below 1.1110 would now take the immediate pressure off the topside.

Data, Events for the Dollar

The highlight should be Wednesday's Federal Reserve decision, but regional sentiment indicators, various inflation prints and retail sales in addition to industrial production will also be of keen interest.

Turning to the FOMC, according to the now prevailing opinion we should see another hike in the target range for the Fed funds rate – by 25bp to 1.00%-1.25% – which has been priced in by money market futures with close to 100% probability.

It is therefore unlikely to have a material impact on the Dollar should it be delivered.

We will instead be listening to the tone coming out of the Fed and markets will scrutinise their economic projections.

"The Fed is likely to take an increasingly cautious approach, also partly because the Fed chair continues to reiterate that the current neutral real interest rate is at a low level (close to zero). A core inflation rate of 1.5% implies a neutral nominal interest rate at around just this level. Accordingly, the upcoming data releases – notably inflation rates – will be of fundamental importance," says Umlauf.

The hard data at the start of the week is likely to disappoint, according to analyst Kathy Lien of BK Asset Management, pulling down the Dollar in the first few days.

Inflation is out at 13.30 on Wednesday, with a small 0.1% rise expected for headline CPI in May from the previous month and a 0.2% rise for Core.

The result should have a binary impact on the Dollar - if the figure comes in lower the Dollar could weaken, if higher then the Dollar could strengthen.

Factory Gate Prices are out on Tuesday at 13.30 and expected to show a market slowdown of only 0.1% in May from 0.5% in April.

Retail Sales are out at 13.30 on Wednesday and likewise forecast to only show a 0.1% rise from 0.4% in the previous month.

Data for the Euro

The Euro may not trade particularly strongly this week so analysts will look to its counterparts for cues on direction.

The main release will be the ZEW survey of businesses which is regarded as a fairly accurate forward indicator of the economy; it is released at 10.00 BST on Tuesday, June 13.

Industrial Production and the Trade Balance are also out in the week ahead.

Last week’s European Central Bank (ECB) rate meeting was almost exactly as analysts had expected it – a nod to growth discounted by continued concerns over inflation.

This means the focus going ahead will be on data which informs the outlook for inflation.