Euro Softer as ECB Gives no Ground on Easing Policy

Above: Executive Board member Peter Praet at the meeting held in Tallinn, Estonia. Photo: Arno Mikkor, ECB.

The Euro has come under fresh pressure after the European Central Bank (ECB) confirmed it had slashed its inflation forecasts in a good hint that no Euro-supportive changes to monetary policy are due anytime soon.

The Bank opted to leave interest rates unchanged at their June meeting, however, there was a slight change to the statement released following the meeting.

"The Governing Council now expects policy rates to remain at their present levels – and no longer at present or lower levels – for an extended period of time and – no change here – well past the horizon of the net asset purchases," says Holger Sandte at Nordea Markets.

As widely expected there were no new indications regarding the asset purchases.

"We think the time is ripe for that in autumn. The ECB kept the dovish QE bias, stating that it stands ready to increase the programme in terms of size and/or duration if deemed necessary," says Sandte.

A more hawkish signal would have been to say “increase or decrease” or just “change”.

"The initial assessment of the early statement is that the ECB may have made some tiny, tentative steps towards policy normalisation by dropping a reference that it could cut interest rates further," says Kathleen Brooks at City Index. "As it stands, it makes sense that the Euro is at fresh lows of the day even though the ECB seems to have adjusted its forward guidance and ruled out the prospect of further rate cuts."

#Euro drops to $1.12 as markets surprised by 2018 #ECB inflation downgrade to 1.3% from 1.6%. pic.twitter.com/XUO8dahKLk

— Holger Zschaepitz (@Schuldensuehner) June 8, 2017

Cuts Made to Inflation Forecast

At the press conference following the release of the Statement, Draghi says inflation pressures must pick up notably before they withdraw their support to the economy.

Better economic activity simply has not yet translated into stronger inflation rates.

However, Draghi notes the risk assessment of growth is now broadly balanced, as opposed to being biased to the downside.

GDP growth forecasts for the Eurozone are upgraded to 1.8% vs 1.7% held previously.

For the moment though, Europe continues to require a very significant amount of policy accommodation as inflation remains subdued; an assessment that hurt the single currency.

On the all-important inflation outlook, the ECB cuts inflation for 2017-2019. 2017 inflation is cut to 1.5% from 1.7% previously, 2018 inflation at 1.3% vs 1.6% and 2019 inflation is seen at 1.6%.

The Euro fell sharply in mid-week trade on a news report that leaked changes to the Bank's inflation forecasts just 24 hours prior.

Draghi: Very substantial degree of accommodation still needed for underlying inflation pressures to build up and support headline inflation

— ECB (@ecb) June 8, 2017

"A surging Euro was hit by a reality check today as ECB President Mario Draghi took a surprisingly cautious tone in his post-meeting statement, choosing to overlook an improved growth picture and instead focus on lower inflation," says Richard de Meo, Managing Director of Foenix Partners.

The Euro has enjoyed strenght of late as political headwinds have dissipated, even becoming the darling of fund managers and real money investors who elsewhere see an increasingly risky global landscape.

Potential Targets for the Euro set Ahead of the Event

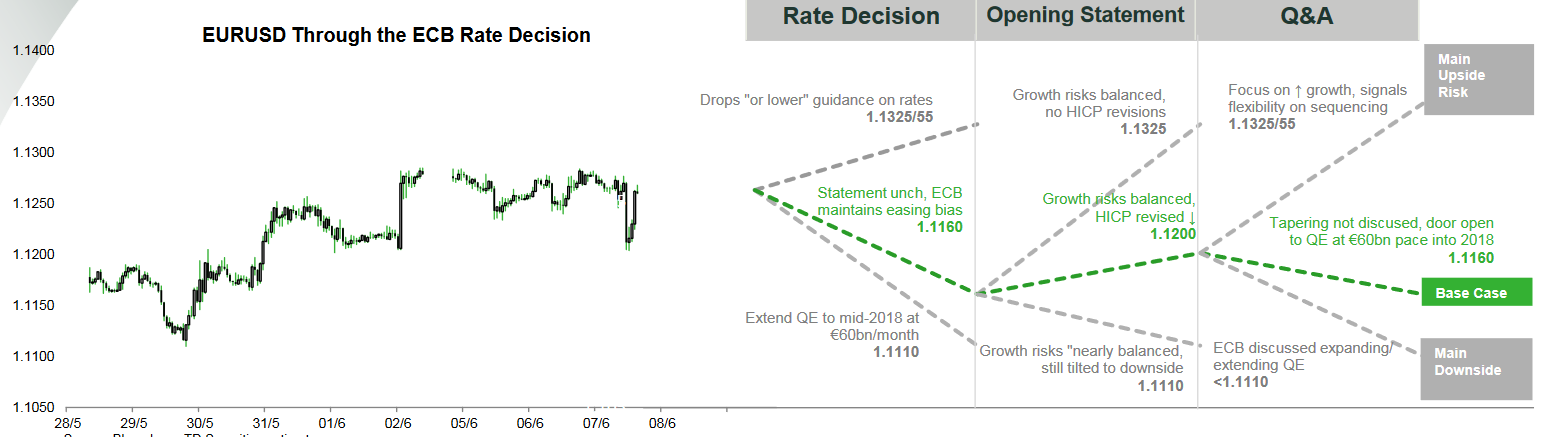

The focus in today’s meeting will be whether the ECB drops the phrase “or lower” to reflect the improved outlook.

If it does, then the Euro is set to rise, with Canadian investment bank TD Securities, modelling such a scenario as a rally on EUR/USD to 1.1325/55.

If on the other hand, as is their base case, if the statement keeps the phrase ‘or lower’ TD see EUR/USD falling to 1.1160.

Unlikely though it may seem - an explicit commitment to extend QE at current 60bn level into mid-2018 would weaken the pair to 1.1110.

"Currently the ECB sees the risks tilted to the downside but if they upgrade the assessment and describe them as broadly balanced, we could see a sharp rally in the Euro. However if their risk assessment remains unchanged, the currency could be brutally punished," says Lien.

Inflation Revelation

The other main issue markets will be focusing on at the meeting is the ECB’s forecasts.

The ECB publishes forecasts for key economic matrices such as GDP and Inflation at its meetings.

The Euro lost ground on Tuesday after a leak suggested that the ECB were intending to revise down their headline inflation forecasts to 1.5% for 2017, ’18 and ’19, from a previous 1.7%, 1.6% and 1.7% respectively.

Lower inflation suggests a continuation of low interest rates and quantitative easing (QE).

If the reports are true then the EUR/USD will probably move to 1.1200 according suggest TD Securities who note most of the news about inflation is already baked in.

Mario Draghi’s Press Conference

The focus on the Press Conference will be whether Draghi talks up Eurozone growth or remains cautious.

If he is upbeat TD see EUR/USD rising to 1.1325/55.

Their base case, however, is that because of the low inflation problem he will avoid discussions of tapering and leave the door open to extending QE into 2018.

The express mention of QE extending at its current pace into 2018 would dash expectations of an Autumn wind-down, or “tapering” of QE as it is known, and see EUR/USD fall to below 1.1110.

Buy Dips in the Euro

Several analysts have recommended buying a possible ‘dip’ in the Euro following the ECB meeting.

"Still, we remain strategic buyers of dips and would reload below 1.10." said Mark McCormick of TD Securities.

TD are not the only bank highlighting a buying opportunity:

BofAML see a cautious ECB leading to weakness in the Euro, and then a buying opportunity:

“We see the balance of risks this week more toward an even more dovish outcome (no change at all to forward guidance, with Draghi merely admitting a "discussion" on the subject in the Q&A," BofAML said.

Adding:

“Our quant indicators and flows still show strong demand for EUR. We also note that the market bought the EUR after dovish comments by Draghi and negative headlines from Greece and Italy pushed it down last week. The fact remains that the ECB will announce this fall its plan for the end of QE next year. Our favorite EUR long trade for the rest of the year is against GBP, as we expect a difficult start for the Brexit negotiations," BofAML argues.

Other’s see the ECB merely ‘kicking the can’ of tapering QE down the road until a later meeting, and therefore no risk of lasting damage to the Euro.

"We would look to buy EUR on dips, in line with our forecast profile and outstanding trade recommendation, as the underlying trend is likely to remain intact if the market simply rolls these outcomes forward to September," said Shahab Jalinoos in a note released to clients on Wednesday.